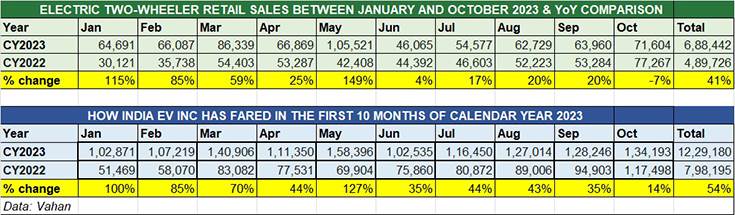

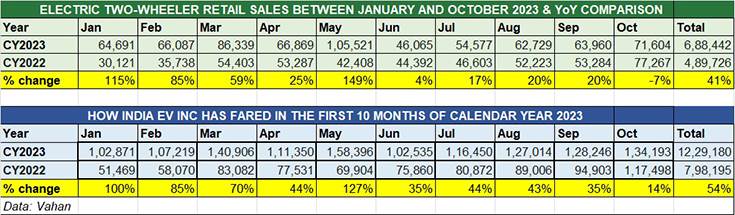

October 2023 and November 2023 are set to be record months for India EV Inc as well as India Auto Inc. With the 42-day festive period beginning from October 15 and continuing through to 15 days after Dhanteras, the ICE and EV segments are benefitting hugely from the increased consumer spend on new vehicle purchases. As per retail sales data on the government of India’s Vahan website at 5am on November 1, a total of 71,604 electric two-wheelers were sold in October 2023 (see data table below).

October 2023 retails at 71,604 units indicate demand has bounced back after FAME subsidy cut in June; cumulative sales of 471,325 units in April-October 2023 are up 27% YoY. January-October’s 688,442 units are up 41% YoY.

October 2023 retails at 71,604 units indicate demand has bounced back after FAME subsidy cut in June; cumulative sales of 471,325 units in April-October 2023 are up 27% YoY. January-October’s 688,442 units are up 41% YoY.

This makes October 2023 the month with the third highest sales after May 2023 (105,521 units) and March 2023 (86,339 units). While March numbers reflect the typical fiscal-year end high, the record retails in May were a result of buyers rushing to buy e-two-wheelers before the slashed-by-25% FAME subsidy kicked in from June 1, 2023.

Overall sales in October 2023 would have been higher, considering that the shraddh period (September 29-October 14), when a large number of people in India prefer to delay new purchases, was in the first fortnight of the month. Nevertheless, demand has turned out to be very strong in the second half of last month.

Consequently, October 2023 retails, which had a tepid first fortnight, saw YoY sales down 7% (October 2022: 77,267) albeit the second fortnight saw accelerated demand. This also means that demand has matched and also gone beyond the monthly sales achieved before the FAME subsidy was slashed by 25% in June 2023 and reflects the gradual maturing of the market as consumers are now buying EVs at higher prices.

As many as 298,935 EVs have been sold since June 2023 at higher prices, followed the reduced FAME subsidy. It may be recollected that e-two-wheeler sales had crashed to an 11-month low of 46,064 units in June 2023 after the FAME subsidy was slashed by a fourth.

Cumulative sales for the first nine months of CY2023, at 688,442 units are 41% better than January-October 2022’s 489,726 units. This means India EV Inc has surpassed entire CY2022’s retail sales of 631,174 units, with two months left for the calendar year to come to a close. With the festive season continuing with Diwali and Dhanteras (in November), it can be surmised that the Indian electric two-wheeler industry could close CY2023 with total sales in the region of 750,000 to 800,000 units, which translates into 18% to 25% YoY growth.

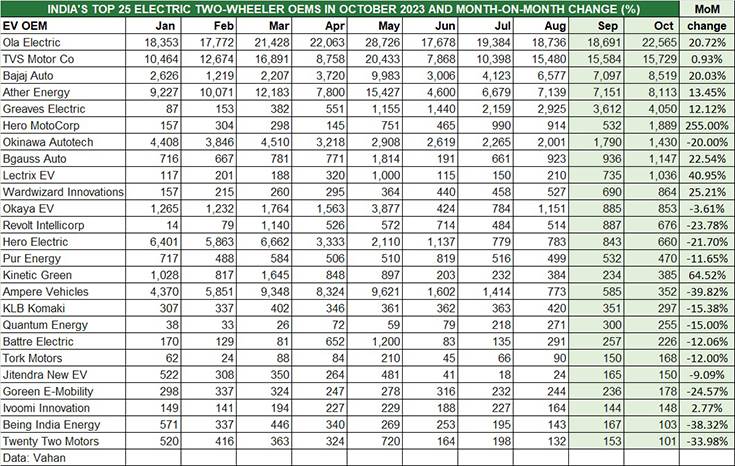

OLA LEADS WITH 31% MARKET SHARE, TVS’ SHARE at 22%, BAJAJ AUTO GOES AHEAD OF ATHER ENERGY

A deep dive into the Vahan retail sales data reveals that of the 165 OEMs in India’s very competitive e-two-wheeler market, the top 9 EV makers have each sold more than 1,000 units each and cumulatively sold 64,478 units, accounting for 90% of total October sales. The top two EV OEMs – Ola Electric and TVS Motor Co – are the only ones with retails in five figures.

As accurately forecast last month, market leader Ola Electric sold over 20,000 units in October – the 22,565 units sees it grow its already-commanding share to 31 percent and makes for strong 21% month-on-month (MoM) growth. What’s more, the company has surpassed the 200,000 sales milestone in the first 10 months of 2023. Expect Ola Electric, which recently launched its refreshed S1 series of e-scooters and has already garnered over 75,000 bookings, to maintain the strong momentum in the months ahead.

TVS Motor Co, with 15,729 units, saw flat sales – the MoM growth is just 0.93% (September 2023: 15,584 units), which gives it a market share of 22%, three percentage basis points more than the 19% share it had in July. Between January and October, TVS has sold 134,279 iQubes, which . In September, the iQube rode past the cumulative 200,000 sales milestone in 45 months since launch in January 2020. In August, the company had launched its new and premium EV flagship, the TVS X, priced at Rs 250,000, at a mega event in Dubai.

Interestingly, Bajaj Auto, which has sizeably ramped up production of the Chetak scooter and is also expanding its network, sold 8,519 Chetaks in October, up 20% on September’s 7,097 units. This is Bajaj Auto’s second-best monthly performance after the best-yet 9,983 units in May 2023 and takes it ahead of Ather Energy, albeit the latter remains the strong No. 3 with cumulative 10-month sales of over 88,390 units versus Bajaj’s 49,077 units.

Ather Energy saw retail sales of 8,113 units, which constituted 13.45% MoM growth compared to September’s 7,151 units. Ather Energy is among the EV OEMs making moves to enable easy finance to potential buyers. In July, the company had announced 100% on-road financing for its e-two-wheelers, barely a month after it introduced a 60-month loan product, resulting in monthly EMIs as low as Rs 2,999, in collaboration with IDFC First Bank, HDFC Bank, Hero FinCorp, Bajaj Finance, Axis Bank, and Cholamandalam Finance.

In fifth position is Greaves Electric Mobility which has delivered its best monthly performance – 4,050 units – in October, and 12% better MoM growth. Greaves’ sister EV arm, Ampere Vehicles is ranked 15th with October sales of 352 units. Combined sales of the two EV divisions would add up to 4,402 units, which still puts in fifth position.

Meanwhile, a hard-charging Hero MotoCorp with its Vida scooter has gone ahead of Okinawa Autotech to take sixth rank. With a total of 1,899 Vidas sold in October, Hero MotoCorp registered 255% MoM growth on a low September 2023 base of 532 units. The strong performance is likely due to aggressive marketing on Hero’s part.

Okinawa Autotech has slipped to No. 7 position with 1,430 units, down 20% MoM (September 2023: 1,790 units). Considering the company had opened CY2023 with 4,408 units in January, it is clearly feeling the heat of slowed-down sales and much increased competition.

Bgauss Auto has witnessed its best monthly sales yet with 1,147 units and 22% MoM growth, and continues to maintain a consistent growth trajectory.

Some of the other OEMs which recorded strong MoM growth include Lectrix EV (1,036 units / up 41%), Wardwizard Innovations (864 units, up 25%), and Kinetic Green (385 units, up 64%)

GROWTH OUTLOOK: NOVEMBER TO SEE ACCELERATED SALES

While the sales momentum for the electric two-wheeler industry was solid in October, expect November 2023 to be far better what with Diwali and Dhanteras coming up in the first fortnight itself.

Static and high petrol prices across the country are seeing a growing number of personal two-wheeler users take the decision to transition to electric mobility which proves more wallet-friendly in the long run.

Meanwhile, the sustained demand for last-mile deliveries across urban India as well as town and country is acting as a sales catalyst for cargo-transporting electric two-wheelers and a number of EV manufacturers are benefiting from bulk orders. India’s improving economy, a marked uptick in consumer sentiment along with OEMs offering sweetened new product deals in the festive season to capture the growing consumer shift to EVs should see India EV Inc maintain a solid growth path in the months to come.

Meanwhile, overall EV sales across segments have crossed the 1.2 million mark in the first 10 months of this year, which calls for an altogether different analysis. Stay plugged in.

ALSO READ:

EV sales in H1 FY2024 jump 51% to 738,000 units, fiscal headed for record 1.5 million

Sixty percent of global 2- and 3-wheeler sales to be electric by 2030: World Energy Outlook study

Honeywell announces EV industry safety solutions portfolio for India market