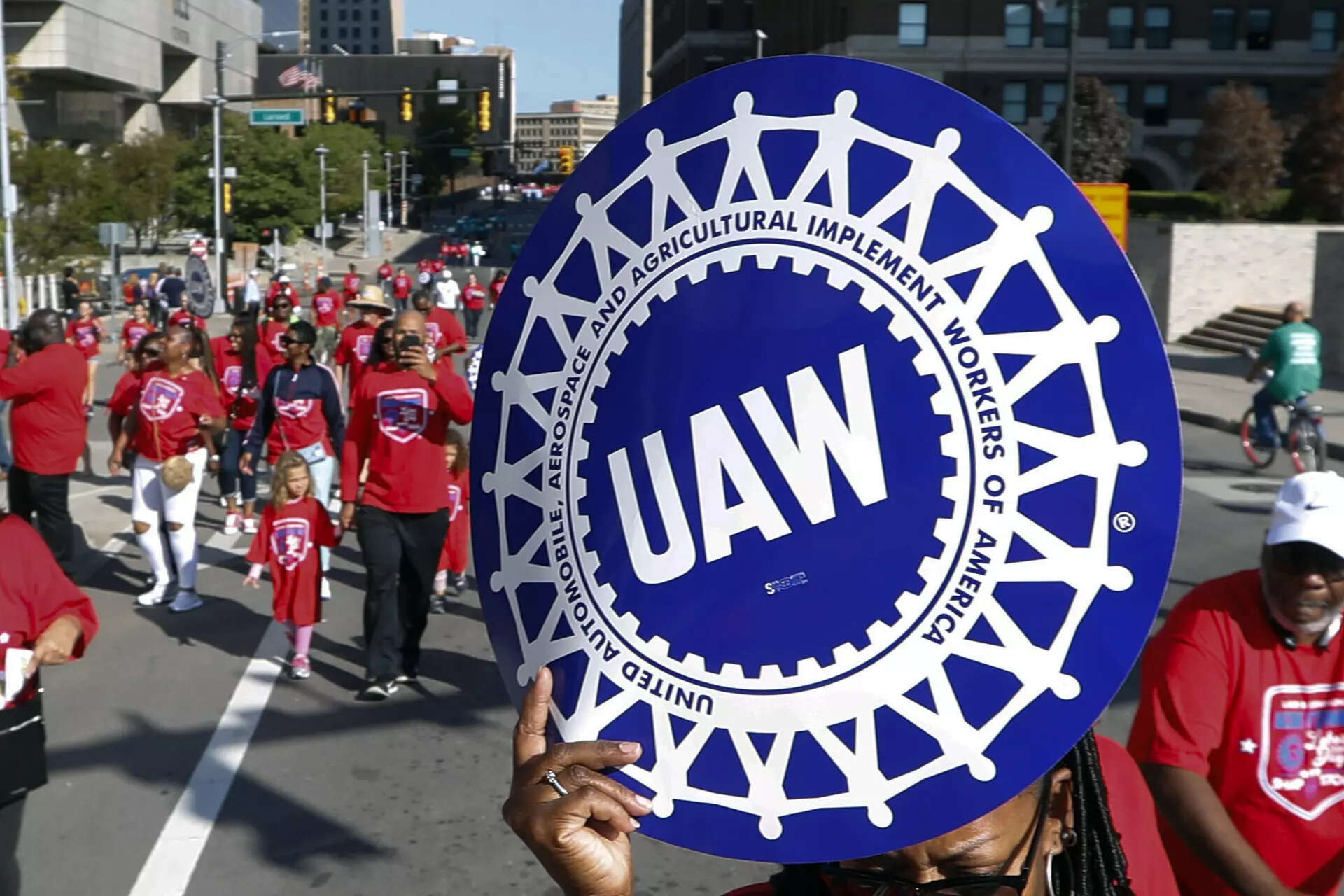

Automaker Stellantis has made a counteroffer to the United Auto Workers that includes wage increases in each year of a new four-year contract totaling 14.5%. The wage increases, which would be for most workers, don’t include any lump sum payments, Mark Stewart, chief operating officer of Stellantis North America, said in a letter to employees.

The proposal by Stellantis, formerly Fiat Chrysler, also includes a USD 6,000 one-time inflation protection payment in the first year of the contract and USD 4,500 in inflation protection payments over the final three years of the contract. In addition, the counteroffer includes boosting hourly wages from USD 15.78 to USD 20 for temporary workers and speeding up the progression timeline from eight years to six years for employees who are moving through the pay scale from starting wages.

The proposal from Stellantis, formed in a 2021 merger of Fiat Chrysler and France’s PSA Peugeot, is closer to the union’s demands of 46% across-the-board increases over four years, but both sides still are far apart. About 146,000 UAW members at the three Detroit automakers could go on strike when their contracts expire at 11:59 p.m. on Thursday. “We remain committed to bargaining in good faith and reaching a fair agreement by the deadline. With this equitable offer, we are seeking a timely resolution to our discussions,” Stewart said.

In a statement Friday, the union called counteroffers from Stellantis, General Motors and Ford “disappointing,” and said President Shawn Fain will discuss them with members in an online chat Friday afternoon. On Wednesday Fain warned that the union plans to go on strike against any Detroit automaker that hasn’t reached a new agreement by the time contracts expire.

A strike against all three major automakers could cause damage not only to the industry as a whole but also to the Midwest and even national economy, depending on how long it lasts. The auto industry accounts for about 3% of the nation’s economic output. A prolonged strike could also lead eventually to higher vehicle prices. Ford’s counterproposal offered 9% raises and lump sum payments over four years, while GM’s offered 10% plus lump sums.