India Auto Inc, which closed FY2023 with total automobile sales of 21.20 million units (up 20% YoY) across the two- and three-wheeler, passenger and commercial vehicle segments, maintains its growth momentum in the ongoing fiscal year. In the first quarter of FY2024 (April-June 2023), cumulative wholesales of these four vehicle segments were nearly 5.5 million vehicles, which is an 11.39% increase over Q1 FY2022’s 49,35,910 units.

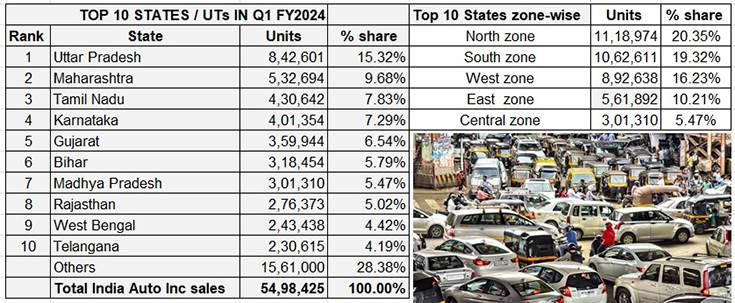

Driving these numbers is the demand emanating from 10 States and Union Territories in India. As per data released by apex industry body, Society of Indian Automobile Manufacturers (SIAM), Uttar Pradesh is the state with the largest volume of sales, followed by Maharashtra, Tamil Nadu, Karnataka, Gujarat, Bihar, Madhya Pradesh, Rajasthan, West Bengal and Telangana.

While the top four states account for 22,07,291 units and 40% of total India sales, the North zone leads with 20.35% with the South close behind with 19.32 percent.

While the top four states account for 22,07,291 units and 40% of total India sales, the North zone leads with 20.35% with the South close behind with 19.32 percent.

Uttar Pradesh the biggest market, Maharashtra takes second spot

Extrapolating the basic state-wise data provided by SIAM with the industry body’s wholesales numbers for the first three months of FY2024 (April-June 2023) reveals that Uttar Pradesh (UP), the largest state by population, accounted for 842,601 vehicles and 15.32% of total wholesales in Q1 FY2024.

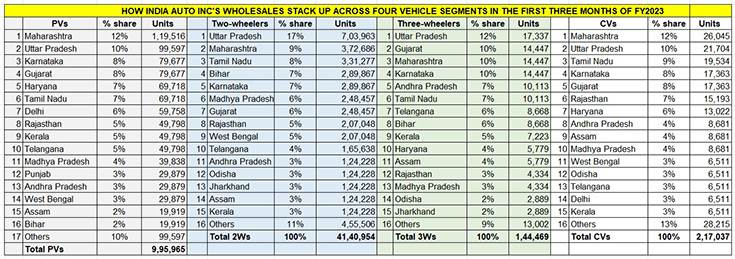

Uttar Pradesh is the No. 1 state for vehicle sales, which is thanks to it having the maximum demand for two-wheelers. With 703,963 units, UP had a 17% share of total bike and scooter sales, nearly twice that of the No. 2 state Maharashtra, in Q1 FY2024. Uttar Pradesh is also the top state in three-wheeler sales with 17,337 units and a 12% share of the market. The state also saw sales of 99,597 PVs and 21,704 CVs, which gives it second rank state-wise in both these segments. Thus, UP lords over other states – leading in two segments and the No. 2 in two others.

Maharashtra, which is home to the financial capital of the country and among the leading automobile manufacturing hubs in the country, saw cumulative sales of 532,694 units across four vehicle segments, which gives it a 9.68% share of overall India Auto Inc’s Q1 FY2024 numbers. Maharashtra’s heft comes from it being the No. 1 in passenger vehicle sales – 119,516 units and a 12% share of the PV market – as well as an identical 12% share in the critical commercial vehicle market – 26,045 units. While the state is ranked second in two-wheelers, with 372,686 units and a 9% share, sales of 14,447 three-wheelers and a 10% share gives it third position after UP and Gujarat. But like UP, Maharashtra has a podium place in all four vehicle segments.

At No. 3 is Tamil Nadu with overall automobile sales of 430,642 units and a 7.83% share. While it is ranked third in both two-wheelers (331,277 units and 8% share) and CVs (19,534 units and 9% share), this state, which is aggressively driving strategy to be the EV manufacturing hub of India, has an identical sixth rank for both PVs (69,718 units and 7% share) and three-wheelers (10,113 units and 7% share).

Just 29,290 units behind Tamil Nadu is another southern state – Karnataka. With 401,354 units sold in April-June 2023, Karnataka has a 7.29% share of India’s automobile market in Q1 FY2024. This figure is a result of the 289,867 two-wheelers (fifth rank and 7% share), 79,677 PVs (third rank and 8% share), 17,363 CVs (fourth rank and 8% share) and 14,447 three-wheelers (fourth rank and 10% share).

North India tops but South a close second in the Top 10

If one takes a look at the six zonal splits (North, South, East, West, Central and North East) in the Top 10 states, the first five zones are well represented in the SIAM numbers. North India tops the lot with cumulative sales of 11,18,974 units which gives it a 20.35% share of overall auto sales. This is thanks to UP’s leading 15.32% share along with Rajasthan’s 5 percent.

South India (Tamil Nadu, Karnataka, Telangana), with 10,62,611 units, is a close second with a 19.32% percent share, followed by the western region (Maharashtra and Gujarat) with 892,638 units and 16.32% share. The eastern region (Bihar and West Bengal) with 561,892 units has a 10.21% share of India Auto Inc’s sales in Q1 FY2024 and the central zone (Madhya Pradesh) with 301,310 units has a 5.47% share.

Number-crunching and the demographic dividend for OEMs

India Auto Inc clocked 11% YoY growth in Q1 FY2024 with sale of 5.49 million vehicles. While demand for utility vehicles continues to power passenger vehicle dispatches, three-wheeler sales are accelerating as a result of the shift to EVs. Two-wheeler wholesales were up 11% up but OEMs are awaiting demand to kick in from the biggest buyer – rural India and Uttar Pradesh. On the CV front, the sales decline for goods carriers pulled the segment down in the first quarter of the ongoing fiscal.

SIAM’s state-wise sales representation offer a clue and more to just how the industry is faring. Most OEMs have dedicated teams that focus on the market performance dynamics as well as demographic shifts and the number-crunching that goes along with it.

ALSO READ:

ALSO READ:

Winners and losers in India’s two-wheeler market in Q1 FY2024

India Auto Inc sells 5.49 million vehicles in Q1 FY24, clocks 11% growth

UV sales grow by 18% in Q1 FY24, Maruti and Mahindra shine, Tata and Kia lose market share

CNG car sales witness slowdown in first-half CY2023, decline 5 percent