Chinese electric vehicle startup WM Motor said it has filed for a pre-restructuring process, marking the demise of a promising standout among China’s EV makers as price competition in the world’s largest auto market heats up.

“WM Motor’s planned reorganisation will introduce strategic investors from across the globe to achieve its rebirth,” the company said in a statement posted on its official Weibo account on Tuesday, adding a court in Shanghai accepted the company’s application for the pre-restructuring on Oct. 7.

The carmaker said it has been mired in an operational dilemma in recent years due to the pandemic’s impact, capital market sluggishness, large price swings in raw materials and setbacks in gaining capital needed for operations and development.

U.S.-listed second-hand car dealer Kaixin Auto Holdings had announced in September a non-binding acquisition term sheet with the troubled EV maker.

The deal came after WM Motor’s backdoor listing through a reverse takeover with Hong Kong-listed Apollo Future Mobility fell through.

The failed deal was seen as a survival move after two previous fruitless attempts by WM Motor to seek a listing in Shanghai’s STAR Market and Hong Kong.

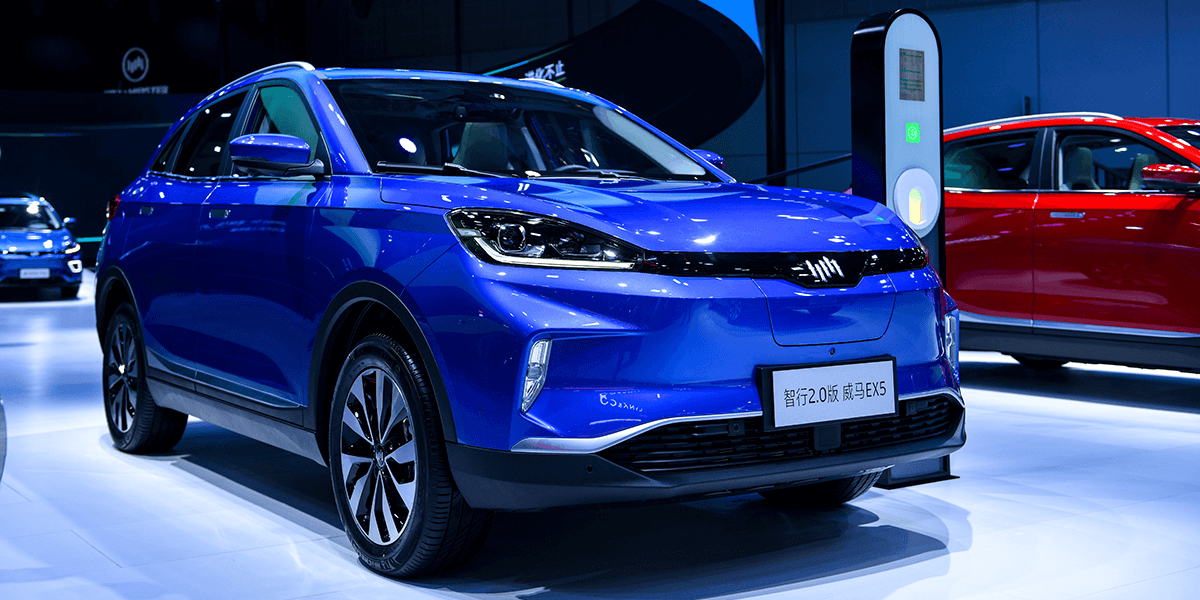

Founded in 2015 by renowned auto veteran Freeman Shen, WM Motor was seen to be among rising Chinese EV startups Nio , Li Auto and XPeng. Its backers included Chinese tech giant Baidu and Shanghai’s state-owned asset regulator.

But the Shanghai-based startup struggled to eke out profits in the capital-intensive auto sector.

WM Motor’s annual losses doubled to 8.2 billion yuan (USD 1.13 billion) over the three years to 2021, according to its stock prospectus released in June 2022 for a planned Hong Kong IPO.

China’s passenger vehicle sales returned to growth in August year-on-year, ending a streak of losses since May, as deeper discounts and tax breaks for green vehicles boosted consumer sentiment.

Concerns remain, however, over consumer spending on big-ticket items such as cars amid a shaky post-COVID economic recovery.