Indonesia’s listed technology group Bukalapak reported losses at around 390 billion rupiah ($24.5 million) for the July-September 2023 period compared to 4.97 trillion ($312 million) in losses in the corresponding period last year.

However, Bukalapak posted a profit of 614 billion rupiah in the previous sequential quarter (April-June 2023).

Bukalapak’s losses for the first nine months of 2023 stood at 776.2 billion rupiah ($48.75 million), a swing from 3.62 trillion rupiah profits in the same period a year earlier.

The stark difference from 2022 was, however, attributable to the substantial gains made by Bukalapak from its investment in PT Allo Bank Tbk last year.

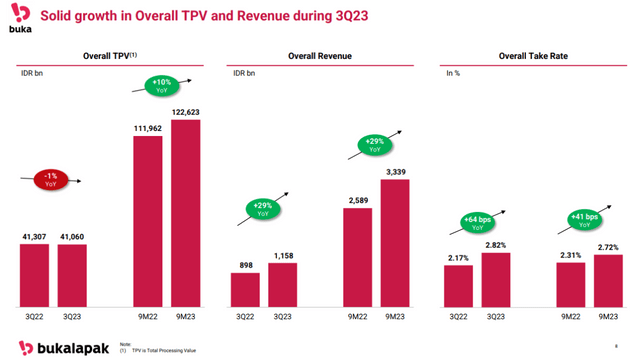

Bukalapak showed several positive developments in its total processing value—the value of payments that indicates the growth in transactions made on the platform known as TPV—revenue, and take rate in Jan-Sept 2023.

Bukalapak’s net revenue increased about 29% year-on-year to 3.34 trillion rupiah in Jan-September 2023, from 2.59 trillion rupiah a year earlier. According to Bukalapak’s presentation, the company had achieved 74% of its guidance for the year.

The company also claimed that it made 18% better than the average guidance for its adjusted EBITDA, having a negative 429 billion rupiah in January-September.

Bukalapak’s overall TPV in Jan-Sep was 122.62 trillion rupiah, an increase from 111.96 trillion rupiah a year earlier. Its overall take rate in Jan-Sep was 2.72%, compared with 2.31% in the same period in 2022.

The overall contribution margin in the July-Sep period increased 37 basis points to 0.44% of TPV, reflecting improved contribution margin in the company’s O2O and marketplace segment.

BRI Danareksa Sekuritas analyst Niko Margaronis said, commenting on the earnings, Bukalapak reported a flattish Q3 2023 total TPV 41.1 trillion rupiah, with Mitra TPV generating larger TPV traffic by 6.4% QoQ that is shifted from Marketplace TPV. This has resulted in slightly lower Q3 revenue at 1.16 trillion rupiah as the take rate is currently lower for the Mitras. “Nonetheless, we deem this to be a positive indication of robustness in Mitras and O2O core business of Bukalapak,” he observed.

Bukalapak reported positive quarterly growth in contribution margin on the back of a sharp decline in marketing costs, he added.

According to the company’s financials report, Bukalapak is cashflow positive thanks to significant proceeds from the disposal of long-term investments.

During the period, its net cash used in operating activities was 18.6 billion rupiah; its net cash used in financing activities was 23.84 billion rupiah; while its net cash proceeds from investment activities were nearly 3 trillion rupiah.

At the end of September 2023, Bukalapak had 19.17 trillion rupiah in cash and cash equivalents, an increase from 16.26 trillion rupiah a year earlier. That brought the company’s total current assets to 23.81 trillion rupiah as of September 2023, from 22 trillion rupiah a year earlier.

Bukalapak’s total assets, however, dropped to 26.65 trillion rupiah at the end of September 2023, from 27.41 trillion rupiah a year earlier.