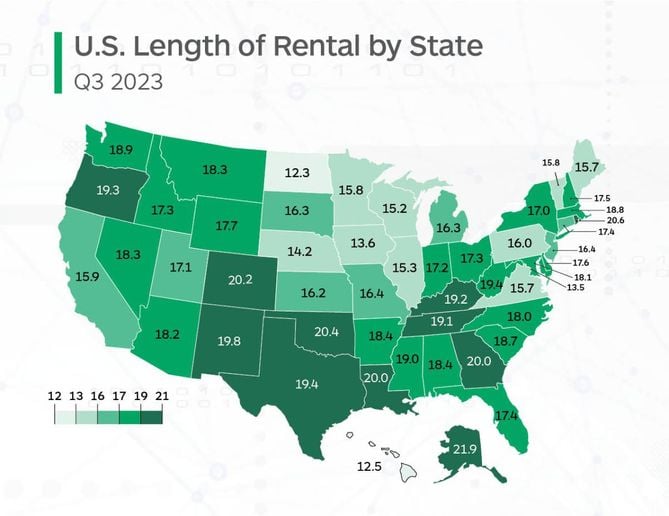

Alaska had the highest overall LOR at 21.9 days, which was an increase of 1.6 days from Q3 2022. Rhode Island (20.6), Oklahoma (20.4) and Colorado (20.2) were the next-highest. North Dakota brought in the lowest LOR at 12.3 days, a decrease of 0.7 days from Q3 2022. Hawaii was right behind at 12.5 days, reflecting a 1.2-day decrease.

Graphic: Enterprise Rent-A-Car

Overall length of rental (LOR) for collision-related rentals was 17.5 days in Q3 2023, which is down 0.7 days from Q3 2022’s LOR of 18.2 days (which itself was up three full days from Q3 2021), according to figures released this week by Enterprise Rent-A-Car.

Likewise, LOR for Q2 this year dropped 0.3 days from Q2 2022.

The growing trend of lowered LOR is promising, but it’s important to note these are still “new normal” figures, as LOR was 15.2 days in Q3 2021 and 12.3 days in Q3 2020.

One notable cause of overall elevated LOR is the growth of electric vehicles in rental fleets.

“Electrical vehicles continue to occupy a greater portion of repairable claims volume at 1.86% in Q3 2023 compared to 1.59% in Q2 2023 and 1.31% in Q3 2022,” said Ryan Mandell, director of claims performance for Mitchell International, in a news release. “EVs have more than six additional labor hours on average per estimate than ICE vehicles. The frequency of calibrations increased above 10% for the first time in Q3 2023, compared to 8.8% in Q2 2023 and 7.5% in Q3 2023.”

Drivable Vehicles

LOR for vehicles associated with a drivable claim was 15.7 days in Q3 2023, flat from Q3 2022’s results.

Drivable LOR increases are becoming smaller with each subsequent quarter for some time now, and this neutral result gives optimism that Q4 could potentially bring a decrease.

“Our average delivery days for all part types are virtually unchanged when we compare Q3 2023 to the same quarter in 2022, which aligns with Enterprise’s drivable LOR being unchanged,” said Greg Horn, PartsTrader’s chief innovation officer. “We are also seeing that shops are sourcing parts when the vehicle is being scheduled for repairs. This seems to indicate that repairers are scheduling more drivable vehicles to arrive when there is capacity, and therefore reducing repair cycle time.”

Non-Drivable Vehicles

LOR associated with non-drivable claims was 25 days in Q3 2023, a 2.2-day decrease from Q3 2022.

John Yoswick, editor of the weekly CRASH Network newsletter, offered insights into some of the headwinds facing the repair industry: “First, while no one would suggest the technician shortage has significantly improved, among 500 shops surveyed by CRASH Network in June, more than 1 in 5 said they were fully staffed and had no job openings. That’s not a lot, but it was up from just 15% a year earlier.

“Secondly, shops’ backlog of work has eased a bit, falling from a nationwide average of 4.7 weeks in the second quarter of this year to 4.3 weeks in July,” Yoswick said. “The average backlog this past summer was more than 10 days shorter than it was in the fourth quarter of 2022.”

Total Loss Vehicles

Rentals associated with total loss claims dropped 1.2 days from Q3 2022, coming in at 16.6 days.

“Total Loss frequency declined to 18% from 18.5% in Q2 2023 but was slightly higher than Q3 2022 (17.8%),” Mandell said.

Overall LOR Outlook

As the numbers show, the trend of ‘predictable’ seasonal LOR continues; the LOR decrease is positive, and many repairers are finding ways to anticipate and operate in the new normal.

However, challenging market conditions remain, and overall LOR remains significantly higher than it was pre-pandemic.

While parts disruptions from the UAW strike are unclear, PartsTrader’s Greg Horn opined: “The impacted OEMs are deploying employees from other areas and hiring temp workers to minimize the impact to OE parts delivery, and though there has been an increase in ‘unable to quote’ parts, the combination of the parts distribution center temporary staff and the increase in alternate parts sales has reduced the impact of the strike efforts.”