/

The US government found the credit reporting agency in violation of the CAN-SPAM Act, which requires companies to explicitly provide a means to opt out of marketing emails.

Share this story

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/24866373/Screenshot_2023_08_22_at_12.43.42_PM.png)

Credit reporting agency Experian must pay a $650,000 fine for violating spam laws. The US Justice Department and the FTC have announced a permanent injunction granted by the US District Court in central California, forbidding the company’s deceptive marketing email practices. The regulators’ complaint last week alleged that Experian had sent customers with free credit monitoring memberships deceptive marketing emails that lacked both “clear and conspicuous notice” of the ability to opt out and “a mechanism for doing so.”

The FTC says this violates the Controlling the Assault of Non-Solicited Pornography and Marketing Act (CAN-SPAM Act). The FTC referred the case to the DOJ to file the injunction before the court granted it, ordering Experian to pay the almost three-quarter-million-dollar fine within seven days.

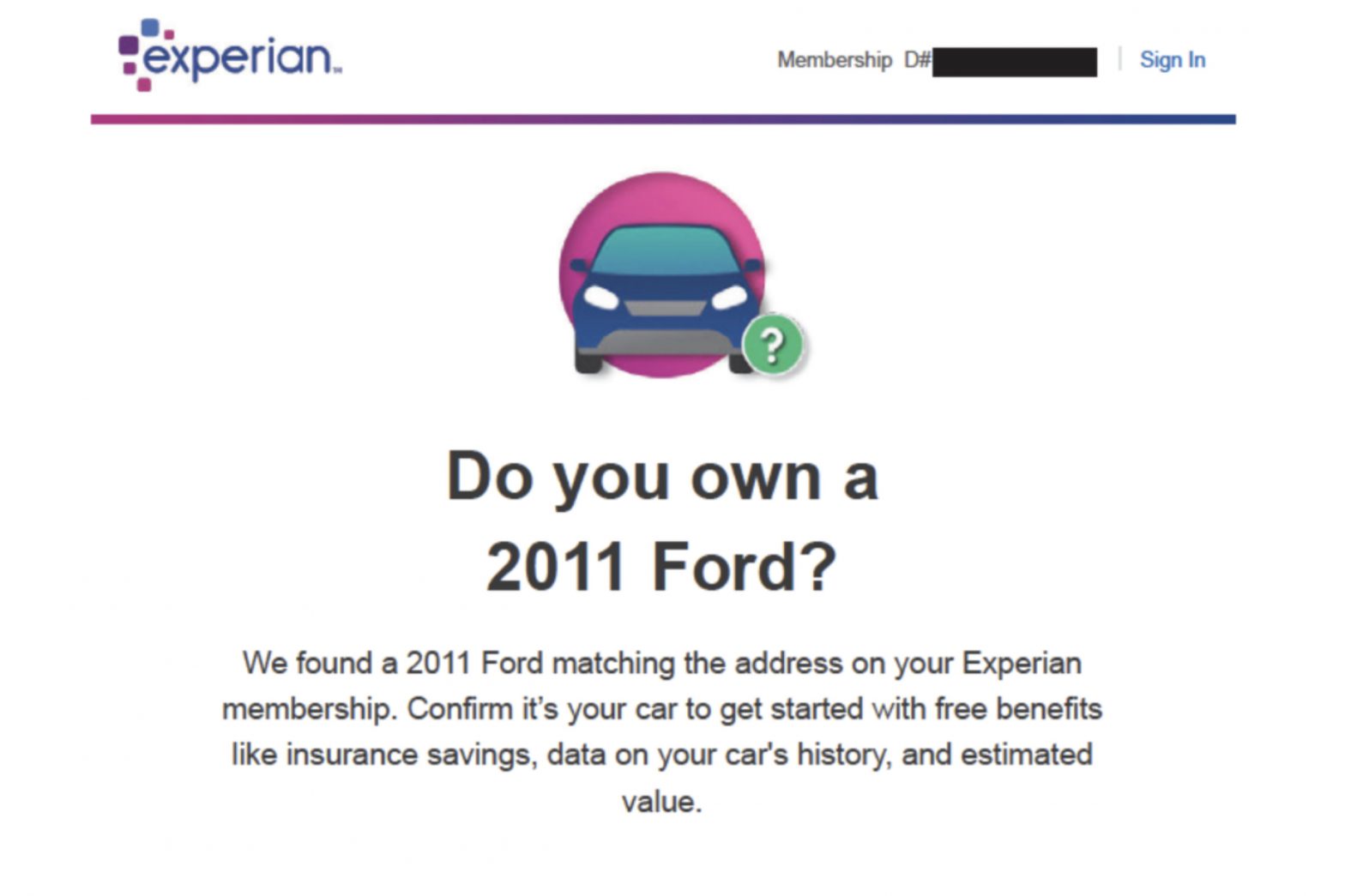

If you’ve been unlucky enough to receive Experian spam, you may already know the format. A new car has been noticed on your account — please confirm it! You need dark web monitoring to protect you! And, of course, that old classic: boost your FICO score. And of course, when you log in to your account, you’re treated to a page that wants you to upgrade your account or sign up for a loan, though that doesn’t appear to fall under the purview of this case.

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/24866382/Screenshot_2023_08_22_at_12.46.05_PM.png)

Text at the bottom of emails shown in court docs reads, “This is not a marketing email,” and claims the messages were notifications of recent account changes. No explicit opt-out link is visible — only a link to the company’s website and a statement that customers “can update some alerts and communications preferences” but will still “receive notifications like this one” on account status.

“Signing up for a membership doesn’t mean you’re signing up for unwanted email,” said director Samuel Levine of the Bureau of Consumer Protection at the time, “especially when all you’re trying to do is freeze your credit to protect your identity.”

The injunction says Experian is permanently forbidden from sending “transactional or relationship” messages if they fall under the FTC’s definition of commercial advertisements. In addition to ordering the company to ensure there’s an explicit opt-out in its marketing emails, the court also issued several compliance requirements to be sure the company is actually obeying the injunction.