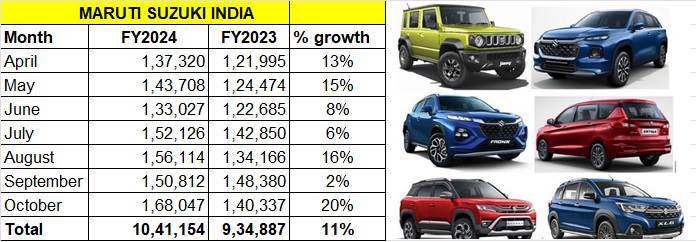

Maruti Suzuki India, the bellwether of the Indian passenger vehicle industry, has announced bumper wholesales of 168,047 units, its best monthly numbers in the first seven months of the current fiscal year and an increase of 20% YoY (October 2022: 140,337 units).

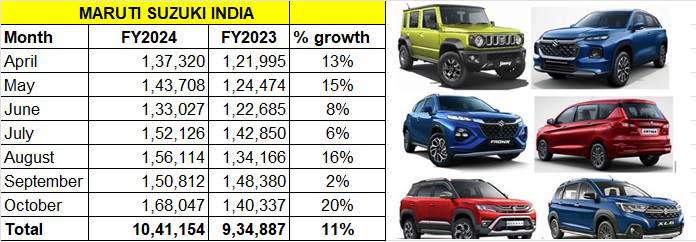

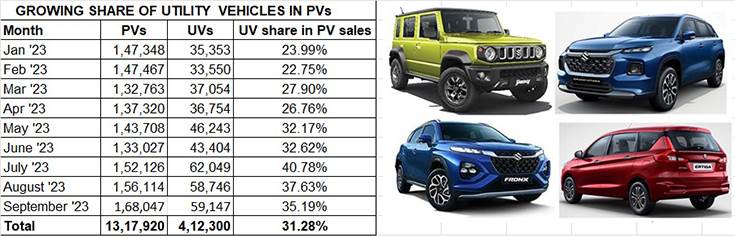

Providing the sales charge, as it has been for the past eight-odd months, is the company’s SUV and MPV range. The eight-model portfolio, comprising the Brezza, Grand Vitara, Fronx, Jimny, S-Cross, XL6, Ertiga and the new Invicto, together sold 59,147 units, which is a 91% YoY increase (October 2022: 30,971 units). Maruti Suzuki UVs have been, in the recent past, saving the blushes for the company with their rapid growth.

The seven-model hatchback category (Baleno, Celerio, Dzire, Ignis, Swift, Tour S and Wagon R), which was down 5% in September, has returned to positive territory in October with sales of 80,662 units, up 9% (October 2022: 73,685 units).

What would have helped beef up sales, particularly of the models sold from the Maruti Arena channel, was the sizeable discounts offered in October on the Brezza, Alto K10, S-Presso, Celerio, Wagon R, Dzire and the Swift in October. These discounts were in the form of exchange bonuses, cash discounts and corporate benefits.

Festive season demand and consumer rush for SUVs and MPVs saw Maruti Suzuki dispatch 168,047 units in October, its highest yet in the fiscal to date.

This sales uptick could be the result of a combination of factors including the festive season. The two entry-level budget hatchbacks (Alto and S-Presso) continue to witness slackened demand –14,568 units, down 42% YoY (October 2022: 24,936). However, this is an improvement over the 10,351 units sold in September, down a massive 65% YoY.

In terms of cumulative sales, Maruti Suzuki has dispatched a little over a million units – 10,41,154 – which is an 11% YoY increase. The car and SUV maker had recorded total sales of 1.6 million units (16,06,870) in FY2023 which was handsome growth of 20 percent. In a market which is expected to growth by 5% to 5.5% on a large year-ago base of 3.89 million units, Maruti Suzuki expects to outperform the PV industry with 10% growth in FY2024.

According to RC Bhargava, chairman, Maruti Suzuki India, “As against last year’s volumes of 16.4 lakh units in the domestic market, we will be over 18 lakh units, we will be growing better than the industry this year, which is only making up for what we had lost in the past and it is nothing exceptional. We will still be below our 50 percent share.”

“India needs the small car segment to grow for a sustained growth in the future,” Bhargava had said after the Q2 FY2024 earnings call with the media on October 27.

What augurs well though for the company is that supplies of semiconductors have considerably improved and with the resultant production ramp-up, the pending order backlog booking for the company is likely to have come down to 220,000 units at the end of October compared to a peak of 400,000 pending bookings a couple of quarters ago.

The share of utility vehicles in Maruti Suzuki’s PV pie is rising speedily as seen in the sales data table above.

MARUTI SUZUKI’S PV MARKET SHARE INCREASES TO 43% IN OCTOBER

According to Shashank Srivastava, Senior Executive Officer, Sales & Marketing, MSIL, “The October sales are the highest-ever monthly sales for MSIL, and with these numbers, we have also crossed the 1-million-unit mark in FY2024, with total sales pegged at 1,060,544 units. Our market share has also increased to 43% last month, compared to 41.7% in October 2022.”

“On the retail front though, the industry retail lagged wholesales at 388,600 units against approximately 367,000 units of October 2022. MSIL registered a 7% retail growth in October, and 10 percent for the April-October 2023 period wherein we grew double the market rate,” he added.

October saw SUVs continue their domination with a 50.7% market share, with hatchbacks being pegged at 29%, and sedan share reducing to 8.1 percent. In the April-October 2023 period, seven out of the Top 10 PV models from a sales standpoint belonged to Maruti Suzuki India. The Swift, Wagon R, Baleno and Brezza were the Top 4 selling models in this seven-month period, with the Brezza emerging as the best-selling SUV in India.

Srivastava, however, cautioned on the industry stock level which is pegged at approximately 335,000 units or around 30 days of inventory. “This is quite a high stock and was last seen around October-November 2018. While it is concerning, we are hopeful of good retail sales in the first fortnight of November which is auspicious in the Northern and Central part of the country. But if the retails fare poorly, we might see an impact on wholesales in the month of November,” said Srivastava.

India’s largest carmaker has seen a sharp reduction in its order backlog, which presently stands at 208,000 units owing to the improvement in semiconductor supplies. “With the semiconductor crisis fading away, the industry has been able to increase production significantly,” he added.

ALSO READ:

Maruti Suzuki takes big lead in car and SUV exports in H1 FY2024

SUVs capture 57% of India’s PV market: Maruti leads with 26% market share, M&M at 18% in H1 FY2024