New Delhi: The GST Council is expected to take up the issue of appointing members to the proposed tribunals, but is likely to leave levies on cement, health insurance premium of seniors and lithium-ion batteries unchanged. The council will meet on Saturday.

One of the issues that is expected to see lower rates is millet mix, a move being pushed by Karnataka to ensure that consumers and farmers get a better deal, sources familiar with the deliberations said. There is likely to be discussion around GST on corporate and bank guarantees as well, given that there is a large implication on companies, with the council expected to prescribe the levy on a certain percentage of the guarantee, so that the corporate sector is not unduly burdened.

While the agenda is not fully firmed up, the government is not keen on lowering the GST on cement from 28% to 18% as was demanded by the industry, given the massive revenue loss as also feedback indicating that the sector may pocket the benefit and not pass it on full to consumers, officials told TOI. Earlier this year, finance minister Nirmala Sitharaman had said that the government will consider the demand, amid a pitch by industry to lower the levy so that construction cost could go down.

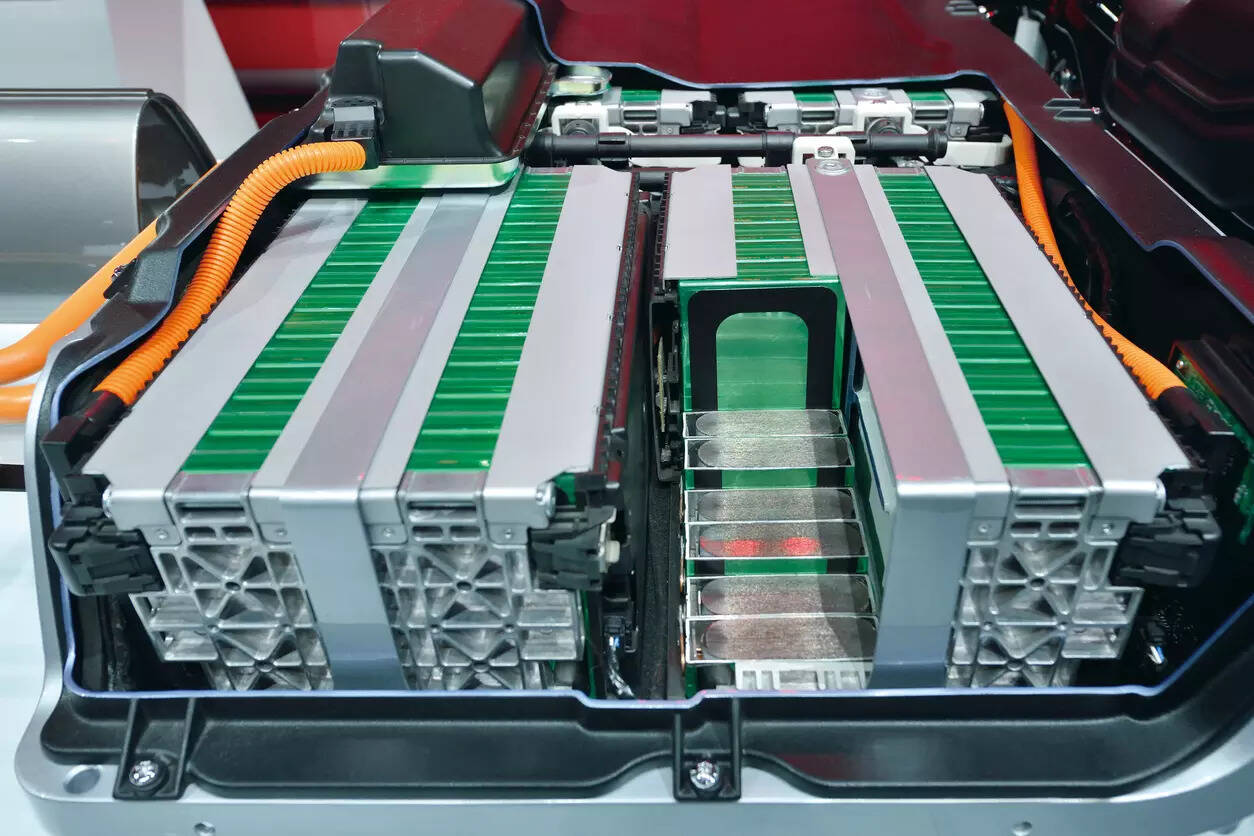

In the case of lithium-ion batteries, officials are of the view that a change in rates will have wider ramifications, given that it is used across sectors and is not limited to electric vehicles, which are being projected as the sole beneficiaries. Further, they said that a discount on health insurance policies just for senior citizens may not be a good idea as it will create carve outs, which may be tough to administer. These issues are expected to be taken up as part of a larger review after the 2024 general elections.

Sources said on the agenda for the meeting are issues related to appointment of members of GST Appellate Tribunal. Some of the terms of appointment are expected to be relaxed, an official said, without providing further details. The meeting of the GST Council, headed by Union finance minister and with all states as members, is also expected to provide a platform to assess the implementation of the tax on online gaming, casinos and horse racing from this month as states and the Centre needed to amend the laws.