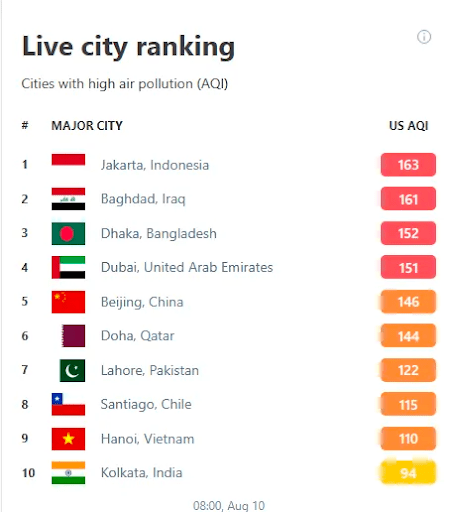

Ahead of the ASEAN summit in Indonesia this month, Jakarta was declared as the world’s most polluted city globally.

While typical solutions such as transitioning to electric vehicles (EVs), opting for public transport, and reverting to remote work can render pollution abatement outcomes, they are limited. Venture investors and climate funds must consider pollution as more than just traffic congestion and focus on a broader set of alternative solutions—particularly those enabled by tech—for more concrete outcomes.

It’s crucial to note that there are three primary air pollutants from fossil fuel combustion: PM (Particulate Matter, tiny solids or droplets under 2.5 micrometres), NOx (nitrogen oxides), and SO2 (sulfur dioxide).

Differentiating these is vital because the notion that post-COVID office commuting is the sole, or even primary, culprit in choking Indonesia’s capital city is a terrible misconception. But that’s only half (or one-third, to be exact) of the truth; road transportation accounts for about 44% of PM emissions in Jakarta, while waste burning contributes nearly the same at 41%. SO2 and NOx pollutants also contribute to PM formation through atmospheric reactions.

Power generation and manufacturing contribute to over 95% of SO2 emissions and 41% of NOx emissions. Interestingly, US Embassy data shows no strong link between congestion and pollution. Despite a 47% traffic increase from 2021 to 2023, PM2.5 levels decreased in Central and South Jakarta. Even though weekend traffic drops 45%, PM2.5 levels only fall by 4% in these areas. Thus, solutions like transitioning to EVs, using public transport, and remote work might not significantly reduce pollution.

Despite a 47% traffic increase from 2021 to 2023, PM2.5 levels decreased in Central and South Jakarta

Climate software models in tech that can render outsized impact

When it comes to emission reduction, two key terms often come to the fore: carbon capture and carbon offsets. Carbon capture stores emissions to prevent atmospheric impact, while offsets invest in emission-cutting projects to internalise costs. Both need substantial time and resources for infrastructure and project development.

More climate funds have been raised over the past few years than ever before, including in Southeast Asia, across early-stage to growth equity, by the likes of Earth VC, Meloy Fund, Silverstrand Capital, Patamar Capital’s Beacon Fund, and Blue7.

Given that there is no dearth of capital for climate investments, investors can consider five venture-backable software models that are capable of achieving outsized emission decarbonisation, with much less initial capital outlay. Founders across Southeast Asia are seizing these opportunities.

1. Vertical workflow management

This thesis is built upon productising legacy operations to taper costs and achieve more efficient workflows.

Startups such as the US-based Aurora Solar and Israeli firm Optibus, for instance, offer SaaS that helps solar panel vendors and EV fleet owners digitalise and streamline their processes, respectively.

Locally, we have seen the likes of Indonesia’s Blitz Mobility, an EV two-wheeler, third-party-logistics (3PL) company, that also develops proprietary SaaS to tech-enable its clients to manage their fleets and optimise the routes for their deliveries.

2. Supply chain traceability

This thesis is built upon providing extensive visibility and integrity along complex supply chains. The French startup Ecovadis, for example, offers SaaS tools to help companies identify and mitigate sustainability risks.

In Indonesia, we have seen the Silverstrand-, AC Ventures-, and Meloy Fund-backed Koltiva, which develops traceability SaaS paired with boots-on-the-ground agronomists and other farmer services to help European MNCs meet their ESG goals and reporting mandates.

3. Carbon accounting

This is built upon automating the extremely laborious process of accurately accounting for corporations’ carbon emissions.

Watershed, Measurabl, and Normative offer SaaS for companies to measure their Scope 1, 2, and 3 emissions across their operational, financial, and supply chain activities.

In Southeast Asia, we have Sequoia- and Y Combinator-backed Unravel Carbon; BCapital- and Accel-backed Accacia; Antler-backed Truclimate; and the BCG-built Terrascope that make the process of inputting and cross-aligning multi-source entity-level emission data to make international emission reporting guidelines simple and intuitive.

4. Carbon project development tools and marketplace

Automating previously long-winded and arduous processes in the project development life cycle forms the gist of this thesis. Startups such as Pachama and NCX work in this area, offering digital tools to streamline the process of carbon project assessment, securing upfront financing, monitoring project growth, and thus the sale of carbon credits.

In Southeast Asia, we have seen the likes of Openspace-backed Thryve Earth, GoVentures backed Fairatmos, Reuben Lai’s Arkadia, and Antler-backed Transitry and Reclimate that help accelerate the assessment-to-sale set of processes for carbon project developers, financiers, and offtakers.

5. Air quality monitoring

With startups such as IQAir offering air purifiers powered by dashboards that help provide visibility on air quality data, this thesis is built upon software-enabling the provision of actionable insights. In Southeast Asia, we have the likes of Alto Partners-backed Nafas, which help provide air quality intelligence across major cities in Indonesia.

Playbook for both builders and investors in climate software

While still in its early innings, proprietary learnings have pointed to two key lessons to be followed by Southeast Asian climate builders and investors in order to render sizable outcomes.

Firstly, while the initial distribution of SaaS products can be tough, especially when selling to industry laggards, climate software businesses should not rely solely on regulatory tailwinds to catalyse adoption.

Instead, players can entice new clients to adopt through more hands-on onboarding, absorbing customisation costs, and taking on shorter contracts, before eventually reaching a steady state in productisation and thus being able to command more recurring SaaS-like fee streams.

Secondly, considering the nascent space, the current Total Addressable Market (TAM) for SaaS-only-solutions may seem limited, given the limited number of total unique clients that can be considered as potential adopters. As such, players in the space should have an expansionary roadmap to have business models that charge fees on a function of growth. For example, carbon accounting businesses typically will have to develop an offset marketplace and EV fleet management software would have to be able to broker logistics a la 3PL in order to expand their market ceiling.

Against the backdrop of a bleak, smog-filled Jakarta, now more than ever we must pay attention to the several asset-light tech models that can disproportionately support the decarbonisation of the Earth, with massive capital availability to fund these opportunities across Southeast Asia.

An economist by training, Aktsa Efendy is a tech builder and venture capitalist, having built, scaled, and invested in a slew of ventures in Southeast Asia across a wide range of verticals for close to a decade, with a core focus on education, health, and climate.