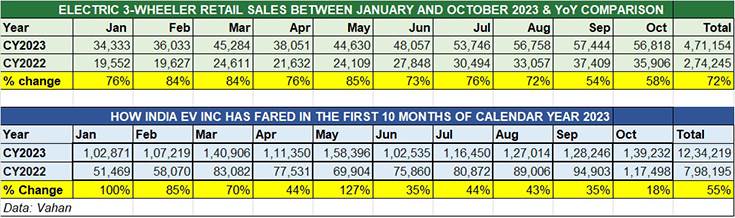

In India’s fast-growing electric vehicle industry, the two- and three-wheeler segments, which are the most affordable compared to their four- and more-wheeled brethren, are setting the pace. While the electric scooter and motorcycle segment leads in terms of sheer volumes, the rate of transition to zero-emission mobility is fastest in the three-wheeler market, where now every second product sold is an electric model. October 2023 numbers as well as cumulative January-October 2023 retail sales are ample proof of that.

This e-three-wheeler sub-segment, which sells passenger-transporting e-rickshaws and cargo-carrying three-wheelers, continues to witness strong double-digit growth thanks to sustained demand for passenger transportation and from last-mile operators for e-commerce applications, food deliveries and other applications.

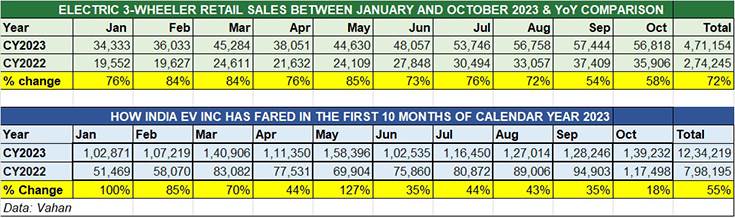

Compared to fossil fuel or CNG-powered models, the long-term wallet-friendly proposition of electric three-wheelers is drawing both single-user buyers (autorickshaw drivers) as well as fleet operators. As per data available on the government of India’s Vahan website, as of November 2, a total of 56,818 electric three-wheelers were sold last month, up 58% YoY (October 2022: 35,906 units). This segment has maintained a consistent growth trajectory, having opened CY2023 with 34,333 units and crossing the 50,000-unit monthly sales mark for the first time in July with 53,746 units.

October saw sales of 56,818 electric three-wheelers, up 58% YoY. Record cumulative January-October 2023 retails of 471,154 units have jumped 72%.

EV SHARE OF INDIA’S 3-WHEELER MARKET EXPANDS TO 54%

The level of electric three-wheeler penetration is rising fast. In fact, every second three-wheeler sold in India is now electric. As per Vahan, overall three-wheeler sales in India last month were 104,712 units, with e-wheelers accounting for 54% of them. In January 2023, when 70,929 three-wheelers were sold, the EV share was 48%, which is reflective of the shift.

Cumulative 10-month sales of e-three-wheelers at 471,154 units are up 72% YoY (January-October 2022: 274,245 units) and account for 53% of total three-wheeler industry retails of 881,355 units.

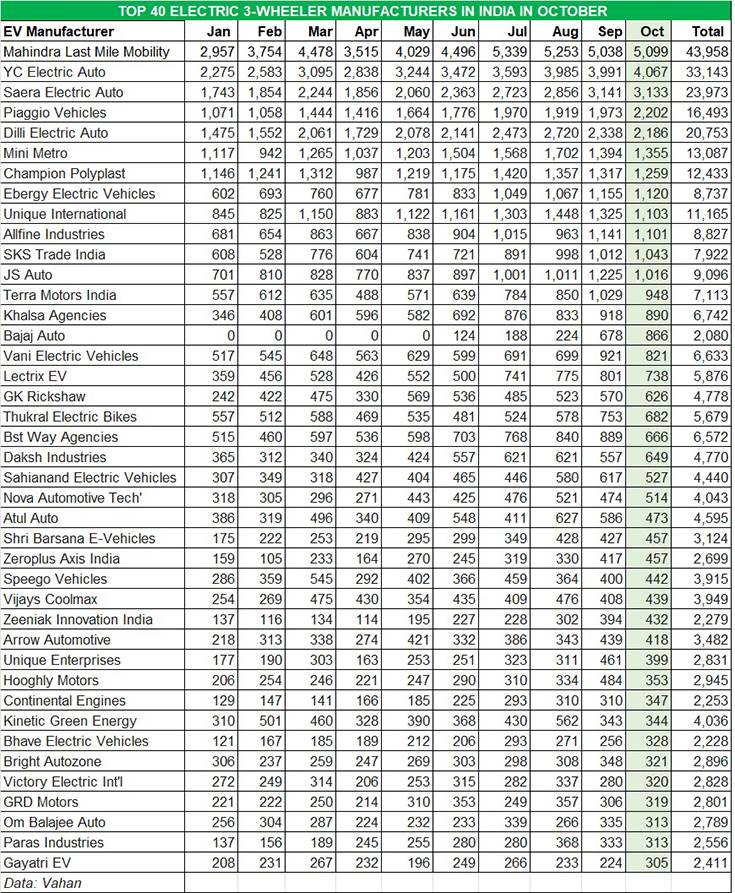

Of the nearly 475 players in the market, we have shortlisted the Top 40 OEMs in terms of sales in October. Mahindra Last Mile Mobility (MLMM), the market leader in FY2023 with over 35,000 units and a 9% share, maintains its leader position status with 5,099 units and January-October retails of 43,958 units. The company, which expanded manufacturing capacity in April with a new line for its Treo e-three-wheelers at the Haridwar plant, currently has six EVs on sale – the Treo, Treo Yaari and e-Alfa Mini for passenger transport and the Zor Grand, Treo Zor and the e-Alfa cargo for goods transport.

YC Electric Vehicles, the firm No. 2 player, has recorded its best monthly sales this year at 4,067 units, and cumulatively 33,143 units in the first 10 months of this year. YC EV has five products – the Yatri Super, Yatri Deluxe and Yatri for passenger duties and the E-Loader and Yatri Cart for cargo operations. Low initial cost, from Rs 125,000 to 170,000 for passenger EVs, and Rs 130,000 to Rs 165,000, is what is driving demand for this OEM.

Third-placed Saera Electric Auto saw sales of 3,133 units in October 2023 and a cumulative 10-month tally of 23,973 units.

Piaggio Vehicles, which is also recording strong market gains, clocked its best monthly retails in the year to date in October: 2,202 units. Janaury-October 10-month sales add up to 16,493 units, the company benefiting from its new models and aggressive network expansion. Last December saw Piaggio launch two new models – the Apé E-City FX Max passenger model (with 145km range) and Apé E-Xtra FX Max cargo carrier (115km range), both fully assembled by an all-women team at its Baramati factory in Maharashtra.

There are eight other OEMs which have sold over 1,000 units each last month. Dilli Electric Auto (2,186 units), Mini Metro (1,355 units), Champion Polyplast (1,259 units), Energy EV (1,120 units), Unique International (1,103 units), Allfine Industries (1,101 units)), SKS Trade India (1,043 units)) and JS Auto (1,016 units).

The Top 12 OEMs, each with four-figure sales, cumulatively sold 24,684 units in October 2023, effectively having a 43% share of the total e-three-wheeler market, leaving the remaining 56% of the market to the other 463 manufacturers to battle it out in the arena. The data table below reveals that the battle down the line is intense, with many OEMs separated by just a few units.

Interestingly, Bajaj Auto, which has recently entered this market, has sold a total of 2,080 units in the past five months, its sales growing smartly month on month from 124 units in June through to 866 in October. The company is currently ranked 13th in the 475-player market.

The Top 12 OEMs together sold 24,684 units in October and have a 43% share of the total electric three-wheeler market, leaving the remaining 56% of the market to the other 463 manufacturers.

The Top 12 OEMs together sold 24,684 units in October and have a 43% share of the total electric three-wheeler market, leaving the remaining 56% of the market to the other 463 manufacturers.

3-WHEELER SHARE OF INDIA’S EV MARKET RISES TO 40%

In CY2022, a total of 350,238 e-three-wheelers were sold in India. At the current rapid pace of growth, their sales in CY2023 are expected to surpass the 550,000-unit mark and achieve strong 57% YoY growth.

Concurrently, from an overall EV industry perspective, electric three-wheelers are making their presence felt. In October 2023’s total EV sales of 139,232 units, e-three-wheeler share was 40%, up from 30% a year ago (October 2022: 35,906 units out of total 117,498 EVs). Cumulative 10-month retails at 471,154 units make for a 38% share of the total 1.23 million EVs sold in India between January and October this year.

EV sales in H1 FY2024 jump 51% to 738,000 units, fiscal headed for record 1.5 million