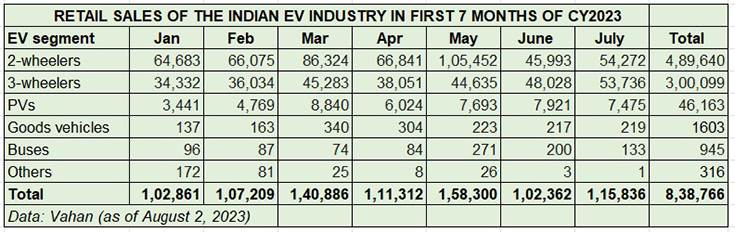

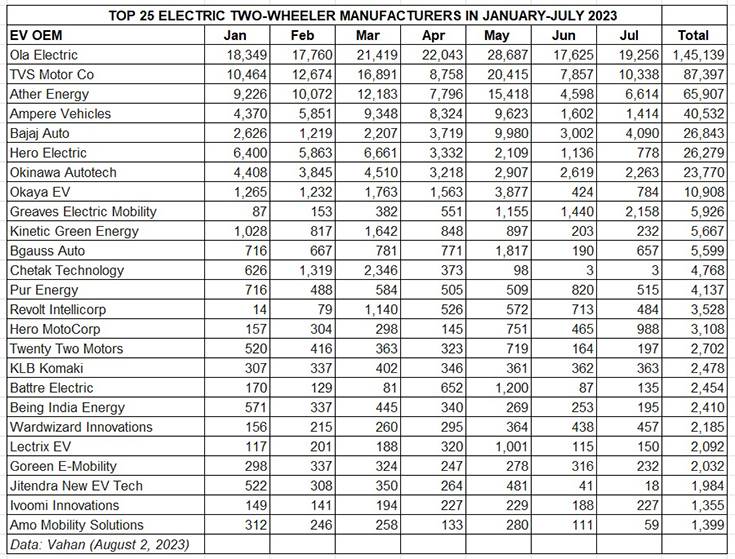

The charge of the Indian electric vehicle (EV) industry continues. Retail sales of EVs across the two-, three-, four-wheeler (car and SUV) segments along with goods- and passenger-carrying commercial vehicles in July 2023 have totalled 115,836 units in July 2023. This data is as per the government’s Vahan website as of 9pm on August 2, 2023. The number should increase marginally as new registrations from last month continue to filter through.

The July retails also mean that EV sales have charged past the 100,000-unit mark for the 10th month in a row. Having first crossed the milestone in October 2022 (117,200 units), the sales momentum has continued in November (121,602) and December (105,003) and all through the first seven months of CY2023, hitting a high in May 2023 (158,291 units).

That the 100,000-sales mark continues to be surpassed each month is proof that the maturing Indian EV market, particularly for electric two-wheelers, has begun to absorb the sharp 25% reduction in the FAME II subsidy for e-two-wheelers, which kicked in from June 1. Monthly EV sales in the past 10 months had dropped to their lowest in June (102,362 units) but the recovery is underway as seen in the improved July numbers – up 13% month on month.

The EV industry’s ongoing growth can also be gleaned from the fact that cumulative sales of the first seven months of CY2023, at 838,766 units, are already 82% of the record one-million-plus (10,24,806 unit) sales in CY2022.

Electric two- and three-wheelers, the two ‘low-hanging fruits’ of the industry and the more affordable segments compared to electric cars, goods carriers or buses, understandably have been the main growth drivers of the sales in first-half CY2023. While e-two-wheelers, with 434,914 units, account for 58% of the total sales, three-wheelers (246,270 units) have a 36% share of the EV pie. A total of 46,163 electric cars and SUVs were also sold, which gives them a 5.5% share, with commercial vehicles comprising goods carriers and buses getting a 0.30% share with 2,548 units (see EV retail sales data table below).

At 838,766 units, EV retail sales in India are already 82% of the record one-million-plus (10,24,806 unit) sales in CY2022.

Let’s take a closer look at how each sub-segment performed along with the company-wise retails.

Electric two-wheelers: Ola’s huge lead, TVS, Ather, Bajaj make gains

Electric two-wheelers: Ola’s huge lead, TVS, Ather, Bajaj make gains

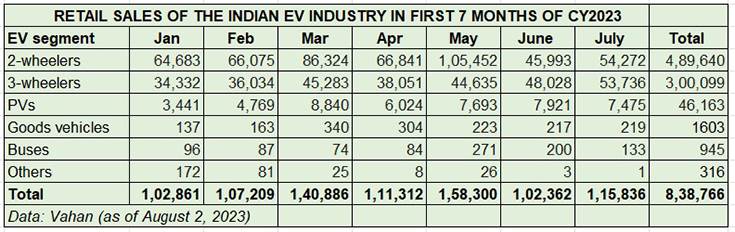

July 2023: 54,272 units, up 18% (June 2022: 44,381)

Jan-July 2023: 489,640 units, up 59.51% (Jan-July 2022: 306,947 units)

The e-two-wheeler industry seems to have taken the reduced FAME subsidy in its stride. After the sharp 56% month-on-month decline in June 2023 (45,993 units), July numbers at 54,272 units are an 18% improvement on June 2023 and 16% YoY (July 2022: 46,607 units). In the first seven months of CY2023, 486,640 units were sold, up 59.51% YoY growth (January-July 2022: 306,947 units).

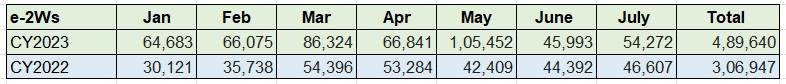

Of the 148 OEMs in the fray, most of the leading players have logged growth in July, bettering their June retails. The top seven OEMs, each having sold over 1,000 units last month, account for 46,133 units or an overwhelming 85% of total sales in July 2023. Of the top 25 EV makers, 18 have registered month-on-month gains while seven have seen a decline (see Top 25 EV OEMs retail sales table below).

Leading the charge is market leader Ola Electric with 19,256 units, up 9% over its June 2023’s 17,625 units. Ola maintains a massive lead over its rivals in the ongoing fiscal year – its January-July 2023 sales at 145,139 units give it a huge lead of 57,742 units over the No. 2 EV OEM, and a commanding market share of 30 percent.

TVS Motor Co sold 10,338 iQubes in July, up 31% on June’s 7,857 units. Cumulative seven-month sales are 87,397 units give TVS an 18% market share. Also, total sales of the TVS iQube have crossed the 150,000 milestone since the e-scooter’s launch in January 2020.

In third place is Ather Energy which sold 6,614 units last month, up 44% on June’s 4,598 units, and 65,907 units in January-July. Bajaj Auto, which has ramped up Chetak production, sold 4,090 units, up 36% on June’s 3,002 units and 28,843 units YTD.

While Okinawa Autotech, ranked fifth, sees its sales decline by 13% to 2,263 units, Greaves Electric Mobility with 2,158 units betters its June sales by 50 percent. However, its sister concern Ampere Vehicles, with 1,414 units, witnesses a 12% MoM decline. Meanwhile, Hero MotoCorp, with 988 Vidas sold, more than doubled its June performance with a 112% MoM increase in sales (June 2023: 465 units) and has gone past Hero Electric (778 units in July 2023) for the first time.

While the June 2023 sales were a harsh reality check for OEMs, who were extremely bullish about demand continuing to extend across 65,000 units a month, the 18% month-on-month improvement in retail sales in July 2023 point to a maturing of the e-two-wheeler market in India.

The fact that over the past two months, over 100,000 buyers – 100,256 – have chosen to purchase an eco-friendly, zero-emission two-wheeler, despite the reduced-by-25% FAME subsidy which has resulted in a higher product price, indicates that the EV consumer is willing to spend more to benefit from a wallet-friendly EV compared to a petrol-engined scooter or motorcycle.

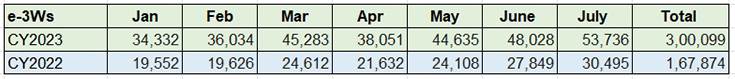

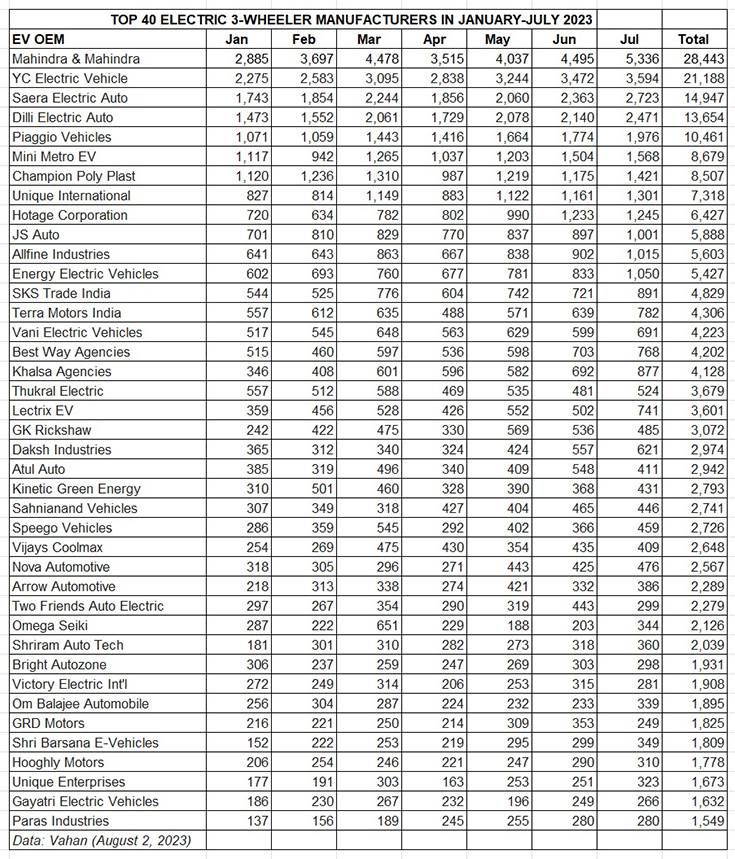

Electric three-wheelers: M&M leads with 9% share, YC Electric a close second

Electric three-wheelers: M&M leads with 9% share, YC Electric a close second

July 2023: 53,736 units, up 76% (June 2022: 44,381)

Jan-July 2023: 300,099 units, up 79% (Jan-July 2022: 167,874 units)

Here is where the real action is – barring April, the sales numbers for the first seven months of CY2023 show sustained growth. This performance has resulted in the segment clocking all of 300,099-unit sales in January-July, up by a strong 79% YoY, and indicating that demand remains strong.

This sub-segment, which sells passenger-transporting e-rikshaws and cargo-carrying three-wheelers, continues to witness strong double-digit growth thanks to sustained demand for passenger transportation and from last-mile operators for e-commerce applications, food deliveries and other applications.

Of the nearly 450 players in the market, we have shortlisted the Top 40 OEMs in terms of sales and Mahindra Last Mile Mobility (MLMM), the market leader in FY2023 with over 35,000 units and a 9% share, maintains its leader position status with 28,443 units in January-July. This total is already 81% of MLMM’s CY2022 sales of 35,013 units. The company, which expanded manufacturing capacity in April with a new line for its Treo e-three-wheelers at the Haridwar plant, currently has six EVs on sale – the Treo, Treo Yaari and e-Alfa Mini for passenger transport and the Zor Grand, Treo Zor and the e-Alfa cargo for goods transport.

Close behind MLMM is YC Electric Vehicles, with 21,188 units and 7% market share. A laudable performance from the company with five products – the Yatri Super, Yatri Deluxe and Yatri for passenger duties and the E-Loader and Yatri Cart for cargo operations. Low initial cost, from Rs 125,000 to 170,000 for passenger EVs, and Rs 130,000 to Rs 165,000, is what is driving demand for YC Electric.

In third place is Saera Electric Auto with 14,947 units and a 5% share, followed by Dilli Electric with 13,654 units (4.5% share) and Piaggio Vehicles with 10,461 units (3.5% share).

The Top 10 OEMs cumulatively account for 125,512 units and 42% of total sales, leaving the balance 58% of the e-three-wheeler market to the other 440 OEMs.

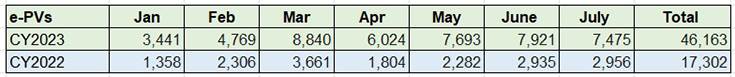

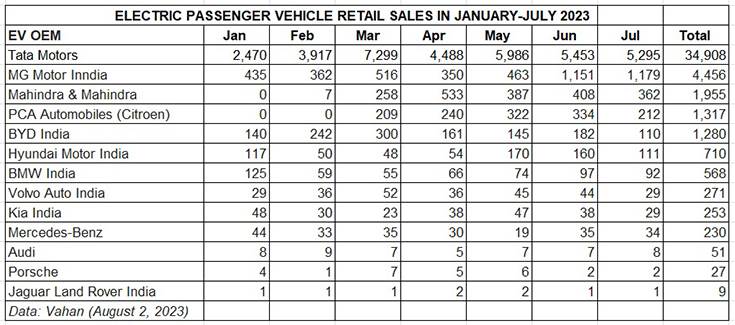

Electric Passenger Vehicles: Tata Motors, MG, M&M the top 3, Citroen goes ahead of BYD

Electric Passenger Vehicles: Tata Motors, MG, M&M the top 3, Citroen goes ahead of BYD

July 2023: 7,475 units, up 153% (July 2022: 2,956 units)

Jan-July 2023: 46,163 units, up 166% (Jan-July 2022: 17,302 units)

E-mobility is thriving in the passenger vehicle (PV) segment and have already scaled a new high, having gone past entire CY2022’s 38,215 units. At a cumulative 46,163 units in the January-July 2023 period, the YoY growth is a robust 166% with average monthly sales being 6,594 units. A year ago, the monthly average was 2,471 units, pointing to the strong wave of demand for electric cars, SUVs and MPVs.

The data table above is indicative of the sustained demand through the year to date. While FY2023-ending March 2023 (8,840 units) was the best month, May (7,693), June (7,921) and July 7,475) have all seen sales in the 7,500-unit region. Given the sales momentum, this segment will hit a new high, likely driving past the 85,000 mark for the full year.

Electric PV market leader Tata Motors, which has the biggest portfolio comprising the Nexon EV, Tigor EV, Tiago EV and the Xpres-T (for fleet buyers), has sold 34,908 units, which gives it a 77% market share and YoY growth of 104 percent. A year ago, in January-July 2022, it had sold an estimated 17,114 PVs. Its market share used to be in excess of 80% but has now reduced due to the expanding market which now has wider product choice from rivals.

MG Motor India, with 4,456 units sold comprising the ZS EV and Comet EV, remains the second-ranked ePV OEM. MG’s performance in the first 7 months of 2023 is up 273% on year-ago sales of around 1,193 units and has seen its market share rise to 10 percent.

Mahindra & Mahindra, with 1,955 units, is in third position having gained traction with the launch of the all-electric XUV400 – the first real rival to the high-selling Tata Nexon EV – in January. The company, which also retails the eVerito sedan, currently has a 4% market share.

The big news from July and the first seven months of CY2023 is that PCA Automobiles India (Citroen India) has gone ahead of BYD India. Total sales of the Citroen eC3, the electric version of the C3 hatchback, has sold 1,317 units in five months since launch in end-February at Rs 11.50 lakh. This gives PCA India an EV market share of 3%, which puts it on a par with BYD India – creditable for a recent entrant.

BYD India, which sells the Atto 3 SUV and e6 MPV, drops one rank to fifth with sales of 1,280 units and a market share of 3 percent.

The Korean siblings – Hyundai Motor India and Kia India – together sold 963 units. While Hyundai, which retails the Kona and the Ioniq 5, posted sales of 710 units, the Kia EV6 went home to 253 buyers.

As per the Vahan data, luxury carmakers in India accounted for 1,156 units or 2.5% of total ePV sales. BMW India is the leader here with 568 units, followed by Volvo Auto India (271), Mercedes-Benz (230), Audi (51), Porsche (27) and Jaguar Land Rover (9)

Electric CVs: Tata Motors tops with 35% share, BYD India has 9%

Electric CVs: Tata Motors tops with 35% share, BYD India has 9%

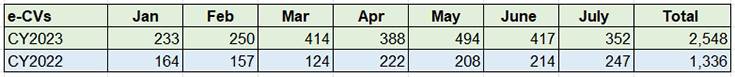

July 2023: 352 units, up 42.51% (July 2022: 247 units)

Jan-July 2023: 2,548 units, 90 % (Jan-July 2022: 1,336 units)

The commercial vehicle industry, where electric mobility makes eminent sense given the much larger number of kilometres driven, compared to personal EVs, has registered cumulative sales of 2,548 units, up 90% YoY on a low-year ago base. The CV sector essentially comprises goods carriers and passenger-transporting buses. As per Vahan, electric goods carriers accounted for 1,601 units and electric buses for 945 units.

In the combined sales tally of goods carriers and buses, Tata Motors leads with 886 units, which makes for a strong 35% market share. It is followed by BYD India with 225 units and a 9% share. PMI Electro Mobility (210), Mahindra Last Mile Mobility (191), Olectra Greentech (137) and Switch Mobility (116) are the other OEMs whose eCV sales run into three figures in the first seven months of CY2023.

The data tables below provide both company-wise sales splits as well as the sub-segment-wise split between electric goods carriers and electric buses.

India EV industry firmly plugged into growth mode

India is targeting EVs to account for 30% of its mobility requirements by 2030, driven by the FAME scheme, state subsidies and a larger portfolio of products across vehicle segments.

The Ministry of Heavy Industries-formulated five-year Faster Adoption and Manufacturing of Electric Vehicles in India Phase II (FAME India Phase II) Scheme, with a total budgetary support of Rs 10,000 crore, comes to a close on March 31, 2024. FAME II is mainly focused on supporting electrification of public and shared transportation, and support through demand incentive for 7,090 electric buses, 500,000 e-three-wheelers, 55,000 passenger vehicles and 10 lakh e-two-wheelers. Creation of EV charging infrastructure is also supported under the scheme.

Given the likelihood of the FAME subsidy scheme not being extended, OEMs and EV buyers will have to contend with the fact that market dynamics will take over even as OEMs and their component and technology supplier ecosystem are hard at work to reduce developmental and product costs to enhance EV affordability compared to IC-engined two-wheelers.

The domestic EV industry’s sales growth in 2023 can be attributed to an increase in the availability of products in the market, high petrol, diesel and CNG prices, state subsidies and sops offered under FAME II. It also helps that there is growing consumer awareness about the need to use eco-friendly transport. And, of course, the wallet-friendly nature of EV cost of ownership over the long run is a big catalyst.

Given the pace of growth, the EV industry can be expected to notch consistent progress in the in the second half of the year. Some challenges remain in the form of inadequate charging infrastructure and high initial EV prices, which is directly related to the battery cost. Nevertheless, with OEMs’ sharpened focus on localisation with a view to reduce costs and enhance affordability, and battery prices expected to reduce gradually, there is cautious optimism for this eco-friendly form of mobility.

On the numbers front, India EV Inc is headed for another record year of sales. Having surpassed sales of 800,000 units in the first seven months of 2023, the five months to go could bring in an additional 550,000 to 600,000 units, what with the festive season coming up in a couple of months. This would translate to an estimate of 1.3-odd million units and 25% YoY growth (CY2022: 10,24,808 EVs). In CY2022, EVs accounted for 5% of total India Auto Inc’s sales of 2,07,52,305 units. Will CY2023 raise the bar on the EV front? Keep watching this space . . .