Japan’s hesitancy toward EVs is taking its toll on automakers in China. Nissan’s sales are plummeting after failing to keep up with EV leaders like Tesla and BYD.

Slow EV transition is costing Nissan in China

Nissan is struggling to keep up in the largest EV market globally as sales continue to slide. The Japanese automaker’s sales fell nearly 29% in China in August, with only 65,000 units sold.

Of those 65,000, only 106 (0.16%) were the Nissan Ariya, the brand’s global electric SUV. Infiniti, Nissan’s luxury brand, saw sales of its D60 EV fall 60% from last year. D60 EV sales are down 55% this year.

Sales in the region have now fallen consistently for the past several months. Nissan’s sales tumbled 28% in June and another 22.6% in July, steeper than other Japanese automakers, including Toyota.

The fallout comes after Nissan’s sales plunged 20% last year, dropping it out of the top five automakers by market share.

Like many legacy automakers, China is a critical market for Nissan, representing almost a third of its global sales. According to estimates from Goldman Sachs (via Nikkei), Nissan generates 34% of its net profit in China, topping every other Japanese automaker.

Nissan cut guidance in China a few months ago to 800,000 vehicles for the fiscal year ending 2024, suggesting a 23% decrease YOY.

Nissan is not the only Japanese automaker feeling the heat amid the EV shift in China. Mitsubishi revealed it would be suspending operations in the region in July.

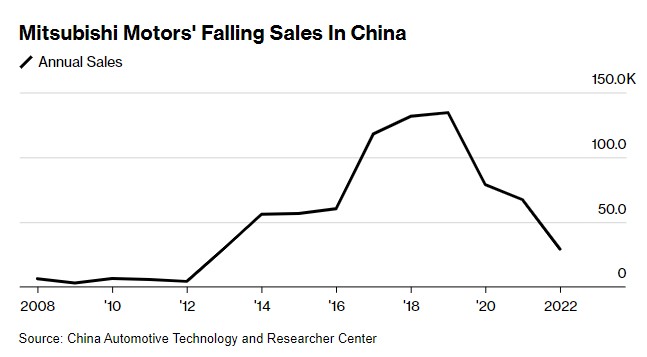

After peaking at around 134,500 in 2019, Mitsubishi’s sales in China have crated with only 34,500 sold last year. The automaker blamed China’s rapid shift to EVs for the fallout.

Meanwhile, Toyota also laid off workers this summer as it struggled to keep up in a competitive Chinese EV market.

Nissan will present a detailed strategy for China this fall as part of a new medium-term plan. Seiji Sugiura, a senior analyst at Tokai Tokyo Research Institute, explained, “Investors are looking to see whether the company comes up with a unique strategy that demonstrates its commitment to EVs.”

Electrek’s Take

Although Nissan was once a leader in the EV space by releasing the LEAF in 2010, technology has advanced greatly in the past decade.

Chinese EV makers like BYD, NIO, and XPeng are taking advantage of the transition by introducing new technology and features, often at lower prices than competitors.

The results are telling. BYD sold 431,603 EVs in the third quarter alone, barely missing Tesla at 435,059.

After surpassing Volkswagen earlier this year, BYD is now China’s top-selling passenger vehicle brand. The automaker is quickly expanding overseas, already dominating markets like Thailand, Brazil, Columbia, and Israel with affordable electric options like the Dolphin electric hatch.

China’s auto market is a representation of what’s happening globally. As EV sales continue picking up, buyers are going with brands with the best features offering more value.

FTC: We use income earning auto affiliate links. More.