If there is one growth story which shows no signs of slowing down and instead is accelerating month on month, then it is that of the electric vehicle (EV) industry. As demand grows for this eco-friendly form of transportation – both passenger and transport – new sales records continue to be set. The latest one is the industry scaling a new high for the first-half of the ongoing fiscal year.

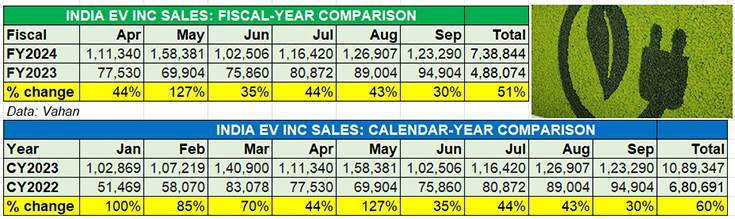

At 738,844 units retailed across India (at 8pm on September 30, 2023 on the Vahan website), India EV Inc has clocked handsome 51% year-on-year growth (April-September 2022: 488,074 units).

With September 2023’s 123,290 units, India EV Inc has surpassed the 100,000-unit sales mark for the 12 month in a row. Having first notched the milestone in October 2022 (117,200 units), the sales momentum continued in November (121,602 units) and December (105,003 units) last year and through each of the first nine months of CY2023, hitting a high in May 2023 (158,381 units) when e-two-wheeler buyers rushed to buy EVs before the slashed FAME subsidy kicked in from June 1, 2023.

There was a sharp decline in June, mainly because of the 25% slashed FAME subsidy on e-two-wheelers and the segment sales plunged 56% month on month. But a maturing India EV market saw sales rise again in July and August and the fact that 225,035 electric scooters and motorcycles have been sold in the past four months from June through to end-September 2023 indicates that buyers are willing to pay more, given the value proposition that an EV offers.

Seen from the calendar-year perspective, year-on-year growth is better than the first six months of FY2024. For the January-September 2023 period, a total of 10,89,347 EVs have been sold, 60% more than the 680,691 units sold in the same nine-month period in CY2022 (see data table below).

TWO- AND THREE-WHEELERS SET THE PACE

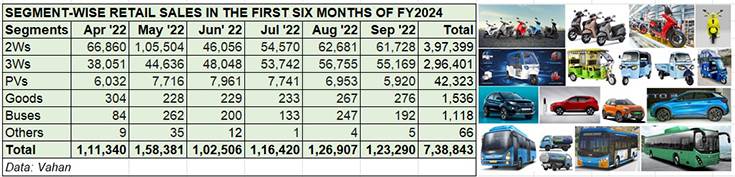

The biggies in terms of EV market share are the two ‘low-hanging fruits’ of the industry and the more affordable segments compared to electric cars, goods carriers or buses.

While electric two-wheelers (397,399 units) account for 54 % of the total EV sales in first-half FY2024, three-wheelers (296,401 units) have a 40% share of the India EV pie. A total of 42,323 electric cars and SUVs and also vans were also sold, which gives them a 5.72% share, with commercial vehicles comprising goods carriers and buses (1,184 units) getting a 0.16% share (see EV segment-wise retail sales data table above).

The domestic EV industry’s continuing sales growth in 2023 can be attributed to an increase in the availability of new products, high petrol, diesel and CNG prices, state subsidies and sops offered under FAME II. What’s also helping is the growing consumer awareness about the need to use eco-friendly transport. And, of course, the wallet-friendly nature of the low cost of EV ownership over the long run is a big catalyst towards making a purchase decision for a zero-emission vehicle. Meanwhile, there is gradual expansion in EV charging infrastructure, both from the private and public sector.

INDIA EV INC ON TRACK TO CLOCK 1.5 MILLION SALES IN FY2024

Given the sustained and rapid pace of growth, India’s EV industry can be expected to notch consistent progress in remaining six months of FY2024 and beyond. While some challenges remain in the form of inadequate charging infrastructure (which is being addressed) and high initial EV prices (which are directly related to battery cost), India EV continues to see robust double-digit growth.

Furthermore, with OEMs’ sharpened focus on localisation with a view to reduce costs and enhance affordability, and battery prices expected to reduce gradually, demand in this eco-friendly vehicle segment can only get better.

At the current high double-digit rate of growth, India EV Inc could be headed towards the 1.5 million units mark this fiscal? Compared to the 11,83,166 EVs sold in FY2023, that would translate into 27% YoY growth. In FY2023, a total of 22.31 million automobiles across multiple fuels were sold, which meant EVs had a 5.30% share of the total India auto market.

The second half of FY2024 has begun today. Hitting the cumulative 1.5 million sales milestone for the fiscal will call for another 760,000-odd EVs being sold in the October 2023 to March 2024 period. Given the current pace of demand, from both personal-use buyers and from last-mile delivery operators, achieving the big number seems doable.

ALSO READ: EV sales between January and September 15 surpass CY2022’s record 1.024 million units

Tamil Nadu accounts for 40% of India’s million EV sales between January and September