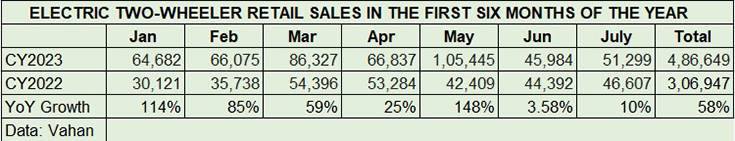

August has dawned and brings with it the news that sales of electric two-wheelers in India, which had plunged 56% in June 2023 following the slashing of the FAME II subsidy, have picked up again . . . albeit marginally. At 51,299 electric scooters and bikes retailed last month, July 2023 sales are 11.55% better than June’s 45,984 units which were at June 2022 levels.

The overall July 2023 retail sales number, which is sourced from the government’s Vahan website as of July 31 (10pm), should increase marginally as additional new vehicle registrations from across the country get factored in. Nevertheless, along with the 11.55% month-on-month growth, July 2023’s 51,299 units are also a 10% year-on-year increase (July 2022: 46,607 units).

From a macro perspective, the Indian e-two-wheeler sector continues to record growth, both calendar year-wise and fiscal year-wise. In the January-July 2023 period, a total of 486,649 units were sold, which constitutes 58% YoY growth (January-July 2022: 306,947 units).

In the first four months of the ongoing fiscal year, 269,565 units have been sold which marks for 44% YoY growth (April-July 2022: 186,692 units). The double-digit growth, despite the lower numbers in June and July, is thanks to the record May 2023 sales (105,445 units, up 148% YoY) as a result of frenzied buying in the last week of May before EV prices rose as a result of the slashed FAME subsidy in June.

Ola, TVS, Ather, Bajaj, Greaves, Hero Vida log month-on-month growth in July

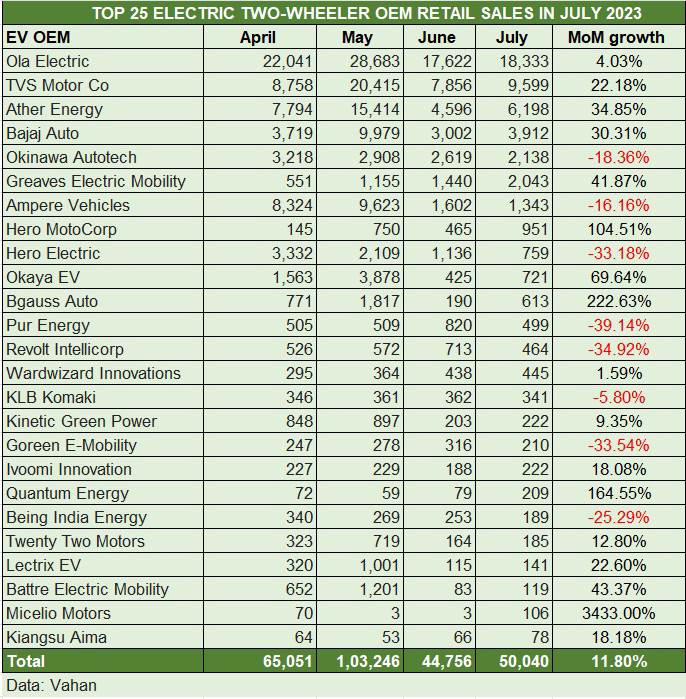

A detailed look at the Vahan retail numbers reveals that of the 148 electric two-wheeler OEMs in the fray, most of the leading players have logged month-on-month growth, with their July sales bettering their June 2023 retails. The top seven OEMs, each having sold in excess of 1,000 units last month, account for 43,566 units or an overwhelming 85% of total sales in July 2023 (see Top 25 EV OEMs table below).

Leading the charge is market leader Ola Electric with 18,333 units, which is a 4% increase over its June 2023’s 17,622 units and gives it a market share of 36 percent. Ola Electric continues to have a massive lead over its rivals in the ongoing fiscal year – its April-July 2023 total at 86,679 units is 40,051 units ahead of the No. 2 EV OEM,

TVS Motor Co sold a total of 9,599 iQubes, up 22% on June’s 7,856 units, and gets a 19% market share last month. If one doesn’t factor in the record May 2023 sales for TVS or other OEMs, then the July numbers are the best monthly sales for TVS in the first four months of FY2024, after April (8,758) and June (7,856). Cumulative April-July 2023 sales are 46,628 units. With this performance, cumulative sales of the TVS iQube have crossed the 150,000 milestone in the domestic market since the e-scooter’s launch in January 2020.

In third place is Bengaluru-based smart e-scooter OEM Ather Energy which sold 6,198 units last month, a 35% improvement on June’s 4,596 units. Bajaj Auto, which has ramped up production of the Chetak and is also expanding its network, sold 3,912 units, up 30% on June’s 3,002 units.

While Okinawa Autotech, ranked fifth, saw sales decline by 18% to 2,138 units, Greaves Electric Mobility with 2,043 units saw its numbers better June sales by 42 percent. However, its sister concern Ampere Vehicles, with 1,343 units, saw a month-on-month decline of 16 percent. Hero MotoCorp, with 951 Vidas sold, doubled its June performance with a 104% MoM increase in sales (see Top 25 EV OEM sales table below).

Maturing of the Indian e-two-wheeler market

While the June 2023 sales were a harsh reality check for OEMs, who were extremely bullish about demand continuing to extend across 65,000 units a month, the marginally improved retail sales in July 2023 point to a maturing of the e-two-wheeler market in India.

The fact that over the past two months, nearly 100,000 buyers – 97,283 – have chosen to purchase an eco-friendly, zero-emission two-wheeler, despite the reduced-by-25% FAME subsidy which has resulted in a higher product price, indicates that the EV consumer is willing to spend more to benefit from a wallet-friendly EV compared to a petrol-engined scooter or motorcycle.

Given the likelihood of the FAME subsidy scheme not being extended, OEMs and EV buyers will have to contend with the fact that market dynamics will take over even as OEMs and their component and technology supplier ecosystem are hard at work to reduce developmental and product costs to enhance EV affordability compared to IC-engined two-wheelers.

The Ministry of Heavy Industries-formulated five-year Faster Adoption and Manufacturing of Electric Vehicles in India Phase II (FAME India Phase II) Scheme, with a total budgetary support of Rs 10,000 crore, comes to a close on March 31, 2024. Till July 20, 2023, all of 740,722 electric two-wheelers have been sold under FAME India Phase II.

Companies are also working on developing lower-cost versions of their popular EVs. For instance, it is learnt that TVS Motor Co is working on a lower-priced iQube which, while it is already priced lower than its key rivals from Ather, Bajaj Auto or Ola Electric, would mean use of a smaller battery pack and possibly fewer features.

As in the petrol-engined two-wheeler market, stiff competition for the EV buyer will result in OEMs rolling out newer and improved products, with focus on the latest tech and higher riding range. There will also some OEMs which will develop variants with optimised features to drive down costs but with lower sticker prices.

While the July retail numbers, as were the June sales, are a real-world reality check for e-two-wheeler makers, the fact is that the EV story is here to stay as a value proposition in terms of mobility. While the rate of growth of personal EV buying has slowed down substantially compared to six months ago, sustained demand from last-mile delivery operators for electric two-wheelers from across the country should keep the momentum going in the current market scenario. Monthly sales numbers should improve in a couple of months. After all, the festive season is not too far away. Stay plugged in for further industry updates.

ALSO READ:

EV sales in India charge past 700,000 units in first six months of 2023