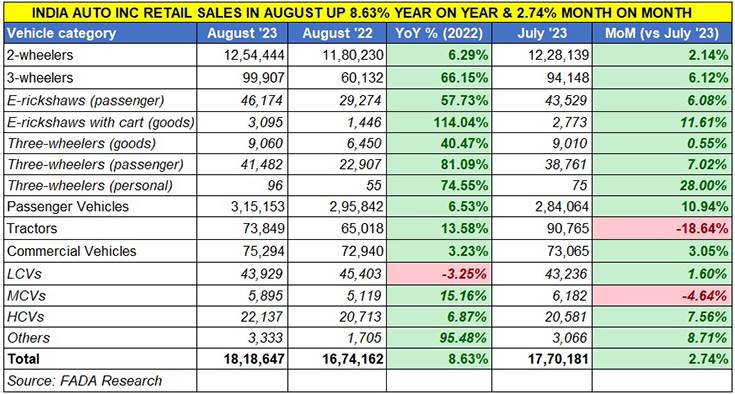

Five days into September, the Federation of Automobile Dealers Associations of India (FADA) has released the retail sales numbers for August 2023. The combined sales of 18,18,647 units across the two- and three-wheeler, passenger and commercial vehicle, and tractor segments, constitute an 8.63% year-on-year increase (August 2022: 16,74,162 units). Month-on-month growth is 2.74% (July 2023: 17,70,181 units).

As per the data released (see the FADA data table below), all five vehicle segments – two-wheelers (up 6.29%) and three-wheelers (up 66.15%), passenger vehicles (up 6.53%), tractors (up 13.58%) and commercial vehicles (up 3.23%) – and their sub-segments other than LCVs have registered growth.

However, when seen on a month-on-month basis, four vehicle segments other than three-wheelers have shown a decline over June 2023 retails. Compared to what they sold in June 2023, two-wheeler retails in July 2023 are down by 6%, three-wheelers by 9%, PVs by 4%, tractors by 8% and CVs by a marginal 0.20 percent.

Commenting on last month’s sales, FADA president Manish Raj Singhania said: “Auto retail in August witnessed a promising 9% YoY growth, maintaining momentum similar to the preceding month. Concurrently, a 3% MoM uptick suggests a reversal in short-term trends. On a YoY basis, comprehensive growth was observed across multiple segments. During MoM, all segments experienced growth, with the exception of tractors, which saw a 19% decline. When compared against pre-Covid benchmarks, the auto retail sector indicated a modest 0.8% improvement, led by two-wheelers recouping lost ground and mitigating the de-growth by 11 percent.”

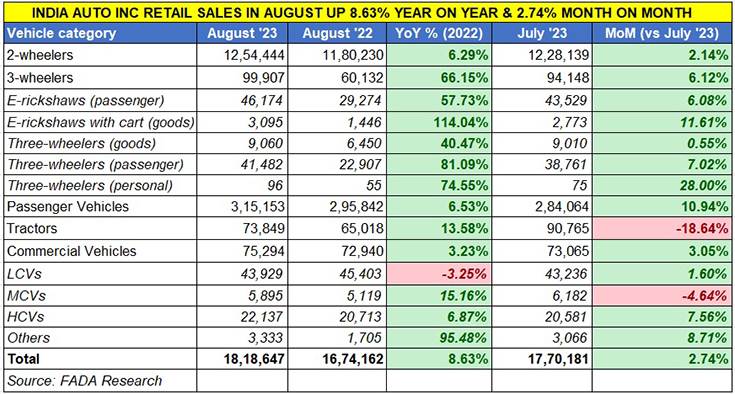

TWO-WHEELER RETAILS UP 6.29%: TVS, BAJAJ, ROYAL ENFIELD, OLA AND ATHER INCREASE MARKET SHARE

Two-wheeler OEMs will heave a sigh of relief with the August retails. At 1.25 million units, the YoY growth is 6.29% (August 2022: 11,80,230 units) and MoM growth is 2.14% (July 2023: 12,28,139 units). Singhania said: “Within the two-wheeler segment, the Indian market displayed a complex yet steady landscape. Despite positive growth, consumer sentiment remained ambivalent, impacting conversion rates and intensifying competition among key players.”

Market leader Hero MotoCorp sold 348,026 units, marginally growing on its year-ago sales of 345,366 units but down 3.67% on July 2023’s 361,291 units. Nevertheless, proof of the increased competition is the fact that its current market share at 27.74% is a tad less than the 29.26% it had in August 2022.

No. 2 OEM Honda Motorcycle & Scooter India, with 310,091 units improved on year-ago 308,262 units and also on July 2023’s 299,090 units. This performance gives it a share of 24.72% but, like Hero MotoCorp, is down on its year-ago market share of 26.12 percent.

TVS Motor Co, ranked third in the OEM scheme of things, continues to make gains every month, which is reflected in its growing market share. In August, TVS sold 224,907 units, 15.63% better than August 2022’s 194,501 units, and a 5.5% improvement over July 2023’s 213,101 units. This gives the Chennai-based ICE and EV maker a market share of 17.93% compared to 16.48% a year ago.

Bajaj Auto too had displayed a similar performance. At 148,129 units, its YoY growth is 22% (August 2022: 121,479 units), which sees its market share rise to 11.81% versus 10.29% a year ago.

In fifth rank is Suzuki Motorcycle India with 69,119 units, up 21% on year-ago sales of 57,095 units and gets a market share of 5.51% versus 4.84% in August 2022. Royal Enfield continues to see demand surge for its popular models – the company sold 58,484 units, up 11.53% (August 2022: 52,435 units) and sees its market share improve to 4.66 percent. Seventh in the two-wheeler OEM rankings is India Yamaha Motor with 49,770 units, better than July’s 45,746 units. However, its share is down marginally to 3.97% from 4.0% a year ago.

India’s electric two-wheeler market leader Ola Electric is ranked eighth with 18,628 units, which I down on July’s 19,263 units, but gives it a 1.48% share of the overall ICE and EV market. The growing demand for Ola EVs is reflected in the fact that the company’s market share was just 0.29% in August 2022.

Similarly, Ather Energy with 7,064 units in August, up 31% YoY (August 2022: 5,376 units), sees its market share grow to 0.56% from 0.46% a year ago. Sales of these two only-EV OEMs is reflective of the maturing Indian consumer who, despite product prices rising after the FAME subsidy, has gone ahead with their purchase decision.

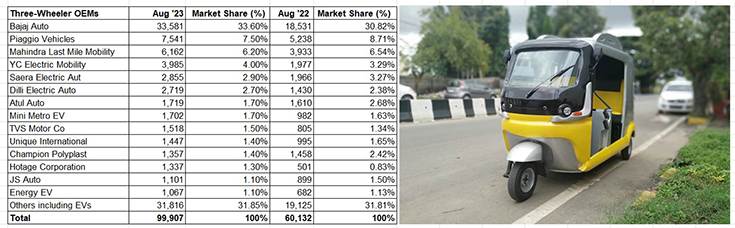

THREE-WHEELERS SCALE A NEW MONTHLY HIGH: 99,907 UNITS

The three-wheeler industry is the one recording the fastest growth, and that’s thanks to the accelerating demand for electric variants for both passenger and cargo transportation. August 2023’s total sales of 99,907 units are the industry’s best monthly numbers yet, three-wheeling past July’s 94,148 units, and up a handsome 66% on August 2022’s 60,132 units. Month on month, August 2023 sales are up 6.12% on July 2023, which had eclipsed the previous high of March 2023: 86,857 units. Now August 2023 has set the new benchmark.

While the FADA president points out that “addressing issues like OEM support and dealer engagement remains crucial”, the fact is that this segment is set to notch a new high for the calendar year and the fiscal.

What is providing a new charge is the sustained demand for electric three-wheelers in the face of high petrol, diesel and CNG prices. Of August’s total 99,907 units, EVs (49,269 units) accounted for 49% of them, growing handsomely by 60% YoY (August 2022: 30,720). The EV share of the overall three-wheeler market is now 49%, which means every second three-wheeler sold in India is a electric model. The electric three-wheeler market continues to witness strong double-digit growth thanks to sustained demand for passenger transportation and from last-mile operators for e-commerce applications, food deliveries and other applications.

A quick look at the company-wise performance (see data table below) reveals that Bajaj Auto has further strengthened its grip on this segment. With sales of 33,581 units, up by a robust 81% YoY (August 2022: 18,531 units), Bajaj’s market share has risen to 33.60% from 30.82% in August 2022. No 2 player Piaggio Vehicles sold 7,541 units in August, which gives it a 7.50% share, and is followed by Mahindra Last Mile Mobility with 6,162 units and a 6.20% share.

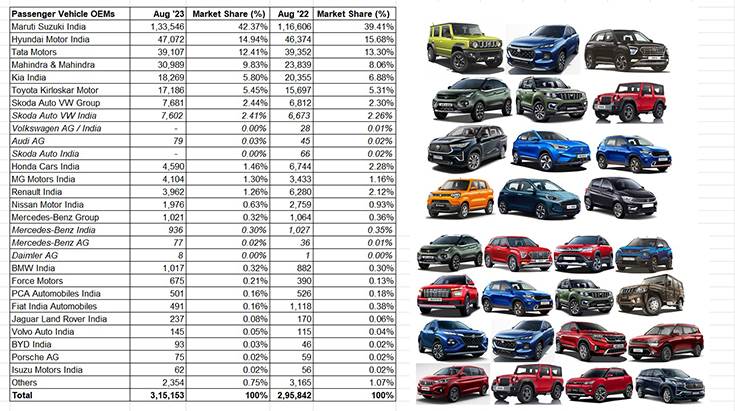

PASSENGER VEHICLE RETAILS UP 6.53%, MARUTI AND MAHINDRA ‘S STRONG SHOWING

Like the three-wheeler segment, the passenger vehicle industry is another growth driver and August retails at 315,153 were up 6.53% YoY and 11% on July 2023’s 284,064 units, which augurs well for future growth. The top 6 OEMs account for 286,169 units or 91% of total PV retails in India last month. Two OEMs have maximised gains last month – Maruti Suzuki India and Mahindra & Mahindra – riding on the surging demand for SUVs.

Maruti Suzuki, which is seeing very strong consumer demand for its SUVs like the Grand Vitara, Jimny, Fronx and the just-launched Invicto MPV, sold 133,546 units in August, which marks 14.52% YoY growth and betters its July 2023 retails of 117,571 units by 13.15%. It’s a performance which results in Maruti’s PV share going up to 42.37% from 39.41% in August 2022.

Hyundai Motor India, the No 2 PV OEM, with sales of 47,072 units in August 2023 saw marginal growth of 1.50% but, given the competitive marketplace which has expanded with new products, its market share has reduced a tad to 14.94% from 15.68% a year ago. The launch of the Exter and the company garnering over 65,000 bookings should see it improve market share over the next few months.

In third position is Tata Motors with 39,107 units, down 0.62% YoY (August 2022: 39,352 units) and also down 0.18% month on month (July 2023: 39,033). Clearly, the company is feeling the heat of growing competition but is taking corrective measures. Starting this festive season, Tata Motors has outlined launch plans for around half-a-dozen models, including facelifts and new powertrain options. First off is the September 14 launch of the facelifted Nexon and Nexon EV. What’s more, given that a Punch EV, equipped with a front charging slot, was snapped testing recently, expect Tata Motors to rev up the launch plans for that variant.

Mahindra & Mahindra, with strong 30% YoY growth with 30,989 units and 7.68% month on month (July 2023: 28,778 units), sees its market share grow to 9.83% from 8.06% a year ago.

Kia India, with retails of 18,269 units last month, down 10.24% (August 2022: 20,355 units), sees its PV share drop down to 5.80% from 6.88% a year ago. In contrast, Toyota Kirloskar Motor’s share has risen marginally to 5.45% from 5.31% a year ago with 17,186 units.

Commenting on PV retails last month, Manish Raj Singhania said: “In the PV arena, improved vehicle supply, bolstered by expanded customer schemes, has maintained positive market dynamics. Despite such advances, supply chain bottlenecks persist, particularly in timely deliveries. The market has responded favourably to the introduction of new hybrid and CNG models. However, a constrained product range in popular segments, such as midsize SUVs, continues to limit overall potential. It is alarming that inventory levels have exceeded a 60-day supply for the first time, even before the onset of the Navratri-Diwali festivities—a trend that necessitates vigilant monitoring by PV OEMs.”

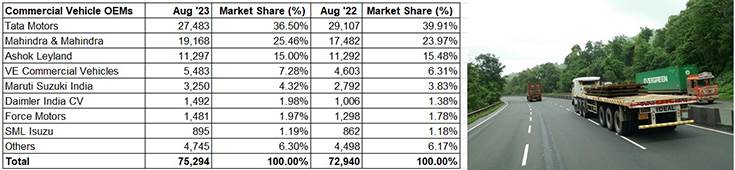

COMMERCIAL VEHICLE SALES UP 3.23% – M&M, VECV MARKET SHARE RISES

The commercial vehicle segment saw total retail sales of 75,294 units, up 3.23% YoY and 3% MoM (July 2023: 73,065 units). While the largest contributor – LCVs – saw sales of 43,929 units, a YoY decline of 3.25%, what saved the blushes for the sector was the strong contribution from medium CVs (5,895 units, up 15.16%) and heavy CVs (22,137 units, up 6.87%)

According to the FADA president, “The CV sector revealed a multi-faceted scenario: despite headwinds such as sluggish cargo movement, verticals like cement, iron ore, and coal exhibited robust demand. As the festive season approaches, indicators suggest a market recovery, reinforced by priority supply scheduling and a resurgence in travel-related sales. Aggressive promotional initiatives and enhanced customer sentiment further support this optimistic outlook.”

Market leader Tata Motors sold 27,483 units, improving upon its July 2023’s 26,635 units but down 5.90% (August 2022: 29,107 units) which is reflected in its overall CV market share reducing to 36.50% from 40% a year ago. Mahindra & Mahindra remains in second place by dint of its strong Bolero Pikup volumes – the company sold a total of 19,168 units, much better than July’s 17,582 CVs, and 9.64% up on August 2022’s 17,482 units. This sees M&M’s share growing to 25.46% from 24% a year ago.

Ashok Leyland sold 11,297 units, 303 CVs less than July 2023’s 11,600 units, and just 5 units more than August 2022’s 11,292 units. Meanwhile, VE Commercial Vehicles has delivered a strong show – 5,483 units, up 19% YoY, which reflect in its share rising to 7.28% to 6.31 percent a year ago.

FADA’S NEAR-TERM OUTLOOK – CAUTIOUSLY OPTIMISTIC

In its near-term commentary, FADA states that the outlook remains cautiously optimistic, shaped by a multitude of factors that vary across vehicle segments. The onset of the festive season, beginning with Onam, has uplifted market mood, improved liquidity and eased earlier bottlenecks in the supply chain across all categories.

In the two-wheeler market, while a broader range of models is now available, subdued rural demand due to insufficient rainfall could temper sales growth. For CVs, although bulk deals and the favourable timing of the construction season in September add to the optimism, the real sales momentum is anticipated to pick up during the Navratri and Deepawali festival following the Shraadh period. The PV market, meanwhile, offers a mixed bag: new product launches and better stock availability are positive signs, but high customer discount expectations and the impact of the Shraadh period may act as small speed breakers.

Meanwhile, after a prolonged period of stagnation, rural demand is showing signs of a positive resurgence, states the FADA president. However, this recovery remains tenuous, contingent on the performance of the final phase of the monsoon season. Lack of sufficient rainfall could precipitate a rise in inflation, adversely affecting consumer purchasing power and diminishing demand. This meteorological shortfall would not only jeopardize the yield of the ongoing kharif crops but also cast a shadow on the subsequent sowing season for rabi crops. Such developments would be particularly inopportune as they would coincide with the peak of India’s festive season, notably Navratri and Deepawali, traditionally periods of heightened consumer activity.