Four months after the reduced-by-25% FAME subsidy kicked in from June 1, 2023, retail sales of electric two-wheelers in India are nearing levels of monthly sales clocked in the first four months of the year. September 2023 has witnessed nearly 64,000 electric scooters and motorcycles being bought across India.

Over 225,000 new electric two-wheelers have been bought between June-September at higher prices, following the reduced subsidy and indicate a gradual maturing of the Indian EV market on two wheels.

Over 225,000 new electric two-wheelers have been bought between June-September at higher prices, following the reduced subsidy and indicate a gradual maturing of the Indian EV market on two wheels.

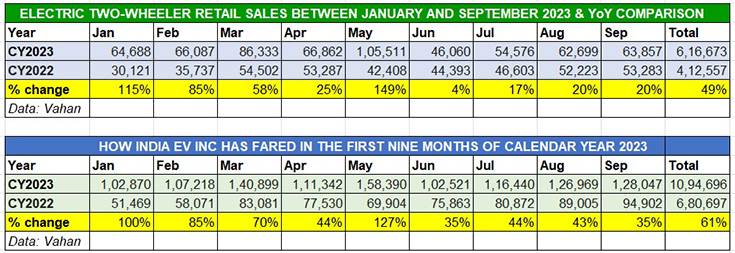

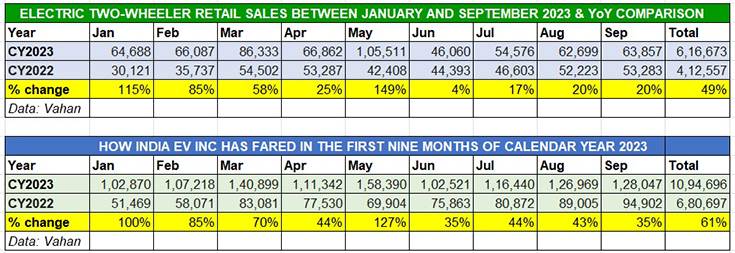

It is to be noted that record sales of 105,511 units in May 2023 were an aberration, given that buyers rushed to make purchases to beat the June 1 deadline. As per retail sales numbers on the government of India’s Vahan website, September 2023 saw 63,857 EVs on two wheels being sold, 1,158 units more than the 62,699 units in August 2023 and 9,281 units more than July 2023’s 54,576 units. It may be recollected that e-two-wheeler sales had crashed to an 11-month low of 46,060 units in June 2023 after the FAME subsidy was slashed by a fourth.

While the month-on-month growth may be marginal – 1.84% in September 2023 – the year-on-year growth has returned to double digits after hitting a low of 4% in June. The YoY sales increase in July (up 17%), August and September (up 20%) indicates that demand for electric scooters and motorcycles remains strong.

Cumulative sales for the first nine months of CY2023, at 616,673 units are 49% better than January-September 2022’s 412,557 units. At end-September 2023, total EV sales were just 14,501 units shy of entire CY2022’s retail sales of 631,174 units, a figure which will be surpassed in October.

With three months to go for this year to come to a close and the festive season continuing with Navratri (October 15-24) and Diwali (in November), it can be surmised that the Indian electric two-wheeler industry could close CY2023 with total sales in the region of 750,000 to 800,000 units, which translates into 18% to 25% YoY growth.

OLA LEADS WITH 29% MARKET SHARE, TVS’ SHARE RISES TO 24%, ATHER ENERGY & BAJAJ AUTO TIED AT 11%

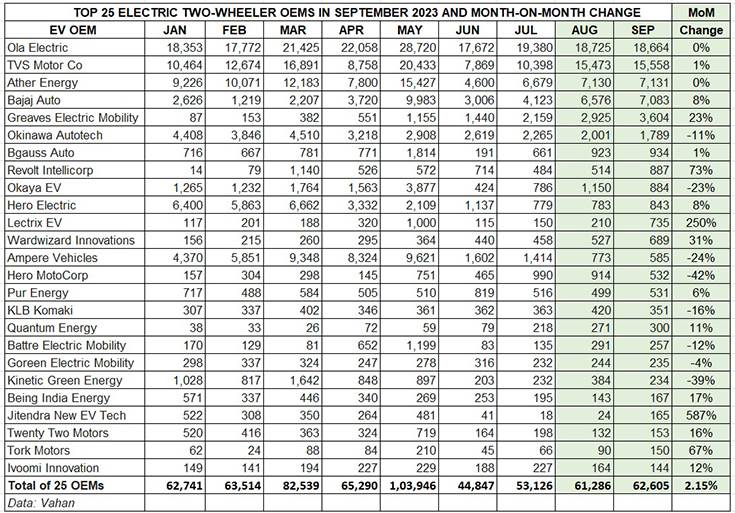

A deep dive into the Vahan retail sales data reveals that of the 161 OEMs in India’s very competitive e-two-wheeler market, the top six EV makers have sold in excess of 1,000 units each, and the top two – Ola Electric and TVS Motor Co – in excess of 15,000 units each. The combined sales of these top six OEMs in September add up to 53,829 units or 84% of total industry retails in September, which means the other 155 players have had to battle it out for the remaining 16% of the market.

Market leader Ola Electric has a commanding share of 29 percent, having sold 18,664 units in September, albeit this makes for flat sales as its August numbers were similar at 18,725 units (see detailed Top 25 EV OEMs table for September 2023 below). Expect Ola Electric, which recently launched its refreshed S1 series of e-scooters and has already garnered over 75,000 bookings, to clock in excess of 20,000 units a month soon given that the festive season will really pick up from mid-October.

TVS Motor Co, with 15,558 units, saw marginal 1% month-on-month growth (August 2023: 14,473) and grew its market share by one percentage basis point to 24% in September – this is a smart increase over the 19% share it had in July. In the calendar year to date, TVS had surpassed the 100,000-unit milestone with a total of 118,518 units. September 2023 also saw the TVS iQube e-scooter ride past the cumulative 200,000 sales milestone in 45 months since launch in January 2020. In August, the company had launched its new and premium EV flagship, the TVS X, priced at Rs 250,000, at a mega event in Dubai.

Maintaining its podium position in third place is the Bengaluru-based smart e-scooter OEM Ather Energy with 6,835 units, which constituted flat sales compared to August 2023’s 7,130 units. Ather Energy is among the EV OEMs making moves to enable easy finance to potential buyers. In July, the company had announced 100% on-road financing for its e-two-wheelers, barely a month after it introduced a 60-month loan product, resulting in monthly EMIs as low as Rs 2,999, in collaboration with IDFC First Bank, HDFC Bank, Hero FinCorp, Bajaj Finance, Axis Bank, and Cholamandalam Finance.

Bajaj Auto, which has sizeably ramped up production of the Chetak scooter and is also expanding its network, sold 7,083 units in September, up 8% on August’s 6,576 units. This is Bajaj Auto’s second-best monthly performance after the best-yet 9,983 units in May 2023. Interestingly, in terms of market share for September 2023, Bajaj Auto and No. 3 OEM Ather Energy have a similar 11% share for last month.

Greaves Electric Mobility, which was ranked sixth in July, retains its fifth rank of August in September as well as a result of the 23% increase in month-on-month retails to 3,604 units (August 2023: 2,925 units), its best monthly sales in the year to date. Greaves’ sister EV arm, Ampere Vehicles is ranked 13th with September sales of 585 units, down 24% on August 2023’s 773 units. Combined sales of the two EV divisions would add up to 4,189 units, which still puts in fifth position.

Okinawa Autotech comes in at No. 6 with 1,789 units, down 11% month on month. Considering the company had opened CY2023 with 4,408 units in January, it is clearly feeling the heat of slowed-down sales.

In seventh position is Bgauss Auto with 934 units, selling 11 more than it did in August. Electric motorcycle maker Revolt Intellicorp has jumped into eighth position for September 2023 with 887 units, up 73% on August 2023’s 514 units. Okaya EV with 884 units, down 11% MoM, and Hero Electric, with 843 units, up 8% MoM make up the ninth and 10th ranks respectively.

OEMs like KLB Komaki, Quantum Energy and Kinetic Green, among others, are seeing demand come their way from last-mile delivery operators keen to benefit from the low total cost of operation, which makes optimised business sense for a commercial operator.

Of the Top 25 e-two-wheeler OEMS, eight have recorded a month-on-month retail sales decline as seen in the data table below. Two OEMs – Lectrix EV and Wardwizard Innovations – though have delivered a strong performance. While Lectrix EV sold 735 EVs on record 250% MoM growth albeit on a low base of 210 units in August, Wardwizard sold 689 e-scooters to post 31% MoM growth.

GROWTH OUTLOOK

While the sales momentum was good in September, it is likely that October 2023 could see a slight dip in sales, across the automobile industry, as a result of the shraadh period (September 29-October 14). That said, the festive season, which had begun with Onam on August 29, will commence again on October 15 with Navratri and continue through to Diwali in the middle of November, which traditionally witness heightened consumer activity and new vehicle purchases.

The sustained demand for last-mile deliveries across urban India as well as town and country is seeing growing demand for cargo-transporting electric two-wheelers and some OEMs are benefiting from bulk orders. Improved economic sentiment, a buoyant stock market, unchanged high fossil fuel prices along with OEMs offering sweetened new product deals in the festive season to capture the growing consumer shift to EVs should see India EV Inc maintain its growth path.

ALSO READ:

TVS iQube e-scooter sales charge past 200,000 units in 45 months

EV sales in H1 FY2024 jump 51% to 738,000 units, fiscal headed for record 1.5 million

India has over 2.8 million EVs on its roads, Central and South India dominate EV ownership

Tamil Nadu accounts for 40% of India’s million EV sales between January and September