First the good news about the passenger vehicle segment. At 20,70,163 units in April-September 2023, up 7% year on year, car, sedan and utility vehicle wholesales have crossed the 2-million mark for the first time, in the first six months of a fiscal year. The not-so-good news is that the decline of the car and sedan sub-segment continues.

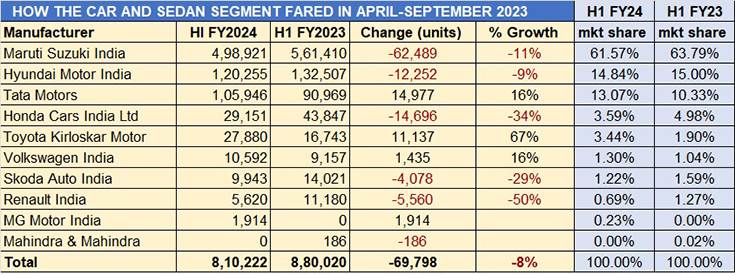

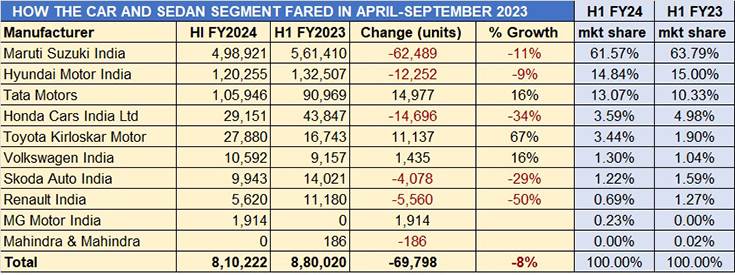

The PV segment’s YoY growth would have been in double-digits if it hadn’t been dragged down the 8% decline in car sales to 810,222 units from 880,020 units in April-September 2022, and the 1% decline in van sales to 73,786 units – H1 FY2024 saw 70,342 fewer cars and vans being sold versus a year ago.

What has buffered this decline is the massive and continuing demand for SUVs and MPVs – at 1.18 million units, utility vehicle wholesales in H1 FY2024 are a strong 21% increase – or an extra 133,359 units – over H1 FY2023’s 982,454 units. Clearly, the UV segment (read SUVs) is eating into the car, sedan and van segment, so much so that the UV share in PVs has risen to 57% from the 51% it had in H1 FY2023. Reason, why every OEM worth its wheel in the Indian market is introducing new models or variants in the SUV and MPV categories.

A close look at the performance of the 10 carmakers in the fray, as per industr data released by SIAM, reveals that six of them – Maruti Suzuki, Hyundai Motor India, Honda Cars India, Renault India, Skoda Auto India, and Mahindra & Mahindra – have seen their car and sedan sales decline. In comparison, Tata Motors, Toyota Kirloskar Motor and Volkswagen India all saw double-digit growth and increased their market share to 13%, 3.44% and 1.30% respectively. And MG Motor India opened its account with sales of 1,914 Comet EVs.

Passenger vehicle market leader Maruti Suzuki India dispatched 498,921 cars and sedans, down a sizeable 11% or 62,489 units, over the 561,410 units in H1 FY2023, which sees its market share reduce by two percentage points to 61.57 percent. The bulk of the decline can be attributed to the two budget hatchbacks, the Alto and S-Presso which, at 72,550 units, were down by all of 40% and 48,506 units fewer than H1 FY2023’s 121,506 units. Sales of the seven-strong model range of the Baleno, Celerio, Dzire, Ignis, Swift, Tour S and Wagon R at 418,930 units were down 3%, with 14,498 units fewer than a year ago. The premium Ciaz sedan though sold 7,441 units, up 7% YoY, and 515 more units that it did a year ago. Meanwhile, the Eeco van at 67,719 units was also down 3% YoY.

Hyundai Motor India, which shifted 120,255 cars and sedans in April-September 2023, witnessed a 9% YoY decline. In the hatchback segment, sales of the Aura, Grand i10 Nios and i20 fell 18% to 100,522 from 123,277 units a year ago. The new Verna though softened the blow considerably with its sales of 19,733 units, up 114% on the 9,230 units in H1 FY2023.

Third-placed Tata Motors is the one which has seen the maximum gains – 105,946 units for a 16% YoY increase – 14,977 units more than the 90,969 units in H1 FY2023. This sees the company’s car and sedan share increase to 13% from 10% a year ago. Tata, which has three cars in this segment (Altroz, Tiago and Tigor), clearly is benefiting from its multi-fuel and multi-powertrain strategy. The premium Altroz range expanded with a CNG variant in May 2023, while the Tiago hatchback and Tigor sedan also have the EV advantage over their rivals.

Honda Cars India, whose presence in this segment is through the Amaze and the City, clocked sales of 29,151 units, down 34% on year-ago sales of 43,847 units. Amaze numbers at 19,650 units were down 20% on year-ago 24,570 units; And City sales have fallen substantially too – the 9,501 units in H1 FY2024 are down 51% on H1 FY2023’s 19,277 units.

Things though are different for Toyota Kirloskar Motor – at 27,880 units, the company saw 67% YoY growth (H1 FY2023: 16,743), a performance which helps increase its market share to 3.44% from 1.90% a year ago. The Glanza hatchback saw demand grow 65% to 26,860 units vs 16,226 units a year ago, and the Camry sedan nearly doubled its sales to 1,020 units from 517 units a year ago.

Volkswagen India, which has a sole model in this segment in the form of the Virtus sedan, sold 8,404 10,592 units versus 9,157 units a year ago, registering 16% growth.

Skoda Auto India with 9,943 units saw a 29% YoY decline (H1 FY2023: 14,021 units). The sales comprised 131 Superb sedans (down 84% on year-ago 837 units) and 9,812 units of the Slavia sedan (down 25% on the 13,184 units in H1 FY2023).

Renault India saw a 50% YoY decline in sales of its entry-level Kwid hatchback to 5,620 units, from the 11,180 units in H1 FY2023.

Meanwhile, MG Motor India, which has entered the segment with the launch of the MG Comet EV, dispatched 1,914 units in the first six months of FY2024.

Van wholesales down 1% in H1 FY2024

There are only three carmakers present in the van sub-segment – Maruti, Mahindra and Tata. Maruti Suzuki India remains the leader here with its Eeco which sold 67,719 units, down 2.5% (H1 FY2023: 69,510). Tata Motors dispatched 6,057 vans, comprising 909 Magic Iris (up 00% on year-ago 92 units) and 5,148 Magic Express (up 84% on year-ago 3,283 units). Mahindra & Mahindra’s van numbers were down to just 10 Supros from the 1,485 units (Maxximo and Supro) in H1 FY2023.

Commenting on the Q2 FY2024 wholesale numbers, SIAM president Vinod Aggarwal said: “With a 75% drop in the mini / micro-passenger vehicle segment, compared to Q2 FY2023, there is a concern in the entry-level passenger vehicle segment. The slowdown in the entry-level PV segment can be attributed to the shifting consumer preferences as well as the rural income levels, which remain low, and these factors are also testified by the continued slowdown in the two-wheeler segment.”