Southeast Asian super app Grab Holdings Ltd, on Wednesday, reported that its losses fell 74% year-on-year to $148 million in the second quarter of 2023 (Q2 2023), from $572 million in the same period of 2022.

Grab also booked revenues of $567 million in the quarter, up 77% YoY from $321 million in Q2 2022 thanks to growth across all business segments and incentive optimisations, as well as a business model change for certain delivery offerings “in one of the markets”, the Nasdaq-listed company said in a statement.

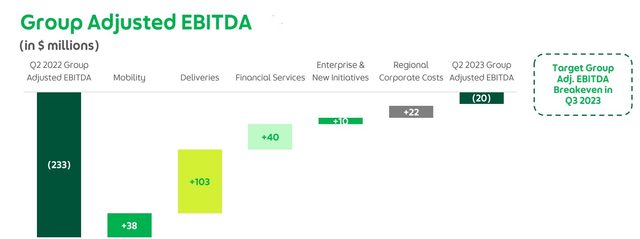

The company attributed the improvement in its bottomline to lower group adjusted EBITDA losses (-$20 million in Q2 2023 vs -$233 million in Q2 2022), and a reduction in fair value losses on investments, net interest expenses, and share-based compensation expenses.

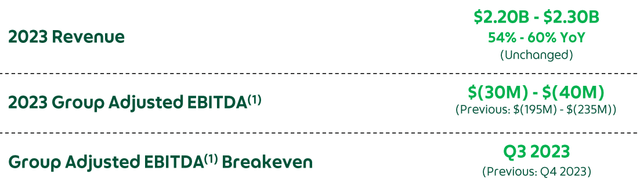

With the group-level adjusted EBITDA narrowing 92% year-on-year, the company advanced its target for achieving breakeven to Q3 2023, from Q4 this year.

Loss for the quarter included $65 million in non-cash, share-based compensation expenses and a $50 million charge due to costs from the restructuring exercise that the company conducted in June 2023.

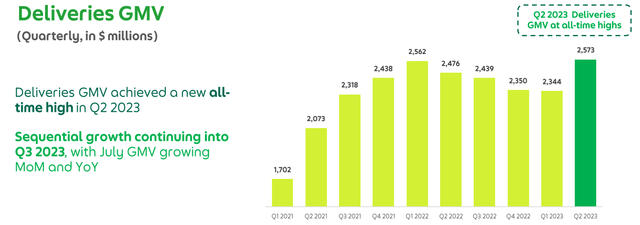

“We had a strong set of results for the second quarter. Deliveries GMV grew YoY to hit record highs, supported by our continued push on key affordability initiatives and an expanding GrabUnlimited subscriber base. More people are using Grab today than ever before, as we achieved our highest Monthly Transacting Users to date,” said Anthony Tan, Group CEO and co-founder, Grab.

“We continued on our path to profitability, with group revenues growing 77% YoY while delivering our sixth consecutive quarter of group adjusted eBITDA improvement,” said Peter Oey, Chief Financial Officer, Grab.

Grab’s GMV grew by a modest 4% YoY while its group monthly transacting users (MTUs) grew 7% YoY.

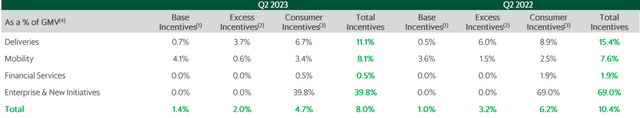

The company reduced its incentives to 8% of GMV in the second quarter, compared with 10.4% in the same period in 2022.

Incentives

Its corporate costs were also down to $192 million in Q2 2023, compared with $214 million a year ago as it implemented cost efficiencies across the organisation. Variable expenses declined 31% YoY from increased operational efficiencies, while staff costs declined 6% YoY due to lowered headcount.

In June, Grab announced 1,000 job cuts, which is equivalent to about 11% of its workforce as the firm wanted to manage costs and ensure more affordable services in the long term.

At the end of the second quarter of 2023, Grab had $5.6 billion of cash liquidity, compared to $5.8 billion at the end of the previous quarter.

Its net cash liquidity—cash on hand, time deposits, and marketable securities—stood at $4.9 billion in Q2 2023, compared with $5 billion at the end of Q1 2023.

Grab’s guidance for revenue for the financial year 2023 remains unchanged at $2.20-2.30 billion [+54-60% YoY]. The company also revised its group adjusted EBITDA guidance range from a loss of $165-195 million, to a loss of $30 million to $40 million for the full year 2023.

Grab’s guidance for 2023

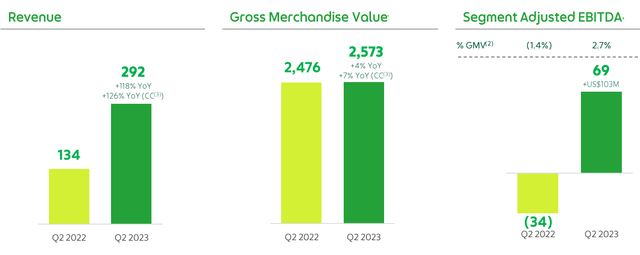

Deliveries division

Revenue for deliveries grew 118% YoY, or 126% YoY on a constant currency basis, to $292 million in the second quarter this year from $134 million in the same period in 2022. The company attributed this growth to a reduction in incentives and GMV growth.

Its GMV grew 4% YoY and 10% on a QoQ basis thanks to robust demand in this segment.

The segment’s adjusted EBITDA as a percentage of GMV expanded to an all-time high of 2.7% in the second quarter of 2023 from 2.6% in the first quarter of 2023 and -1.4% in the second quarter of 2022.

Grab’s deliveries segment in Q2 2023

The company’s subscription programme continues to see strong growth with a 43% YoY and 25% QoQ increase. In the quarter, GrabUnlimited users accounted for almost a third of Deliveries GMV and on average, spent 3.8x more on food deliveries services relative to non-subscribers.

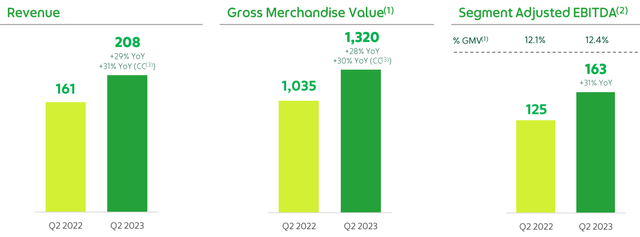

Mobility division

Revenue for the mobility business unit rose 29% YoY to $208 million in Q2 2023 from $161 million in Q2 2022.

GMV of this segment increased 28% YoY from $1.04 billion in Q2 2022 to $1.32 billion in the April-June period this year.

Grab’s mobility division in Q2 2023

“In Q2 2023, monthly active driver supply increased by 10% YoY while earnings per transit hour of our driver-partners increased 9% YoY,” the company said.

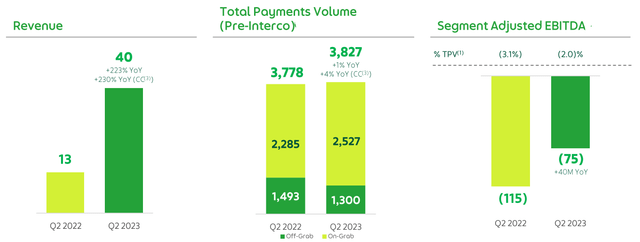

Financial services

On the fintech front, revenue grew 223% YoY to $40 million in the second quarter of 2023 due to improved monetisation of the payment business and higher contributions from lending.

However, GMV declined 13% YoY in the second quarter of 2023 to $1.3 billion from $1.49 billion in the same period last year.

Segment-adjusted EBITDA for the quarter improved by 35% YoY to -$75 million, as an increase in Digibank-related costs was more than offset by lowered spend in GrabFin. Its loans disbursement grew by 47% YoY.

Grab’s financial services division in Q2 2023

Enterprise and new initiatives

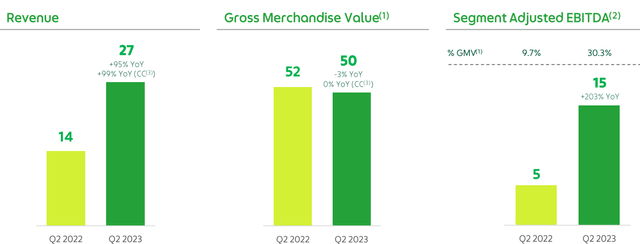

Grab booked $27 million in revenue from its enterprise and new initiatives segment, which represents a 95% increase YoY in the second quarter of 2023, thanks to growing revenues from advertising which amounted to $100 million on an annualised basis.

GMV for the period declined 3% YoY while segment adjusted EBITDA grew 203% YoY in the second quarter this year.

Grab’s enterprise and new initiatives division (Q2 2023)