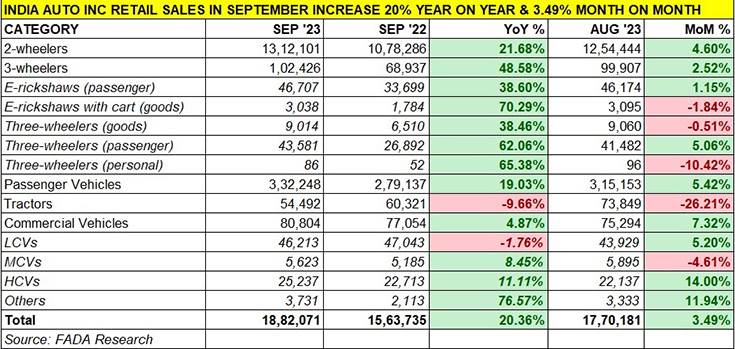

India Auto Inc has plenty of reasons to smile – cumulative retail sales of automobiles across five segments – two- and three-wheelers, passenger vehicles, commercial vehicles and tractors – have registered strong 20% year-on-year growth in September 2023. At 18,82,071 units, last month’s sales were 318,336 units more than the 15,63,735 units in September 2022. The month-on-month growth though is a little more subdued – 3.49% over the 17,70,181 units in August 2023 but a positive growth indicator given the high month-ago base.

The big takeaway from September 2023 retail sales is that apart from the tractor sub-segment, which saw a 10% YoY decline, all other sub-segments are delivering the goods – two-wheelers (up 22%), three-wheelers (up 49%), passenger vehicles (up 19%) and commercial vehicles (up 5%).

Commenting on September 2023 numbers, FADA president Manish Raj Singhania said: “September’s auto retail celebrated a 20% YoY leap, continuing the momentum from the previous month while marking a 3.5% MoM increase, seamlessly transitioning into the festive period’s sweet spot set to unfold over the next 42 days.”

He added, “The YoY analysis reveals broad-based growth across segments as two-wheelers posted a 22% increase, three-wheelers soared at 49%, PVs grew by 19% and CVs by 5 percent. However, tractors diverged with a -10% decline. In comparison to pre-Covid benchmarks, the sector enjoyed a robust 14% uplift, with the two-wheeler category registering growth (2%) for the first time.”

Singhania highlighted the robust performance of the three-wheeler industry: “Remarkably, thre-wheeler sales notched another all-time high in September, recording 102,426 units. This represents a 49% YoY and a 3% MoM growth, surpassing the previous record of 99,907 units set in August 2023.”

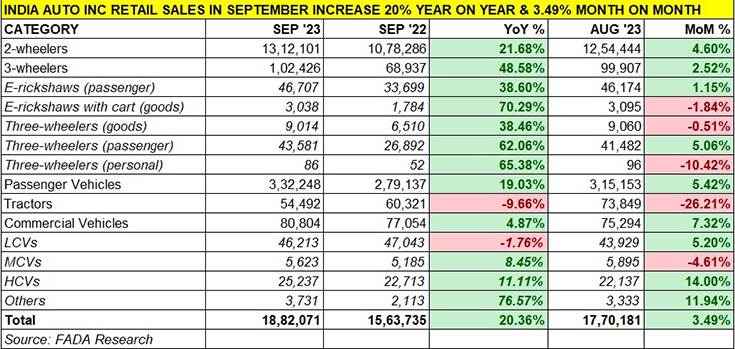

2-WHEELER RETAILS UP 20% YoY TO 1.31 MILLION UNITS, UP 4.60% OVER AUGUST 2023

The segment which is the biggest contributor to India Auto Inc is back in action! At 13,12,101 units, sales in September bettered the year-ago retails by all of 22% and also posted 4.60% growth over August 2023’s 12,54,444 units. In September, this segment accounted for 70% of the total auto retails.

Market leader Hero MotoCorp sold 351,781 units in September – that’s 11,726 units a day! – to record 30.53% YoY growth (September 2022: 269,498). This performance has helped it increase its market share to 27% from 25% a year ago.

Honda Motorcycle & Scooter India missed going ahead of Hero MotoCorp in September by a whisker – just 2,882 units. At 348,899 scooters and motorcycles, HMSI retails last month were up 17% (September 2022: 298,389). Clearly, HMSI has benefitted from rolling out a number of new products – between August and September, the Japanese OEM launched no less than 7 motorcycles (SP160, CD110 Dream Deluxe, 110cc Livo commuter bike, Hornet 2.0, CB300F, CB200X, SP125 Sports Edition) and more recently the luxury Gold Wing Tour.

TVS Motor Co, the third-ranked OEM, registered 28% YoY growth with sales of 228,852 units. The company continues to make market share gains – TVS now has a 17.44% share compared to 16.56% it had in September 2022.

Bajaj Auto, the No. 4 player, recorded similar growth like TVS – 29% to 149,314 units versus 116,034 units in September 2022. However, compared to August 2023’s 149,129 units, the month-on-month performance is flat. Nevertheless, Bajaj’s market share is up marginally to 11.38% from 10.76% a year ago.

Like TVS and Bajaj, Suzuki Motorcycle India has also seen 29% YoY gains at 73,452 units and MoM growth of 6% over August 2023’s 69,119 units, to get a market share of 5.60% versus 5.28% a year ago. Meanwhile, Royal Enfield continues to see demand surge for its popular models – the company sold 63,084 units for 9% YoY growth albeit market share is down to 4.81% from 5.37% a year ago. Seventh in the two-wheeler OEM rankings is India Yamaha Motor with 49,510 units.

India’s electric two-wheeler market leader Ola Electric is ranked eighth with 18,647 units, which is an 88% jump over September 2023’s 9,898 units and gives it a 1.42% share of the overall ICE and EV market – very creditable. Similarly, Ather Energy with 7,123 units saw 13.40% YoY growth but just 1% MoM growth (August 2023: 7,064 units). The growing sales of these two only-EV OEMs is reflective of the maturing Indian consumer who, despite product prices rising after the FAME subsidy, has gone ahead with his/her purchase decision.

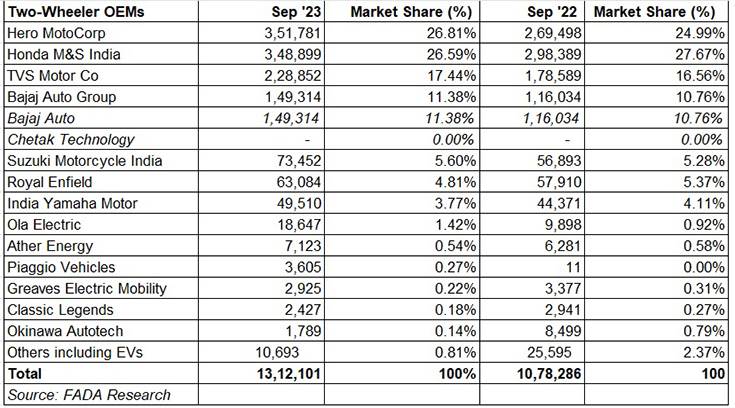

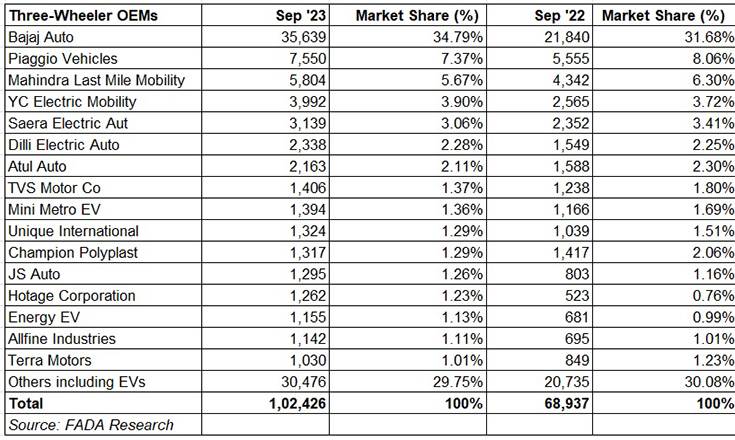

3-WHEELERS ON A ROLL – RECORD HIGH OF 102,426 UNITS, ELECTRICS ACCOUNT FOR 49% SHARE

One of the breakout numbers in September is that of three-wheelers – the retails of 102,426 units sets a new benchmark for monthly sales, constituting robust 49% YoY growth and also 5% MoM growth on a high month-ago base. This is the first time that three-wheeler sales have gone past the 100,000 mark, beating the previous best of 99,907 units in August 2023.

Electric three-wheelers, along with their two-wheeled brethren, are the low-hanging fruit of the EV industry and at 49,765 units, up 40% YoY (September 2022: 35,483 units), accounted for 49% of total three-wheeler sales last month. This also means that every second three-wheeler sold in India is now an electric one.

Market leader Bajaj Auto has increased its stranglehold on the segment with a 35% share – 35,639 units, up by a strong 63% YoY. Piaggio Vehicles, with 7,550 units and a 7.37% share, is a distant second as is Mahindra Last Mile Mobility with 5,804 units and 5.67% market share.

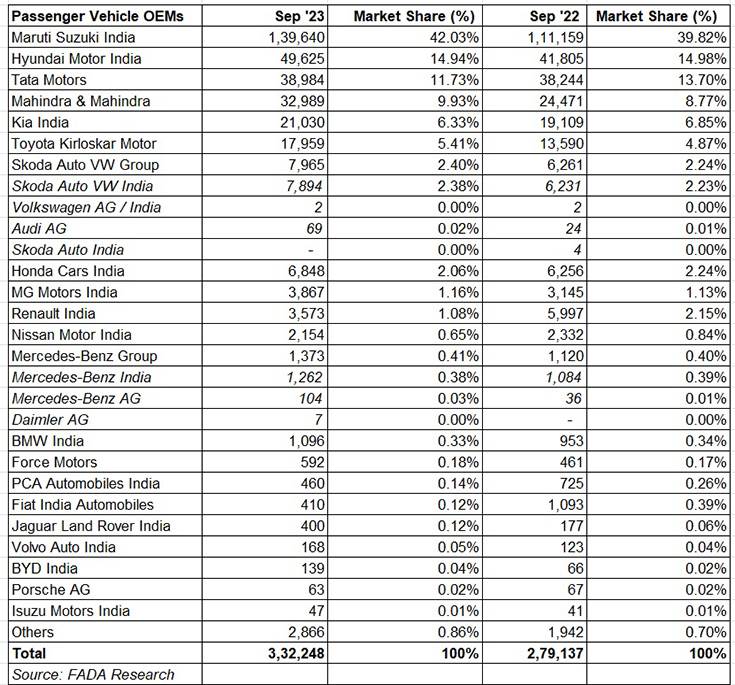

PASSENGER VEHICLE SALES RISE 19% TO 332,248 UNITS, MARUTI & MAHINDRA MAXIMISE GAINS

Like the three-wheeler segment, the passenger vehicle industry is another growth driver and September retails at 332,248 units were up 19.3 YoY and 5.42% on August 2023’s 315,153 units, which augurs well for future growth. The top 6 OEMs account for 300,227 units or 90% of total PV retails in India last month. Maruti Suzuki India and Mahindra & Mahindra, riding on the surging demand for SUVs, has maximised their market share gains. While Maruti Suzuki PV share is now up to 42%, M&M’s has increased its share to 9.93% from 8.77% a year ago. Tata Motors, which has seen two straight months of wholesales decline, sees its PV share reduce to 11.73% from 13.70% a year ago. It’s the same for Kia, whose share is now 6.33% from 6.85% a year ago. Toyota Kirloskar Motor, with 17,959 units in September, has improved its share to 5.41% from 4.87% a year ago.

In his comments on the PV sector, FADA president Manish Raj Singhania said: “The PV category experienced a stimulating resurgence as the market enjoyed improved vehicle availability and an influx of new and refreshed models from various OEMs. This uplift was supported by enhanced supplies and an increasing variety in the product portfolio, answering to a diversifying consumer demand. The market showed consistent demand for luxury cars and SUVs, signifying a robust consumer appetite for premium segments. The segment also witnessed the benefit of good pending bookings and the launch of promising products, laying the groundwork for potential growth in the upcoming festive season.”

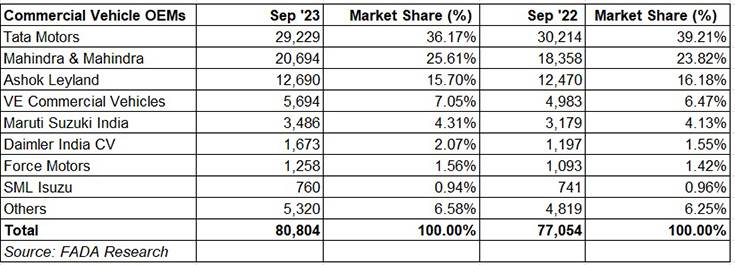

COMMERCIAL VEHICLE SALES UP 5% – M&M, VECV MARKET SHARE RISES

Coming on the back of August 2023’s sales of 75,294 units, the 7.32% MoM growth and 5% YoY growth that September 2023’s 80,804 units constitute indicate a resilient commercial vehicles segment. The CV sector is benefiting from the growing need for transportation of coal, cement and general market load, even as the passenger carrier segment (buses) is also witnessing an uptick in demand. This positive trend can be attributed to the adequate deployment of funds from the Central government towards infrastructure development, which fostered an environment for bulk deals, especially in tippers and government sectors, states FADA.

NEAR-TERM OUTLOOK: OPTIMISTIC

FADA has been maintaining a ‘cautiousy optimistic’ outlook for the past few months. However, with the 42-day festive period (Navratri and Deepawali) approaching, the apex automobile dealer association has changed its stance from to ‘optimistic’, anticipating a vibrant festive season for auto retail in India with monsoon worries dispelled.

While the first fortnight of October will be tepid for the two-wheeler sector in view of the shraddh period, upcoming festivals like Durga Puja and Navratri are expected to accelerate sales with new products, improved customer sentiment and competitive pricing playing pivotal roles driving new vehicle purchases.

It’s the same for CVs states FADA. “With the cessation of monsoons, a resurgence in infrastructure projects and essential goods transportation is anticipated in creating a robust demand. The market is likely to be buoyed by the availability of a broader range of vehicles and enticing finance options thus facilitating bulk purchases.”

In the PV segment, the market foresees a boost with the launch of new products, improved availability of popular models and continued success of recently unveiled vehicles. However, FADA adds a cautionary note with PV inventory reaching an unprecedented 60-65 days threshold. The association says that it is crucial for OEMs to proceed with caution, avoiding excessive inventory pushes, thereby ensuring a market that’s both vibrant and stable during the festive spree.

ALSO READ:

Electric two-wheeler sales near pre-slashed FAME subsidy levels