Car taxes are an important source of funding for the Norwegian state and there are taxes on both the purchase and use of a car. There are different political opinions about how much car tax the authorities should collect and how the tax system should be designed.

Purchase taxes Historically, the rationale for purchase taxes on cars has almost exclusively been to generate income for the state. In recent years, taxes have increasingly been used as a means of reducing emissions from road traffic by making it favorable for buyers to choose cars with low or no greenhouse gas emissions.

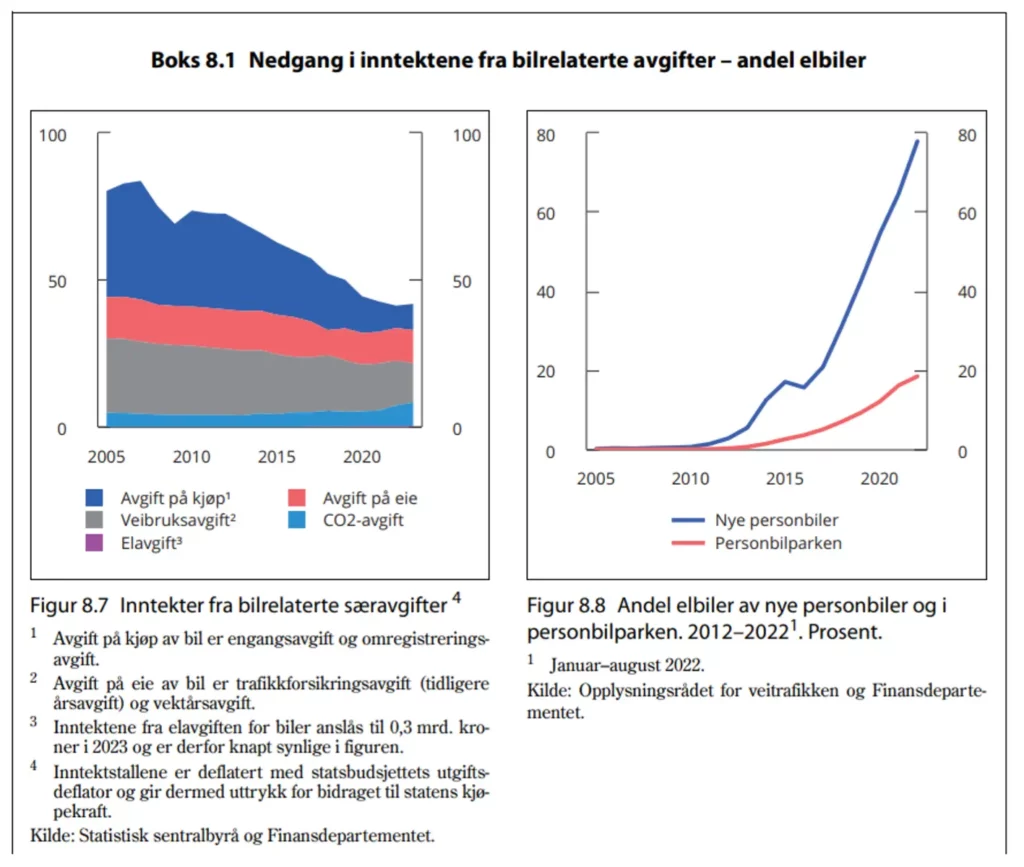

This has greatly contributed to Norway having the world’s highest proportion of zero-emission cars, around 80 per cent of all new cars in 2023 being electric. Another consequence is that the state’s income from car taxes has been greatly reduced.

The Storting aims for all new passenger cars and light vans sold from 2025 to be zero-emission vehicles. With that, the prerequisites for the tax system will change.

The total car taxes in 2023 will be around NOK 40 billion, just over NOK 40 billion lower than in 2007.

The one-off fee (the fee paid when registering a new car) has been gradually changed over the years. There are currently taxes on the car’s weight, as well as CO2 and NOX emissions.

The CO2 tax is progressive. That is, the rates are lower the less CO2 the car emits, and negative if the emissions are very low. On cars with a negative CO2 tax, this is deducted from the weight tax, up to a lower limit of zero kroner. The various rates and steps for the fees are adjusted in the annual state budgets in line with technological development and/or political guidance.

Rechargeable hybrids have had tax advantages over several years through weight deductions and negative CO2 tax. The benefits for plug-in hybrids have been phased out over several years and from 1 January 2024 all benefits will be gone.

Until 2023, electric cars were neither subject to value added tax nor one-off tax. For many years there was broad political agreement that electric cars should be exempt from all purchase taxes.

But from 2023, the Storting decided that electric cars must pay value added tax for the part of the purchase price that exceeds NOK 500,000.

From 1 January 2023, a new partial fee was also introduced in the one-off fee based on weight. The new weight tax applies to all passenger cars. For weights over 500 kg, a one-off fee of NOK 12.50 per kg is calculated.

Cars with internal combustion engines are covered by the new weight tax and the general one-off tax (CO2, NOx and net weight), while electric cars are only covered by the new weight tax. For heavier vehicles, there is no one-off tax. However, the Storting decided in connection with the consideration of the State Budget for 2023 that the one-off tax for heavier vehicles with fossil powertrains should be investigated until the consideration of the State Budget for 2024.

User fees In order to use the car, motorists pay a number of different fees. The traffic insurance fee (formerly annual fee) is collected via the insurance companies and is a fee for compulsory liability insurance. In addition, motorists who have cars with a combustion engine pay CO2 tax and road use tax as part of the price when they fill the tank with fuel.

Tolls are another user fee paid by motorists. The revenue from tolls is estimated at NOK 16.1 billion in 2023. In some tolls, zero-emission cars are exempt from paying tolls. The Storting has decided that no toll company has the right to demand zero-emission cars for more than 70 per cent of the rate that cars with fossil powertrains pay.

The electric cars are also not required to pay road use tax when they charge, as the cars with internal combustion engines do through the road use tax on fuel. The growth in the number of electric cars on the roads thus has major consequences both for the state’s income from tolls and the income from road use tax.

The Norwegian Tax Agency and the National Road Administration have therefore been commissioned by the government to investigate a new, comprehensive system for road use tax and tolls, with the aim of a kilometre-based, flat road use tax for electric cars and a two-zone based road pricing system for heavy vehicles. If this is to be introduced, it must first be approved by the Storting.

What does BIL mean?

BIL cooperates with the consumer organization NAF and the Norwegian Automobile Industry Association in car tax policy.

We are concerned withthat bilen is both necessary and a social good. For most families, the car is a big investment, and they depend on the car to make everyday logistics work. The car policy must be predictable and all changes must take place in small steps.

BIL’s aim is that the policy pursued reinforces the green shift on the roads, but without driving up the tolls.

BIL believes that a modern car tax system must be long-term, predictable and comprehensive. It shall promote mobility and recognize the value of high mobility, both for society and for individuals. A modern car tax system promotes the climate goals through positive incentives and makes it possible for it to pay off to make climate-friendly vehicle choices, both for businesses and families.

Car taxes must be used to cover the car’s socio-economic costs, not be a means of providing the state with independent revenue income. BIL believes it is correct to count tolls as a car-related tax.

Purchase taxes The replacement of the car fleet must be accelerated if we are to reach the climate targets. The car taxes must be adapted to this.

For the electric passenger cars, value added tax for purchase amounts under NOK 500,000 should be phased in gradually and predictably throughout the parliamentary period 2025 – 29. A moderate one-off tax for zero-emission vehicles must be predictable and based on objective criteria. The fee level must be adapted to the need to phase in new zero-emission vehicles in the car fleet.

For commercial vehicles, there is a need for significant purchase incentives for emission-free goods vehicles and heavy vehicles to ensure that they are competitive in price. A one-off tax on heavy vehicles must not be introduced.

User charges When the level of user charges is set, BIL believes that the value of mobility, consideration for business and the risk of adverse social consequences must be emphasised.

High mobility is good for society and creates great value, both economically and socially. For commercial transport, the user charges must provide a predictable charge picture that is easy to invoice.

The user fees must not be so high that such mobility is reduced, especially not for emission-free vehicles.

BIL believes it is right that zero-emission cars should pay for road use. In our opinion, a flat, moderate mileage rate is preferable. If, in the long term, one is to consider further investigating a position-based system, we must be sure that all privacy considerations are adequately taken care of.

For heavy transport, a position-based system is acceptable from a privacy perspective. The prerequisite is that it is kept revenue-neutral and ensures equal competitive conditions for everyone who operates commercial transport on Norwegian roads.

The balance between purchase and use It is important that we have a tax system where the purchase tax does not become so high that the rate of replacement of the car fleet is reduced. This will slow down the green shift.

It is also important that we have a tax system where the user fees do not become so high that people cannot afford to use the car. It will affect the economy and social sustainability.

Over the past twenty years, the average age of the car fleet has risen by one year. It is in the districts that the car park is the oldest. Although the average scrapping age is 18.2 years, a large proportion of the car fleet in Norway is still over 20 years old. A system must be introduced that helps to get the oldest, least traffic-safe and most polluting cars off the road.

BIL is in favor of strengthening public transport and building better roads. It will be a good contribution to reducing greenhouse gas emissions, solving traffic challenges and reducing both the number and potential damage in traffic accidents. The green shift in utility transport requires available and adequate green technology. When the technology exists, BIL must be in the first row to help get it into use. But the technological maturity has come significantly shorter for utility transport than for private cars. For many van customers (loading and towing heavily) there are no good electric alternatives. The tax level for diesel/petrol vans must reflect that. At the same time, solid green incentives are needed to ensure the pace of the transition to zero emissions for commercial transport.

Read more/current links: National budget for 2023; Prop. 1 LS (2022–2023) — Taxes, duties and customs 2023:https://www.regjeringen.no/no/dokumenter/prop.-1-ls-20222023/id2931482/

National Transport Plan 2025-2036 Climate – delivery to the priority assignment:https://www.regjeringen.no/contentassets/f517f097ff11468fbb8087f6bc981c43/felles-svar-prioppdrag-310323/klima.pdf

The government’s political platform, the Hurdal platform: https://www.regjeringen.no/no/dokumenter/hurdalsplattformen/id2877252/

BIL’s strategy 2025 – 2029:https://bilimportorene.no/nyheter/bilbråjens-strategi-for-2025-til-2029/