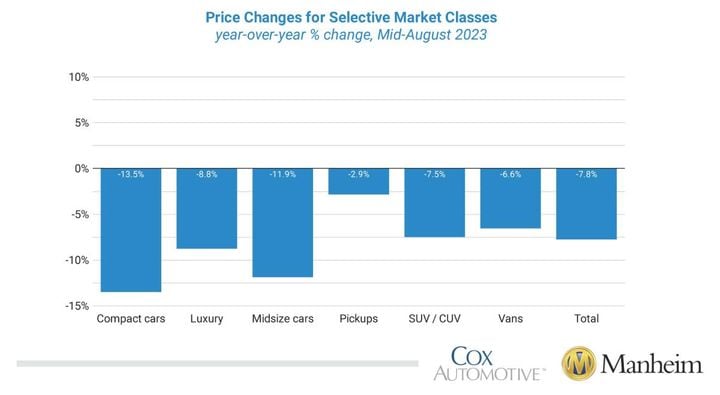

All major market segments saw seasonally adjusted prices that were again lower year over year in the first half of August, including pickups, sports cars, vans, and SUV’s.

Photo: Cox Automotive/Manheim

Wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased 0.1% from July in the first 15 days of August, according to the midmonth Manheim Used Vehicle Value Index, which rose to 212. That was down 7.8% from August 2022.

The seasonal adjustment diminished the increase. The non-adjusted price change in the first half of August increased 0.7% compared to July, while the unadjusted price was down 7.6% year over year. Over the last two weeks, Manheim Market Report (MMR) prices declined an aggregate of 0.2%, equal to the normal decline for the time of year.

Over the first 15 days of August, MMR Retention, the average difference in price relative to current MMR, averaged 99.3%, indicating that valuation models are getting closer to market prices. The average daily sales conversion rate of 57.3% in the first half of August increased substantially relative to July’s daily average of 49.3% but was below the August 2019 daily average of 60%..

The conversion rate indicates that the first 15 days of the month saw buyers with more bargaining power for this time of year.

All major market segments saw seasonally adjusted prices that were again lower year over year in the first half of August. Pickups, sports cars, vans, and SUVs lost less than the industry in seasonally adjusted prices, at -2.9%, -4.6%, -6.6%, and -7.5%, respectively. Continuing the recent trend, compact cars lost the most, down 13.5%, followed by midsize cars, down 11.9%, and luxury, declining by 8.8%.

The major segments saw mixed price movement compared to July, with sports cars up 3.3%, vans up 0.7%, and pickups increasing 0.4%. Compact cars and midsize cars were down by 0.8% and 0.4%, respectively, while SUVs and luxury were flat against July’s price performance.

Retail Supply Lower in Mid-August

Using estimates based on vAuto data as of Aug. 14, used retail days’ supply was 44 days, which was down three days from a revised end of July estimate. Days’ supply was down eight days year over year and down one day compared with the same week in 2019. Leveraging Manheim sales and inventory data, Cox estimates that wholesale supply ended July at 27 days, up one day from the end of June and down two days year over year.

As of Aug. 15, wholesale supply was down two days from the end of July at 25 days and down four days year over year but down one day compared to 2019.

Used retail supply measured in days’ supply and compared to 2019 suggests supply is tighter than normal for this time of year. Wholesale supply has decreased with stronger wholesale purchase activity in early August and is tighter than normal for this time of year.

Rental Risk Prices Decline in First Two Weeks of August

The average price for rental risk units sold at auction in the first 15 days of August was down 7.4% year over year. Rental risk prices were also lower by 0.3% compared to July. Average mileage for rental risk units in the first half of August (at 57,800 miles) was up 2.3% compared to a year ago but down 4.5% month over month.

Consumer Sentiment Declining in August

The initial August reading on consumer sentiment from the University of Michigan fell by 0.6% to 71.2, as views of current conditions improved but future expectations declined.

However, the median expected inflation rate over the next year dropped to 3.3% from 3.4% last month, and the longer-term view increased 0.1% to 2.9%. Consumers’ views of vehicle buying conditions improved to the best level since January and were much better than a year ago.

Consumers saw improved prices but worse interest rates and still viewed both negatively. The daily index of consumer sentiment from Morning Consult has also declined so far in August, as it is down 1.9% for the month through Aug. 15 compared to the end of July.

Increasing gas prices and falling stock prices are weighing on consumer sentiment. The average unleaded gas price has increased 2.5% so far in August to $3.87 per gallon as of Aug. 15.

Originally posted on Vehicle Remarketing