New Delhi-headquartered Anand Group’s flagship company — Gabriel India — which is a leading supplier of suspension components including over 500 high-precision ride-control products such as shock absorbers, and dampers to two-, three-, four-wheeler, and commercial vehicle OEMs in India and overseas, is looking at its next growth phase after completing more than six decades of operations.

The company which clocked revenues of Rs 2,972 crore in FY23 (FY22: Rs 2,322 crore / +27 percent), is adopting a four-pronged strategy to fulfil its future growth ambitions. While it is bullish on the sustained demand for vehicles in the domestic market, which emerged as the third-largest passenger vehicle market by overtaking Japan last year, Gabriel India is also aiming to grow its exports as global OEMs increasingly consider reducing their dependence on China after Covid-19.

“We have an outlander vision of being amongst the Top 5 shock absorber manufacturers in the world. Our strategy is based on four building blocks — domestic leadership, exports, M&As, and technology — which will help us achieve our goal,” Manoj Kolhatkar, Managing Director, Gabriel India said in an exclusive interaction with Autocar Professional.

Suspension systems being jig tested at Gabriel India’s two-wheeler development and test facility in Hosur.

Suspension systems being jig tested at Gabriel India’s two-wheeler development and test facility in Hosur.

The company is particularly keen to foray into the European passenger vehicle market with its semi-active suspension systems, which are currently being developed with a renewed focus on technology that forms the third enabling ingredient of its growth story. Gabriel India has opened a brand-new technology centre in Europe, and aims to leverage the expertise of its resources to develop these advanced suspension systems, which promise good demand from such mature markets.

“We are looking at a global play with semi-active suspension systems because we believe we will be able to offer a frugally-engineered product that offers high value. Our products are under development and will be ready by FY25. We are currently engaging with customers in the two-wheeler and passenger vehicle segments in Europe and India for the semi-active suspension systems,” added Kolhatkar.

With the mega disruption in the global automotive landscape, the suspension systems specialist is also looking to diversify from its core business by virtue of mergers and acquisitions. For instance, earlier this year in May, Gabriel India announced its foray into the sunroof segment for the domestic passenger vehicle market by partnering with Netherlands-based Inalfa Roof Systems.

‘We have an expertise and know-how on suspension products and are now developing semi-active suspension systems for India and European markets’: Manoj Kolhatkar, MD, Gabriel India.

The company will hold a minority stake in the joint venture — Inalfa Gabriel Sunroof Systems (IGSS) — and is targeting a 12-15 percent annual growth rate in the coming years. While a new 200,000-unit facility in Chennai is nearing completion, IGSS aims to start supplies to the Hyundai Group (Hyundai and Kia) in India, which is a global customer for Inalfa Roof Systems, from January 2024.

On solid ground, expansions in pipeline

Gabriel India, which has its technologically-advanced and high-on-automation plants in all the key automotive belts of the country, is well placed to cater to the future demand anticipated from India’s booming automotive market, which is poised to grow with the strengthening infrastructure, urbanisation, and rising purchasing power of its population. Currently, the company has six plants — Khandsa (Haryana), Chakan (Maharashtra), Nashik (Maharashtra), Hosur (Tamil Nadu), Sanand (Gujarat), Parwanoo (Himachal Pradesh) and Dewas (Madhya Pradesh) — and is supplying locally manufactured suspension components to key OEMs, across vehicle categories.

While it used to be a big exporter to Volkswagen Russia, and Renault Iran, both revenue streams have recently been closed due to the Russia-Ukraine war. In the domestic market, Gabriel India is a key supplier to brands like Maruti Suzuki India, Toyota Kirloskar, Tata Motors, Mahindra & Mahindra, Stellantis, and Skoda-Volkswagen.From its Khandsa, Parwanoo and Chakan units, the company services the passenger vehicle clients, where its market share has grown from being pegged at 20 percent a couple of years ago to over 30 percent by end of FY23.

Anticipating further growth in its volumes, the company has initiated expansion at these two facilities to strengthen capacities for future. While Gabriel India is investing Rs 30 crore in each of the two plants to augment capacities, it is also in the process of setting up an additional footprint to cater to future demand, and eye more growth. The greenfield facility will cater to both passenger vehicles, and two-wheelers, along with some backward integration in terms of being equipped with in-house casting capabilities for front-fork outer tubes. The company says leveraging backward integration will helpit address scale, as well as remain competitive in a fierce market.

“While we are currently in the phase of land acquisition, the new plant in South India will get commissioned in FY25,” revealed Kolhatkar, while adding that this will be Gabriel India’s only new suspension facility in more than two decades, after it last commissioned its Sanand plant in CY2000.

Gabriel India is also a major player in the two-wheeler segment, with customers such as TVS, Royal Enfield, Honda Motorcycle & Scooter India, Bajaj Auto and has also engaged with EV players of the likes of Ather Energy and Ola Electric, among others, to service them from its state-of-the-art facilities in Hosur, Tamil Nadu, and Nashik, Maharashtra. The company holds a lion’s share of over 60 percent of the electric two-wheeler market in the country. It is also supplying to Honda Motorcycle & Scooter India from its Sanand plant in Gujarat.

The plant in Dewas, Madhya Pradesh, supplies to the commercial vehicle OEMs with Gabriel India being a dominant player with an almost 90 percent market share in the segment caters to a majority of commercial vehicle players, including the likes of Tata Motors, Ashok Leyland, Volvo Eicher, Force Motors, Daimler India,Isuzu and Mahindra & Mahindra. From this plant, the company is also a global supplier to Netherlands-based DAF, which is part of the Paccar Group, and has deepened its relationship to have started receiving more RFQs from the European CV giant.

Indigenously developing advanced tech

While Gabriel India started its journey by manufacturing suspension components designed by Japanese giants — KYB, and Yamaha Hydraulics – which have global relations with most Japanese passenger vehicle and two-wheeler OEMs, the company has come a long way in gaining know-how and developing competencies to design, prototype, develop, test, and validate suspension systems indigenously. With 75 patents filed, and six granted, Gabriel India’s mother technology centre housed within its Chakan premises, as well as its engineering centre in Hosur, speak volumes about the company’s evolution in becoming a self-reliant organisation from a technology standpoint.

The recent addition of a European technology centre – Gabriel European Engineering Centre (GEEC) in Belgium further strengthens Gabriel India’s position to tap into future growth opportunities. The company’s expat CTO, Koen Reybrouck, who comes with over three decades of experience in the suspension domain is leading this innovation centre, which is tasked with the design and development of its semi-active suspension technology. The centre will also coordinate with Gabriel’s two engineering centres back home and will co-create future-ready solutions. “While we have an expertise and know-how on suspension products for India, the technology is globally moving in a completely different direction of electronic suspensions. That is why we realised that there is some knowledge lying elsewhere, and we needed to bring it into our fold,” said Kolhatkar.

Mahindra’s XUV700 SUV comes factory-fitted with FSD shock absorbers by Gabriel.

Mahindra’s XUV700 SUV comes factory-fitted with FSD shock absorbers by Gabriel.

While it has supplied the FSD or frequency-selective damping technology on the suspension of the blockbuster Mahindra XUV700 SUV, the company is now aiming to venture into active- and semi-active suspensions, with initial potential from the European market. “Listening to our customers has been the biggest driver for our technological innovation, and growth. The space of active suspensions is evolving globally, and with our expertise on the requirements for the Indian road conditions, we plan to introduce such technologically-advanced solutions for the domestic market as well,” he added.

The company undertakes a lot of endurance, performance, and abuse-condition testing of its shock absorbers and dampers at its state-of-the-art technology centres in Hosur and Chakan, where all the deployed equipment is from MTS — the gold standard in suspension testing solutions.

Interestingly, Gabriel India’s in-house process engineering team is also helping design and develop customised manufacturing solutions for the company’s products. “The technology centre also supports the process, which is a key aspect of manufacturing in the automotive components industry. We have an elaborate process engineering team, which has developed technologies in India at a fraction of the cost compared to what is available globally. While it helps reduce cost, it also enables us to build our own competence,” explained Kolhatkar.

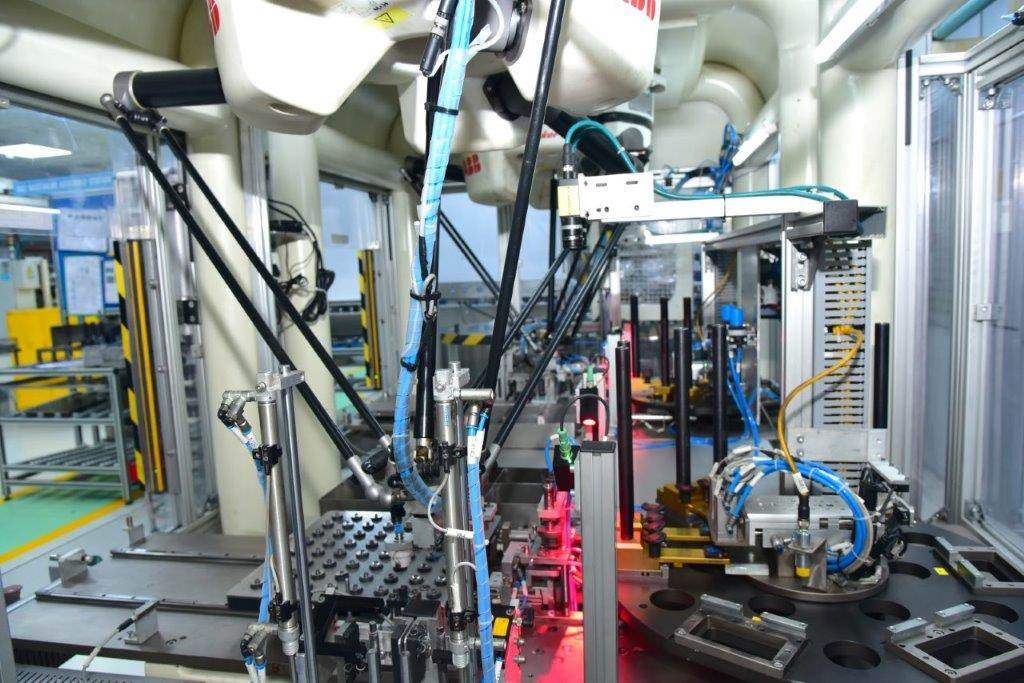

A visit to its two facilities — Hosur and Chakan — gives an idea about how they are replete with robotic lines, and automation, for instance, implementation of automation at the valving stage during a damper’s manufacturing process. The company is also deploying high-speed production lines to cater to the growing industry demand.

Eyeing new opportunities

While its core remains in suspension systems, Gabriel India is also looking at some product diversification opportunities to cater to the changing aspirations of customers. “As we were evaluating the potential product lines, we zeroed down upon technology-agnostic products like shock absorbers, but, at the same time, wanted to venture into a space where the value addition is good, perception is high, and the customer positioning is good as well. And that is how we identified sunroofs,” said Kolhatkar.

A high-on-automation manufacturing setup at Gabriel India’s facility in Hosur, Tamil Nadu. The company has implemented automation at the valving stage during a damper’s production.

The company is bullish about the premiumisation trend in the Indian automotive market, and confident about the opportunities, given the pace at which the market is maturing. “Higher volumes of feature-rich vehicles clearly reflect the change in the buyer’s mindset, and with that the sunroof emerged as the right product for us to tap into the next wave of growth,” he added.

“While the company will start supplying the BLTS – bottom-loaded tilt-and-slide sunroofs –to Hyundai Motor India from January 2024 from its upcoming plant in Chennai, it will then supply to a Kia India new model.“ A lot of interest has also been shown by several OEMs, and we intend to bring more customers, and more business to this alliance with Inalfa Roof Systems that is headed into a joint venture with Gabriel India having a minority stake,” said Kolhatkar.

The company says that contrary to suspension components, sunroofs are part of the Class-A Surface of a vehicle, and therefore, must offer high levels of quality. “It is a nice product to have and we have an excellent partner in Inalfa, and we are excited about the growth in this segment,” Kolhatkar pointed out.

However, he added, “Sunroof is the first step in our diversification journey and we have clear plans. We are not going to stop here, and are actively scanning for more opportunities for mergers and acquisitions (M&As) in the suspension space and beyond. Having said that, we are looking at technology-agnostic parts, or something which is on solid ground, despite the disruption that is underway in the mobility landscape.”

With a sure footing in its core product domain where it has gained excellence and a dominating market share, complemented by an aftermarket presence through over 700 distributors, reach in over 30 countries, and a solid brand image, Gabriel India is now eyeing horizontal growth by identifying segments promising high-growth opportunities in the future. The company is not giving up on the ICE space completely, and is confident about India’s prospects of being one of the few markets globally that will see the co-existence of ICE and EVs.

“There is a good amount of future left in ICE, and we will be scanning opportunities which continue to offer solid growth potential even in the traditional propulsion technology domain, as there is still solid growth potential with immense scope for Indian suppliers to export to the world,” Kolhatkar said.

This feature was first published in Autocar Professional’s September 1, 2023 issue.