Indonesia-listed e-commerce firm Bukalapak has swung into a loss in the first half of 2023.

Losses attributable to shareholders for the six months ended June 30, 2023 stood at 389.27 billion rupiah ($25.77 million), compared with a profit of 8.6 trillion rupiah in the same period of 2022.

According to the company’s filings to the Indonesia Stock Exchange (IDX), the losses were on account of 120 billion rupiah in unrealised losses on investment in the period. In the first six months of 2022, Bukalapak had clocked 9.8 trillion unrealised gains on its investment.

Bukalapak’s investments include an 11.49% stake in PT Allo Bank Indonesia Tbk, which it acquired in Jan 2022. It also owns 35% in Allo Fresh, 9.09% in Indonesia’s micro warehousing startup Crewdible, and 40% in Belanja Online Streaming.

Bukalapak’s revenue in the first half of 2023 increased to 2.18 trillion rupiah, compared with 1.7 trillion rupiah a year ago.

The company reduced expenses in H1 2023 as reflected in the sharp year-on-year decrease in its selling and marketing expenses—which nearly halved to 322 billion rupiah from 601 billion rupiah— and general and administrative expenses that fell 47% to 682 billion rupiah from 1.3 trillion rupiah.

However, Bukalapak’s cost of revenues rose to 1.63 trillion rupiah in H1 2023 from 1.163 trillion rupiah a year ago.

The company’s assets as on June 30, 2023 stood at 27.1 trillion rupiah, nearly flat from Dec. 31 2022, when it had stood at 27.4 trillion rupiah.

Bukalapak had liabilities of 825 billion rupiah at the end of H1 2023, compared with 908 billion rupiah at the end of H2 2022.

Niko Margaronis, an analyst at BRI Danareksa Sekuritas noted that Bukalapak’s losses were gradually decreasing. In Q2 2022, the marketplace’s losses stood at 6 trillion rupiah, but it reduced to 1 trillion rupiah in Q1 2023 and it booked profits of 617 billion rupiah in Q2 2023. (See net profit in table below)

Sources: BRI Danareksa Sekuritas

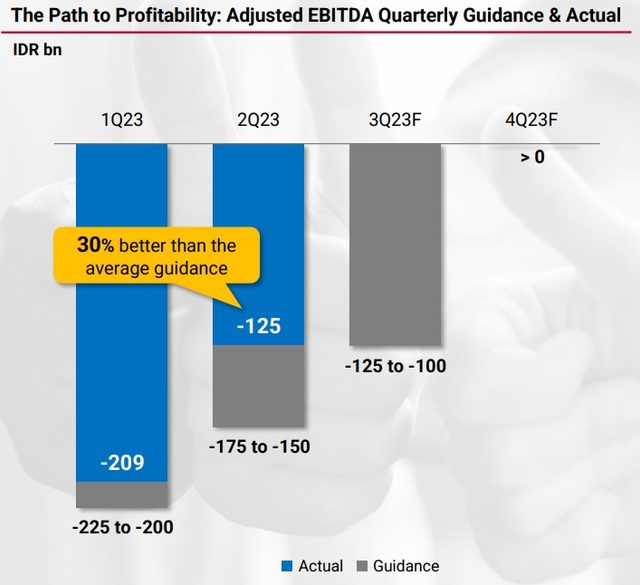

Teddy Oetomo, Bukalapak’s president said, “Both our marketplace business and O2O [online to offline] operations continue to deliver good results across our apps and platform. We’re getting ever more confident in delivering our long-term mission of turning profitable by the fourth quarter of 2023 having posted six sequential quarters of adjusted EBITDA improvement.”

In March 2023, Bukalapak had mentioned that it expects to narrow its adjusted EBITDA losses by 100-125 billion rupiah in Q3, before turning adjusted EBITDA positive in Q4 2023.

As the business scales over the coming years, the focus is on growing our higher take-rate businesses and driving operational efficiencies so that the long-term growth momentum continues, he added.

Bukalapak saw its take rate expand 28 basis points to 2.67% in H1 2023 from 2.39% in the corresponding period last year, due to improved sourcing and supply chain efficiencies. There is further scope to improve the take rate in the future as the benefits of the higher take-rate products are felt across the platform.

Bukalapak’s total processing value (TPV) grew 15.4% to 81.56 trillion in H1 2023. “It is trending well compared to our full year 2023 forecast of 171.6 trillion rupiah with a blended take rate of 2.67%,” Margaronis said to DealStreetAsia.

Oetomo mentioned 70% of the company’s TPV is generated outside the tier 1 regions of Indonesia.

“Bukalapak is delivering on the strategy to deliver more profitable and sustainable growth while managing costs and expenses. The second quarter general & administrative expense, excluding stock-based compensation, to TPV ratio has improved to 0.6%, compared with 1% in the same period last year.”