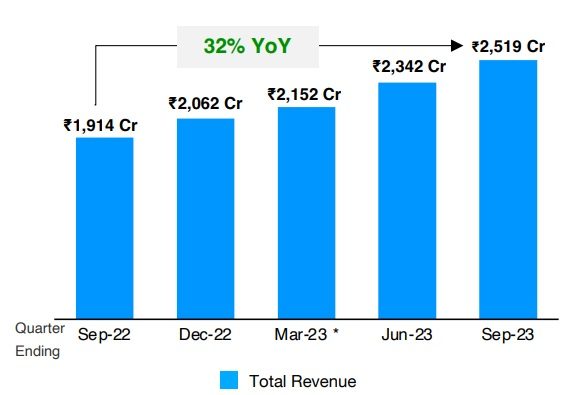

Paytm, one of the first Indian startups to go public, announced on Friday that its revenue for the second financial quarter ended Sept. 30, 2023 rose 32% year-on-year on the back of a steady growth in loans at its financial services business.

The Vijay Shekhar Sharma-led digital payments firm recorded a revenue of Rs 2,519 crore ($302 million) in July-September 2023, compared with Rs 1,914 crore in the same quarter last year.

Revenue in the first half of the fiscal year, meanwhile, rose 35% year-on-year to Rs 4,860 crore, compared with Rs 3,594 crore in April-Sept 2022.

Paytm’s revenue growth

The higher revenues helped Paytm narrow its losses. It posted a net loss of Rs 292 crore in Q2 2023 ($35 million), which is nearly half of Rs 571 crore posted in Q2 of last fiscal. For the half-year, too, losses nearly halved to Rs 650 crore from Rs 1,217 crore in April-September 2022.

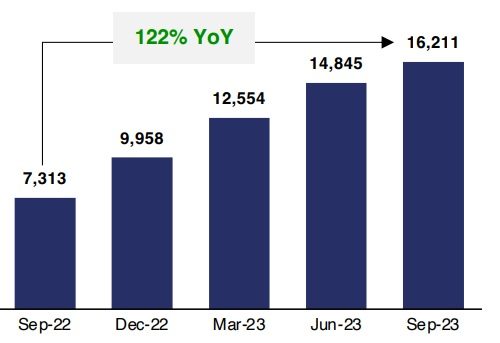

Paytm said the value of loans disbursed through the platform in the September quarter jumped 122% year-on-year to Rs 16,211 crore. Meanwhile, the number of loans distributed through the platform grew to 1.32 crore, up 44% YoY. The firm said it added 14 lakh merchant subscriptions in the three-month period.

Value of loans distributed through Paytm

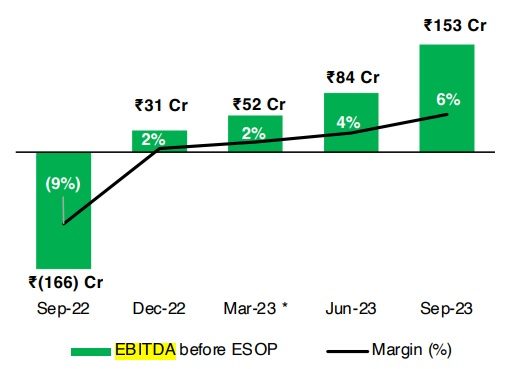

Paytm, which went public in 2021, recorded earnings before interest, depreciation, taxes and amortisation (EBITDA) of Rs 153 crore (before ESOP expenses) in July-Sept. In the corresponding period of the previous fiscal, it had posted an EBIDTA loss of Rs 538 crore. EBITDA margin grew to 6% from -9% in the same period.

Paytm’s Ebitda

According to the company, its net payment margin has gone up 60% year-on-year to Rs 707 crore due to increase in payment processing margin and increase in merchant subscription revenues.

Paytm‘s shares closed at Rs 980 apiece ahead of results on Friday, up 1.2% from the previous close. The share price of the company is up 84% so far this year.

Several Indian startups, including Paytm, are taking drastic steps to fall in line with investor expectations and achieve profitability.

Left in the cold amid the so-called ‘funding winter’, India’s startups have little choice but to erase the red ink from their balance sheets as investors tighten their purse strings and liquidity dries up. Paytm has been profitable at an Ebitda level for four straight quarters including the latest one.

Reuters