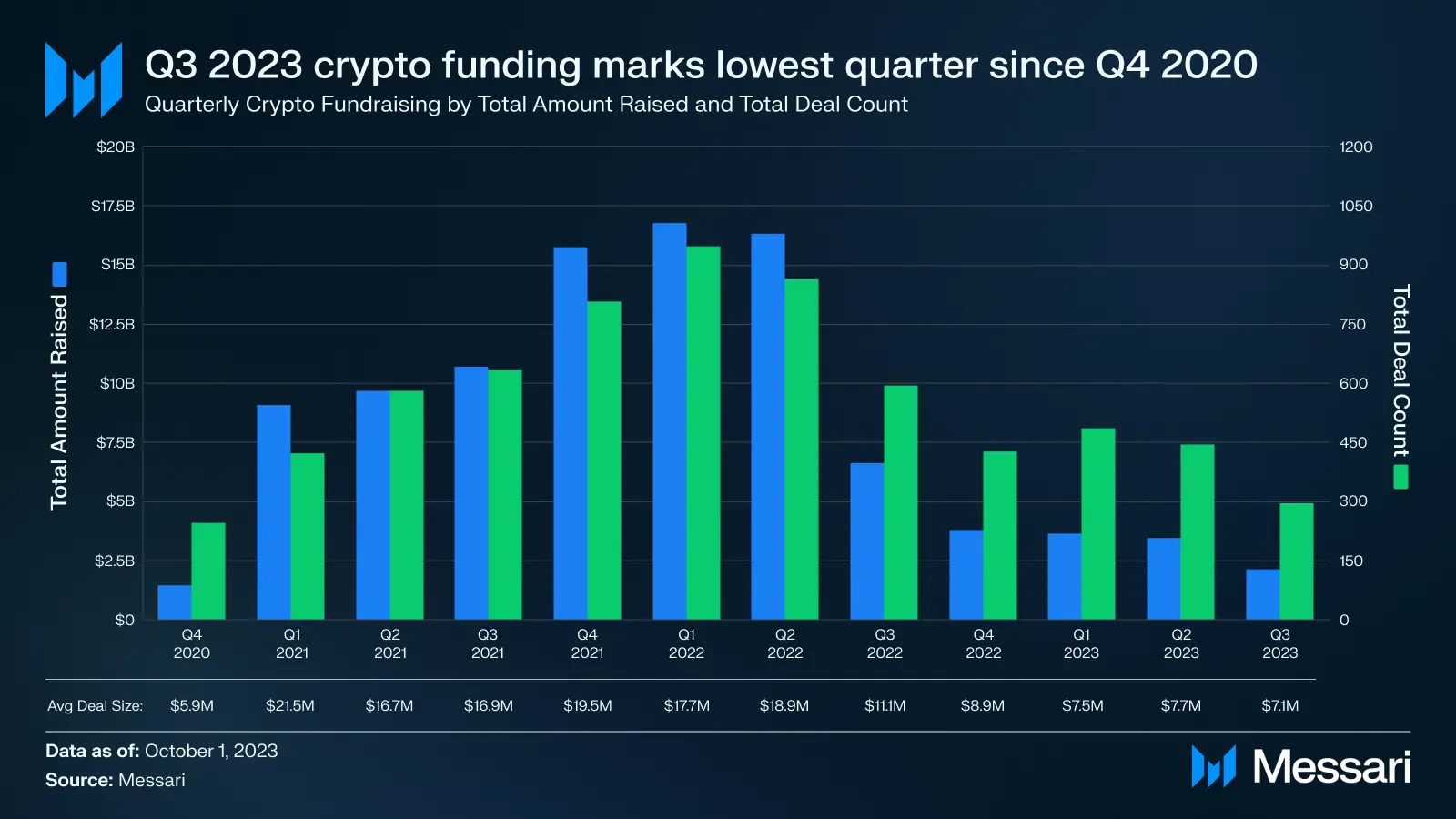

Q3 2023 was a sluggish quarter for crypto startup fundraising as the number of venture deals and capital raised recorded their steepest fall since Q4 2020, according to crypto intelligence firm Messari.

The quarter saw a total of 297 crypto firms and projects raising just under $2.1 billion, a 36% drop in terms of both deal count and deal value compared with Q2 2023, according to Messari’s latest report titled ‘State of Crypto Fundraising – Q3 2023’.

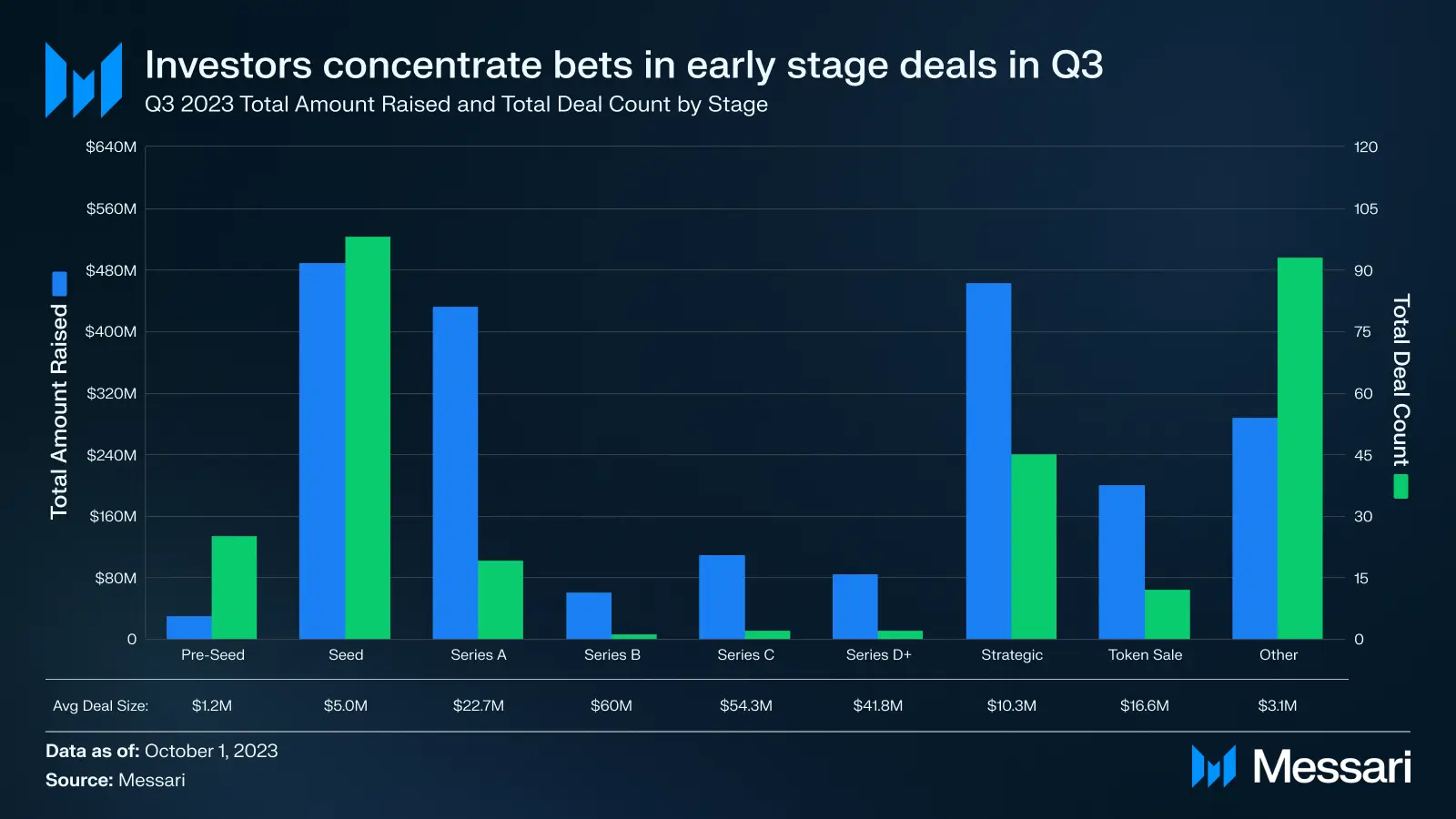

Investors have been flocking to early-stage deals now to maximise the upside that can be realised when the market rebounds. Series A and prior transactions contributed 48% of the quarterly deal count, while Series B and beyond deals accounted for only 1.4% of the total deals, per the report.

Strategic investments, on the other hand, picked up as the bear market pushed projects to go for short-term bridge rounds or get acquired by larger firms to stay afloat afloat. As a proof, strategic investments accounted for 22% of the total deal value in Q3 compared with the peak of the bull market in Q4 2021 when they occupied a negligible 0.2% of the deal value.

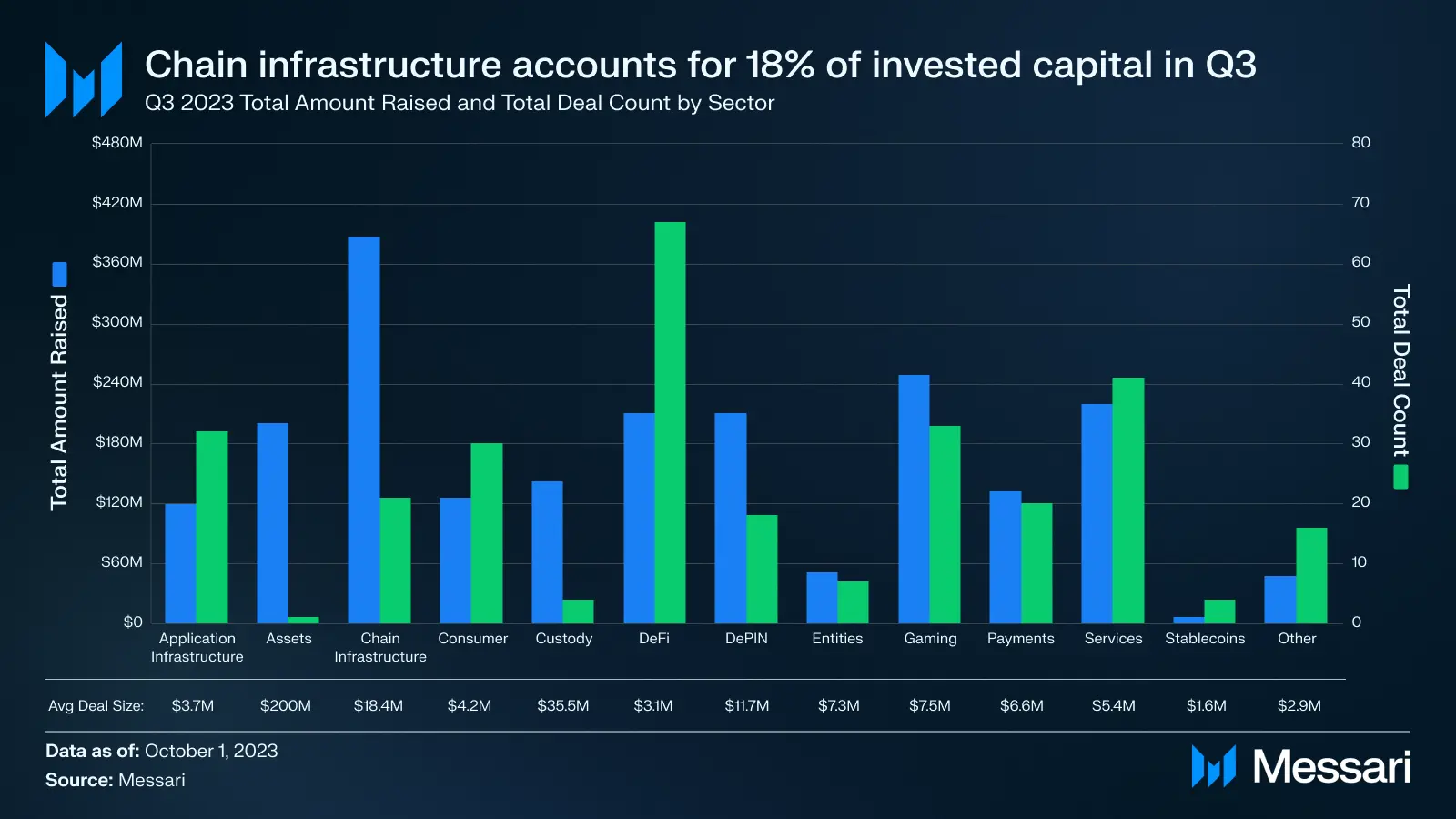

Chain infra, DeFi the most funded sectors

Chain infrastructure was the most-funded sector which secured a combined $387 million across 21 deals, or 18% of the total deal value in Q3; while decentralised finance (DeFi) was the most-invested sector which recorded 68 deals despite raising more than $180 million.

About 43% of the invested capital within the chain infrastructure sector went to the subcategory of scaling solutions, followed by around one-third of the capital that was splurged on smart contract platforms, per the report.

Meanwhile, the report observed that there is a continued shift away from smart contract platforms to scaling solutions.

“The ratio of capital invested in scaling solutions to smart contract platforms has eclipsed the previous Q1 2022 high in three of the last four quarters. The ratio has reached as high as 7x during Q4 2022 mostly due to a lack of investment activity in the smart contract platform category during the quarter,” the report stated.

Gaming was another sector popular among investors, raising a total of $249 million across 33 deals.

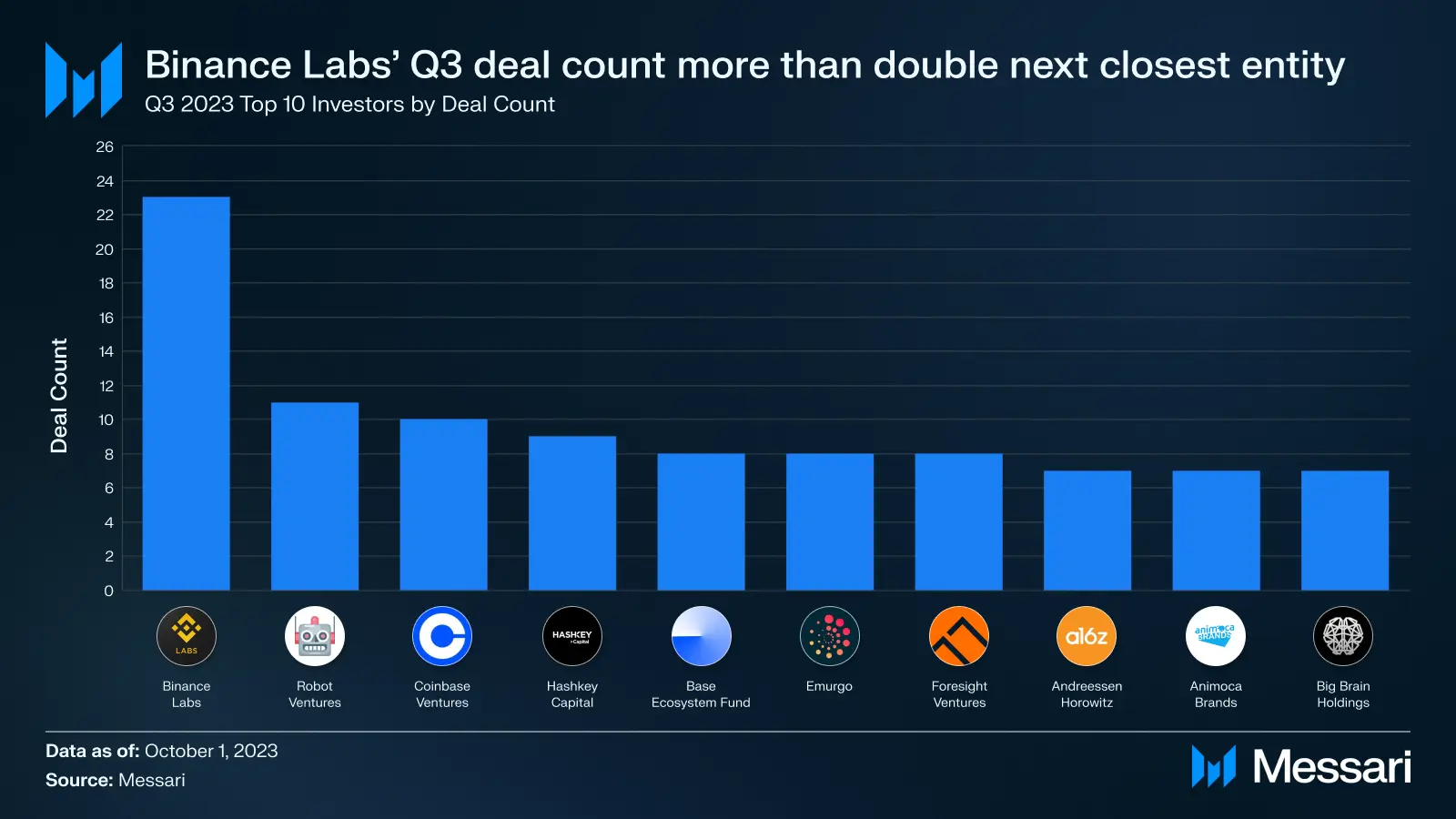

Binance Lab the top investor

Binance Labs, the venture capital arm of the world’s largest cryptocurrency exchange Binance, became the most active investor in Q3, sealing a total of 23 deals. Notably, around half of the 23 deals were projects participating in the firm’s accelerator programme.

Binance Labs has been an active investor so far this year in the areas of gaming, DeFi, or projects developing zero-knowledge and private technology, according to a report published by Messari in August.

The US remained the headquarters of over half of the active investors in Q3, despite rising regulatory clampdown against the sector.