Deep tech ventures are gradually carving a larger slice of the investment pie in Southeast Asia at a time when the overall startup ecosystem is struggling with a worldwide liquidity squeeze and deteriorating risk appetites.

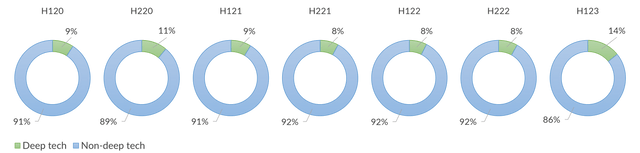

Since COVID-19 hit the region in early 2020, deep tech deals have been trending on an upward trajectory, accounting for 14% of the total deal volume in the first half of 2023, or the highest in the last seven semesters, according to a new report – The State of Deep Tech in SE Asia 2023 – from DealStreetAsia’s DATA VANTAGE.

The encouraging trend suggests that the deep tech sector operates under its own unique set of drivers and dynamics given its potential impact on challenges facing humanity such as climate change, food scarcity, and degenerative diseases.

“The global pandemic, while it is a generational terrible event costing human lives, has accelerated the development of the deep tech ecosystem and VC funding into the sector in Southeast Asia,” said Greenwillow Capital Management managing partner Wong Mun Yew.

SGInnovate executive director Hsien-Hui Tong said Sectors and technologies that addressed challenges thrown up by the global pandemic thrived. Not only those in the biomedical ecosystem, but also those relating to food security, traceability and others.

“In the past few years, VC funding has followed government funding, and the wiser startups took this opportunity to build more solid businesses for the future, knowing that the tide would turn once the world came out of the pandemic,” he said.

While resilient, deep tech is not immune to asset price adjustments. Projections for 2023 show a rise in deal quantity, but the total proceeds for this year are expected to fall sharply after amounting to only 26% of 2022’s total value by mid-year.

Deep tech’s share of overall startup funding proceeds in SE Asia

Little beyond Singapore

Singapore stands as the region’s deep tech titan with 86% of the total deal volume in Southeast Asia originating from the city in the last seven semesters. The country also attracted a whopping 96% of the overall proceeds.

Singapore’s ascendancy in the deep tech space is underpinned by a potent combination of forward-thinking governmental strategies and robust academic contributions, said fund managers interviewed for the report.

Entities like the National University of Singapore and Nanyang Technological University serve not only as academic hubs but are also crucial in nurturing deep tech startups. Both have spawned significant deep tech projects and spin-offs, including Breathonix, Red Dot Analytics, Visenze, and Zilliqa, among others.

“Initiatives like NUS Grip, NUS JumpStart and institutions like A*STAR have contributed immensely to the surge in new companies being launched. The Singapore Deep-Tech Alliance has proven to be an amazing source of deal flow for us with their extensive work to help form teams and commercialise IP from across Singapore R&D institutions,” said Will Klippgen, managing partner at Cocoon Capital.

The rest of Southeast Asia has produced few deep tech startups but Klippgen believes there should be tremendous opportunities for countries like Vietnam and Indonesia to find catalyst policies to kickstart more IP commercialisation.

“We have seen how the Vidyasirimedhi Institute of Science and Technology (VISTEC) in Thailand has launched a major initiative to become a world-class frontier science and innovation hub,” he said.

Share of deep tech funding from Jan 2020-June 2023

Healthtech absorbs more than half

Healthtech stands out prominently, absorbing a major chunk of the deep tech investments. A quarter of funding deals in deep tech target healthtech, amounting to over half of the total investment value.

This is a testament to the vital role technology plays in reshaping the health sector, from advanced diagnostics to treatment of terminal illnesses. Half of the top 10 most-funded deep tech entities represent this sector.

Outside of healthcare, efforts to address climate change mitigation and adaptation influence the deep tech investment scenario in Southeast Asia.

Investments in progressive green technology and food security solutions hold a considerable share of the deep tech ventures. Together, they represent almost a quarter of deal volume and over a quarter of deal value, showcasing the region’s accelerated move towards more sustainable innovations.

Though benefitting from the global success of OpenAI’s ChatGPT, funding into generative AI startups in the region has not taken off. The overall flow of funding into data analytics; AI/ML category, however, shows a strong promise.

“The underlying burst of opportunities in innovation driven by advances in generative AI, biotechnology, materials, space, and sustainability will continue to play out in very exciting ways, and we are bullish in all these impactful sectors and applications especially personalised healthcare, learning solutions and climate transitions because these will transform life and well-being as we know it today,” said Chik Wai Chiew, CEO & executive director or Heritas Capital.

AI is disrupting deep tech research said Peak XV Partners partner Anandamoy Roychowdhary.

“The fact that AI can speed up an R&D cycle from years to months is incredibly exciting. Deep tech across industries will see a major boost in productivity from the smart application of new AI techniques, creating potential for new disruptions,” he said.

DealStreetAsia’s The State of Deep Tech in SE Asia 2023 report has extensive data on:

- Fundraising by Southeast Asian deep tech startups

- Most funded startups in the region’s deep tech space

- Sub-sector review, including healthtech, green tech, artificial intelligence and more

- Data-led analysis on future trends

- Perspectives from fund managers investing in deep tech