Singapore-headquartered media firm SPH Media said it will acquire technology media startup Tech in Asia to strengthen its offerings, according to a company statement.

In the longer term, the acquisition will support SPH Media’s broader transformation efforts, the company said.

The synergies from the proposed acquisition will deepen the value of SPH Media’s The Business Times publication and accelerate its goal of becoming a regional player for business and tech news, and events, per the statement.

“For SPH Media, this acquisition is a strategic move that will enable us to provide our readers with a more comprehensive suite of products and services,” said Wong Wei Kong, Editor-in-Chief, of English/Malay/Tamil Media Group at SPH Media.

The deal is expected to close by the end of this year. Although financial details were not disclosed, DealStreetAsia has learnt from multiple sources that the agreed transaction pegs Tech in Asia’s valuation at $30 million.

Tech in Asia has been seeking buyers for some time, the sources added.

It is understood that The Business Times is working on the integration of Tech in Asia into its business, which is expected to take place over the next 12-18 months.

Tech in Asia and SPH Media did not comment on the article when reached.

Founded in 2010, Tech in Asia covers technology news and organises tech events in Southeast Asia. It claims to have a user base spanning mainly Southeast Asia, India and North America.

The Singapore-based startup has raised a total of $13.5 million in funding, per DealStreetAsia’s DATA VANTAGE. Its last round of financing in 2017 valued the company at about $25 million.

10 largest shareholders of Tech in Asia

| Shareholder name | Shareholding |

|---|---|

| Hanwha Investment & Securities | 18.2% |

| Fenox Venture (Pegasus Tech Ventures) | 14.7% |

| Willis Wee Shin Chuen | 14.6% |

| East Ventures | 9.5% |

| SB ISAT (Softbank Indosat Fund) | 8.9% |

| Ligth VC | 6.0% |

| Simile Venture Partners | 5.5% |

| Walden International | 4.0% |

| Y Combinator | 3.8% |

| Foo Ji-Xun | 0.7% |

Investors on its cap table include South Korea’s Hanwha Investment & Securities, Pegasus Tech Ventures, East Ventures, SoftBank Indosat, Light VC and Y Combinator, among others.

Tech in Asia founder and CEO Willis Wee said, in his post, “Joining forces with SPH Media provides Tech in Asia with more stability and resources as well as an environment to thrive. Additionally, this deal offers liquidity for our shareholders, some who have patiently fought alongside us for over a decade.”

Post-acquisition, he added, “TIA will remain independent, maintaining our unique culture, processes, and HR policies.”

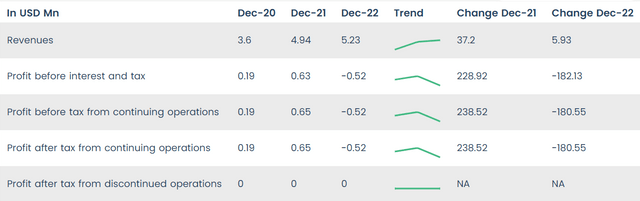

Tech in Asia reported a loss of $0.52 million in 2022, compared to profits before interest and tax of $0.63 million and $0.19 million in 2021 and 2020 respectively.

In other major M&As in the SE Asian media space, Nikkei acquired a majority stake in DealStreetAsia in 2019, four years after the Japanese media giant acquired the Financial Times.

Other deals in Asia include Charlton Media Group’s acquisitions of Retail Asia and Asia Pacific Broadcasting+, and the merger of Taipei-based The News Lens Co and Tokyo-based Mediagene Inc to form TNL Mediagene, which in June 2023 finished a business combination with Blue Ocean Acquisition Corp to list in the US.

Editor’s Note: SPH Media Fund was an investor in DealStreetAsia and sold their stake to Nikkei in 2019.