India’s domestic market sales of over 2 million passenger vehicles (cars, sedans and utility vehicles) in the first six months of FY2024 have got carmakers brimming with hope for a strong fiscal. What’s more, this segment’s positive export performance, amid a sea of red ink for the rest of the vehicle industry, is also encouraging news. Of all the four sub-segments, PVs are the sole vehicle category to post year-on-year growth in April-September 2024.

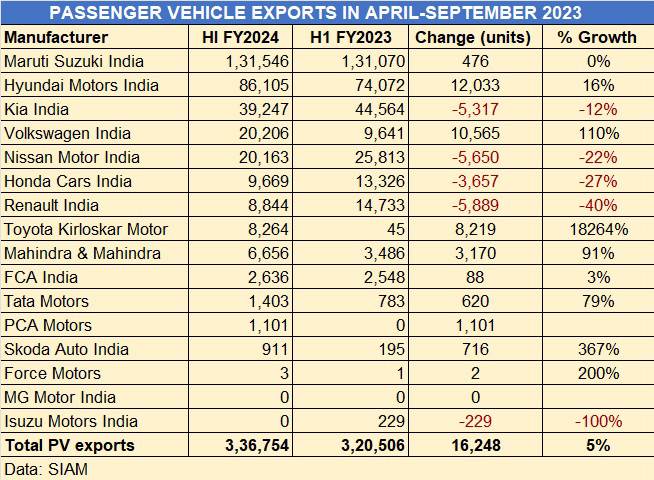

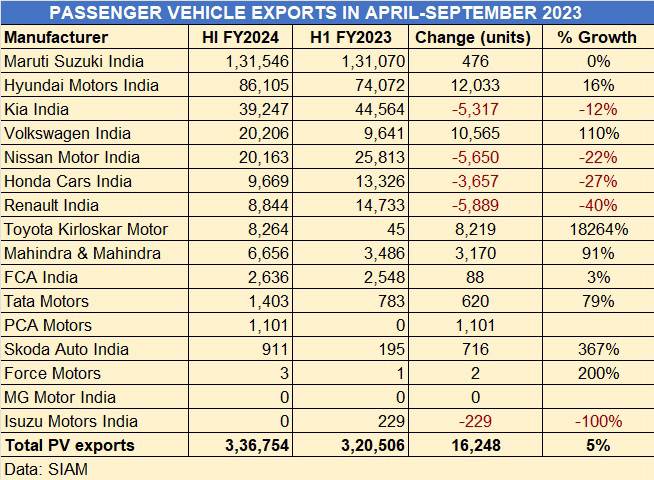

A total of 336,754 units comprising 2,15,514 cars and sedans, 117,250 UVs and 3,990 vans were shipped overseas in H1 FY2024, up 5% year on year (H1 FY2023: 320,506 units).

Leading the charge is PV market leader Maruti Suzuki with 131,546 units, which while it is flat sales (H1 FY2023: 1,31,070 units), makes for a solid lead of 45,441 units over Hyundai Motor India. At halfway stage in the current fiscal, Maruti Suzuki has achieved 51.49% of its record FY2023 exports of 255,439 units, up 8% (FY2022: 235,670). The company exports 18 models with the Jimny five-door SUV being the latest to join the company’s export portfolio. At present, the Maruti Suzuki models with the highest export demand are the Dzire sedan, the Swift, S-Presso and Baleno hatchbacks, and the Brezza SUV.

Hyundai Motor India, with total exports of 86,105 units, bettered its year-ago performance by 16% but will have to deliver a very strong export performance if it is to catch up with Maruti Suzuki.

The next three ranks belong to Kia India (39,247 units / down 12% YoY), Volkswagen India (20,206 units, up 110% YoY) and Nissan Motor India (20,163 units, down 22% YoY).

CAR & SUV EXPORTS SHINE AMID 17% DECLINE FOR INDUSTRY EXPORTS

As per the vehicle exports data released by SIAM, a total of 22,11,457 vehicles across the PV, CV, two- and three-wheeler segments were exported between April-September 2023. That’s 469,070 units less than the 26,80,527 units shipped overseas in the year-ago period – down 17.49% year on year.

While PV shipments are the sole category in positive territory, all the other segments are in the red. Commercial vehicle exports, at 31,864 units, are down 24.68% YoY (H1 FY2023: 42,306); two-wheelers at 16,85,907 units are down 20% (H1 FY2023: 21,04,845) and three-wheelers, at 155,154 units, are down 27% YoY (H1 FY2023: 2,12,126).

Speaking to PTI, SIAM president Vinod Aggarwal said vehicle shipments from India have been under pressure as a result of ongoing geopolitical issues in some regions and also due to pressure on foreign exchange reserves in some countries. Though the demand for India-made vehicles exists in some of these markets, the challenge of availability of forex and the need to focus on imports of essential goods, is limiting sale of vehicles. However, the SIAM president added that “a lot of work is going on, including facilitating trade in rupee terms so exports are expected to improve going ahead.”