Six months after the Centre slashed the price of CNG (compressed natural gas) by Rs 8 per kg to Rs 79 per kg, Mahanagar Gas has announced a Rs 3 per kg reduction to Rs 76 per kg as of October 1, 2023.

This latest cut is the third CNG price reduction in CY2023, with the first being a Rs 2.50 cut which saw CNG at Rs 87 per kg in Mumbai. CNG price had hit its all-time high of Rs 89.50 per kg in November 2022, following eight price hikes in the first 10 months of CY2022.

In a statement on October 1, Mahanagar Gas said: “MGL welcomes the reduction in price of domestically produced High Pressure High Temperature (HPHT) Natural Gas by GOI. This reduction will further promote usage of natural gas in general and will contribute to increase in consumption of natural gas in domestic and transportation segment in particular. MGL’s CNG now offers attractive savings of more than 50% compared to petrol and almost 20% compared to diesel at current price levels in Mumbai.”

WALLET AND ECO-FRIENDLY FUEL

From a consumer’s point of view, other than the environment-friendliness of CNG, a CNG-powered vehicle provides considerable savings compared to its petrol or diesel-engined siblings. What’s also driving the consumer shift to CNG models is the high price of petrol (Rs 106.29 a litre in Mumbai) and diesel (Rs 94.25 a litre in Mumbai on October 2, 2023). Following the latest price cut of CNG to Rs 76 a kg, filling CNG is Rs 30.29 cheaper than petrol and Rs 18.25 cheaper than diesel. This is set to give a fillip to sales of CNG vehicles across segments.

Sales of CNG vehicles have been on the upswing for the past few years, despite the large number of price hikes in CY2022. In FY2023, retail sales, across four sub-segments, crossed 650,000 units for the first time in a fiscal, registering strong double-digit YoY growth of 46%.

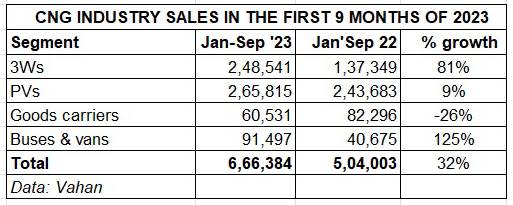

A deep dive into Vahan retail sales data for the first nine months of CY2023 reveals that a total of 666,384 CNG-powered vehicles have been sold across India. This constitutes 32% year-on-year growth (January-September 2022: 504,003 units). The passenger vehicle sub-segment leads with a total contribution of 40%, having registered 9% YoY growth with 265,815 units (January-September 2022: 243,683 units).

Sales of CNG-powered passenger vehicles (PVs) have in the first nine months of CY2023 surged by 40.71% year on year to 318,752 units (FY2022: 226,547 units), accounting for 8.80% of overall retail sales of 36,20,039 PVs in India.

MARUTI SUZUKI COMMANDS 72% MARKET SHARE, TATA AND TOYOTA REV UP

Passenger vehicle market leader Maruti Suzuki India, which has a 15-strong stable of CNG cars and SUVs, from the entry level Alto hatchback to the premium Grand Vitara SUV, has a strong grip on the market. With 191,013 units and 11% growth (January-September 2022: 172,315), the company has a commanding share of 72% in the segment. The company, which introduced CNG in the S-Presso, Brezza, Grand Vitara, Swift, Dzire, Baleno and XL6 in FY2023, expanded the fuel option to the Fronx in July 2023 now offers the factory-fitted CNG option in all of 15 models, the largest for any carmaker in India. Having moved out of diesel in April 2020, the company is betting on CNG demand from car buyers sensitive to running costs.

As per Vahan data, Hyundai Motor India, which has the Aura sedan, Grand i10 Nios and recently introduced the Exter SUV as its CNG offerings, sold 35,513 units, giving it a 13.36% market share. However, year-on-year, retail numbers are down by 10% (January-September 2022: 39,757).

Tata Motors, which had entered the CNG market in FY2022 with the Tiago and the Tigor, and has is making strong gains. In FY2023, the company saw retails of 40,323 units, which a 471% YoY increase albeit on a low-year-ago base (FY2022: 7,059). What is creditable is that despite its recent entry into the CNG market, Tata Motors has already grabbed 13% of the CNG car market.

Tata Motors, which had entered the CNG market in FY2022 with the Tiago and the Tigor, is already making strong gains. In FY2023, the company retailed 40,323 units, a 471% YoY increase albeit on a low-year-ago base (FY2022: 7,059). What is creditable is that despite its recent entry into the CNG market, Tata Motors has already grabbed 13% of the CNG car market and is hard on Hyundai’s heels.

In the January-September 2023 period, Tata has sold 34,224 units, up 14% YoY.

Tata Motors is bullish on demand for premium CNG variants and offers a CNG option right from base to top-spec. In May 2023, the company launched its Altroz iCNG, which also introduced Tata Motors’ patented twin-cylinder layout, which frees up boot space and makes it very practical and usable, unlike other large CNG tanks that eat into boot space. The Altroz iCNG also gets a sunroof which takes its premium quotient up a notch. On August 4, Tata launched the Punch CNG, priced in the range of Rs 710,000-Rs 968,000 ex-showroom range, and designed to take on the new Hyundai Exter CNG. And in a swift move, the carmaker also standardised its twin-CNG-cylinder technology across the Altroz, Tiago, Tigor, and Punch, with the aim to extract maximum usable boot space despite CNG cylinder integration.

The company remains bullish on the CNG car market. In May 2023, Shailesh Chandra, MD of Tata Motors Passenger Vehicles told Autocar Professional, the CNG segment has taken off in the last few years and Tata Motors wants to harmonise this technology across its portfolio. “Our multi-powertrain strategy has helped us grow faster than the market, and it will continue to drive sales this year too. The CNG penetration is expected to move up from 10% at present to 25% by the end of the decade, we would like to move in line with that or even have a higher share,” he said.

Toyota Kirloskar Motor, which entered the market in 2022 with the Glanza CNG hatckback and Urban Cruiser Hyryder CNG SUV, has expanded its stable with the recently launched Rumion MPV, all products from its alliance with Maruti Suzuki. In fact, an overwhelming response to the Rumion CNG variant has led to the company temporarily stopping to take bookings. The move to offer CNG products has paid dividends – TKM has retailed 4,679 units in January-September 2023 compared to just 52 units in the year-ago period.

BAJAJ AUTO STRANGLEHOLD ON THE 3-WHEELER MARKET

The CNG-powered three-wheeler market is witnessing a strong run and the 248,451 units in the first nine months of CY2023 are a robust 81% increase over year-ago sales of 137,349 units. This sub-segment is the second-largest contributor with a 37% share of the market.

Bajaj Auto, with 215,315 units, up 111% YoY, has a stranglehold with an 87% market share, leaving the others to battle it out for the remaining 13% share of the pie.

Piaggio is No. 2 player in this segment with a 6.38% market share, having retailed 15,853 units, and is followed by TVS Motor Co, with 8,717 units and 3.50% market share. The goods vehicle segment is seeing greater demand in the form of electric mobility, where the lower cost of ownership, compared to CNG, is driving demand from last-mile mobility and logistics operators.

GOODS CARRIER SALES DOWN 26% YEAR ON YEAR

A year ago, CNG-powered goods carriers across categories (small, medium and large), accounted for 16.32% of the market – that has now reduced to 9% in the January-September 2023 period with sale of 60,334 units, down a sizeable 26% on year-ago sales of 81,797 units.

As per Vahan data for the period under review, four OEMs have seen their sales decline year on year. Tata Motors, which has a fairly large range of commercial vehicles ranging from the Ace through to the Ultra, remains the market leader with a 38% market share with 23,220 units retailed in the first nine months of CY2023. However, this number is down a sizeable 41% YoY (January-September 2022: 39,682 units).

At No. 2 position is Maruti Suzuki India, which sold 21,689 Super Carrys to register 9% YoY growth and a 36% market share. Mahindra & Mahindra, with 10,436 units, has recorded 8% growth and has a 17% share of the goods carrier market. Ashok Leyland saw demand decline 50% YoY to with 1,443 units. VE Commercial Vehicles, with 3,138 units, sees its numbers down 63% year on year, which is a similar downturn witnessed by SML Isuzu with 408 units versus 1,119 units a year ago.

Demand for passenger-transporting buses and vans (heavy, light, medium) rose substantially – up 125% to 91,497 units YoY (January-September 2022: 40,675). Heavy passenger vehicles or buses accounted for 1,296 units.

Overall, the demand for CNG vehicles continues to be driven by the lower cost of ownership mantra that the greener fuel offers in the face of high petrol and diesel prices. The latest price cut will only serve to spur demand in FY2024.