Riding on the success of SUVs – Brezza, Fronx, Jimny and the Grand Vitara – the company has more than tripled its SUV market share to 24.6 percent in July, over 7 percent in July 2022.

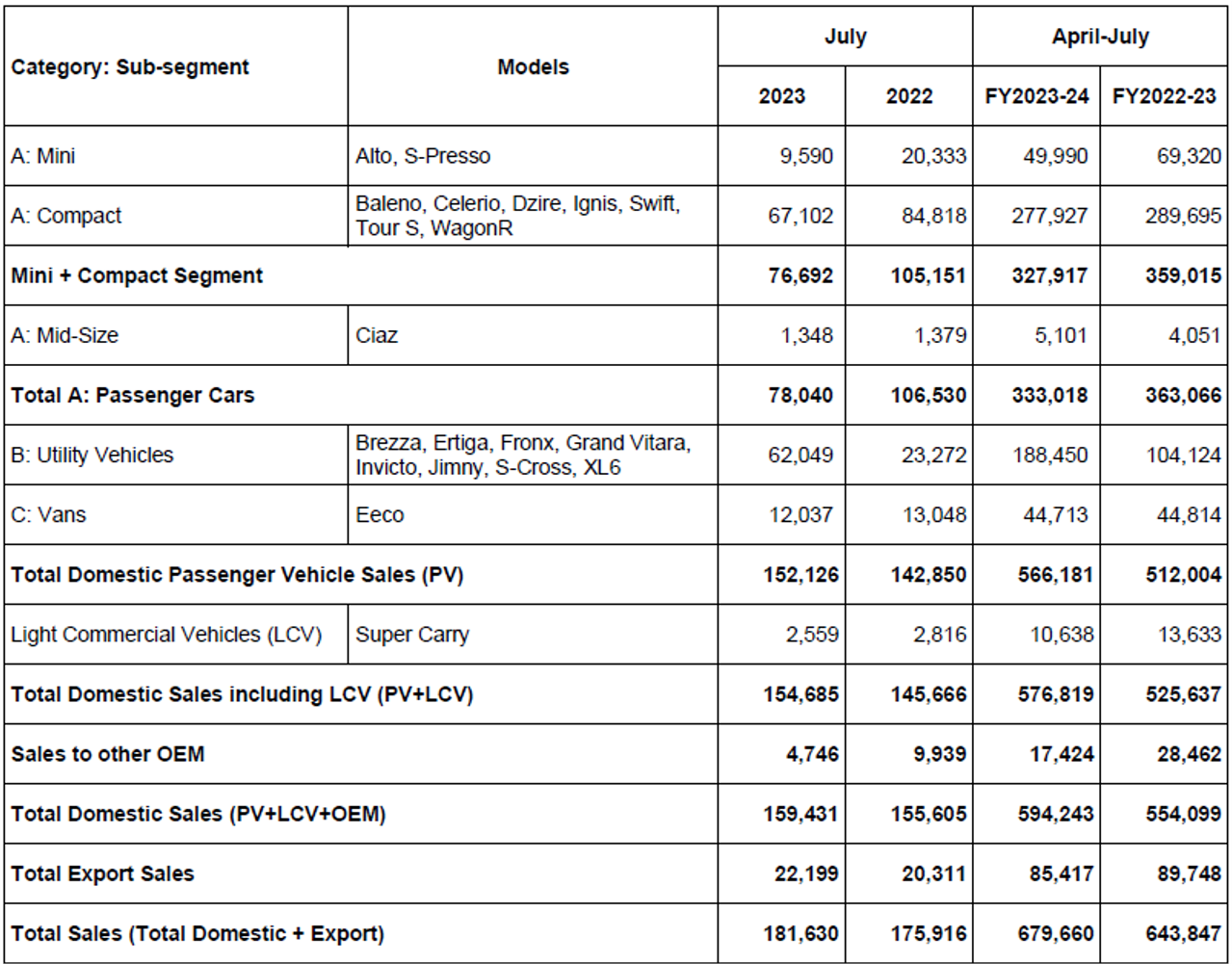

Maruti Suzuki India (MSIL) has clocked overall sales of 152,126 units in July 2023, registering a 6.5 percent year-on-year (YoY) growth over 142,850 units sold in July 2022. The growth was primarily led by its SUVs, which registered a 166 percent YoY uptick to 62,049 units (July 2022: 23,272). MSIL says the strong performance of its SUV models, including the Brezza, Fronx, Jimny, and the Grand Vitara, has enabled it to clinch the No. 1 spot in SUV sales last month, making it overtake Mahindra & Mahindra.

India’s largest carmaker was also able to more than triple its SUV market share in the month, to 24.6 percent, which was pegged at only 7 percent in July 2022, when it did not have the Grand Vitara mid-size SUV in its portfolio. MSIL says the contribution of SUVs in its overall sales was 49.1 percent in July, growing from 47.2 percent in the previous month.

On the other hand, the company’s range of entry-level cars – Alto and S-Presso – registered a significant decline, de-growing by 53 percent from 20,333 units sold in July 2022 to 9,590 units in July 2023. Sales of its line-up of compact cars, including the Baleno, Celerio, Dzire, Ignis, Swift, Tour S and WagonR, also dropped to 67,102 buyers (July 2022: 84,818 /- 20.8%).

Shashank Srivastava, Senior Executive Officer, Marketing and Sales, MSIL, explained that the percentage of industry sales coming from the sub-Rs 10 lakh price category is pegged at 55.7 percent for the April-July 2023 period, whereas it was at 60 percent in the same period last year.

The company, however, raised a red flag about the growing level of stock in the pipeline with the dealer ecosystem now sitting at an overall inventory of 294,000 units – the highest since September 2019. For MSIL, the company’s retail channel currently has an inventory of 139,000 units, with company discounts ranging from Rs 16,000 to Rs 17,000 on every model last month.

“If the stock increases beyond a certain level, we will have to modulate our production in line with the retail. However, the good thing is that one can now do the model-wise adjustment as the chip supplies are getting better. Earlier, we were unable to produce cars which were in high demand and therefore, our order backlog kept getting higher despite a robust inventory,” Srivastava told journalists on a virtual call.

As of August 1, 2023, MSIL has an order backlog of 336,000 units with 95,000 units of its Ertiga and XL6 MPVs forming the largest chunk of the backorder. While it had lost almost 28,000 units in production in Q1 FY24, MSIL is confident of significantly improved semiconductor supplies going forward, despite the full visibility on supplies being unclear.

At 6.5 percent, MSIL grew faster than the industry, which is estimated to have clocked sales of 352,492 units (July 2022: 341,971 / +3.1%). The company says its strong performance on the back of SUVs has enabled it to gain 1.4 percentage points and grow its market share to 43.3 percent in July 2023, as against 41.8 percent in July 2022.

The company also saw its Nexa retail channel clock 52,500 units in July sales, making it the No. 2 car brand in the country, after MSIL itself. MSIL is confident of rural India being a strong demand driver with an 18.6 percent growth rate, over urban India’s growth rate of 14.2 percent. The company saw rural market penetration in sales at 43.8 percent in July 2023.

MARUTI SUZUKI INDIA JULY 2023 SALES