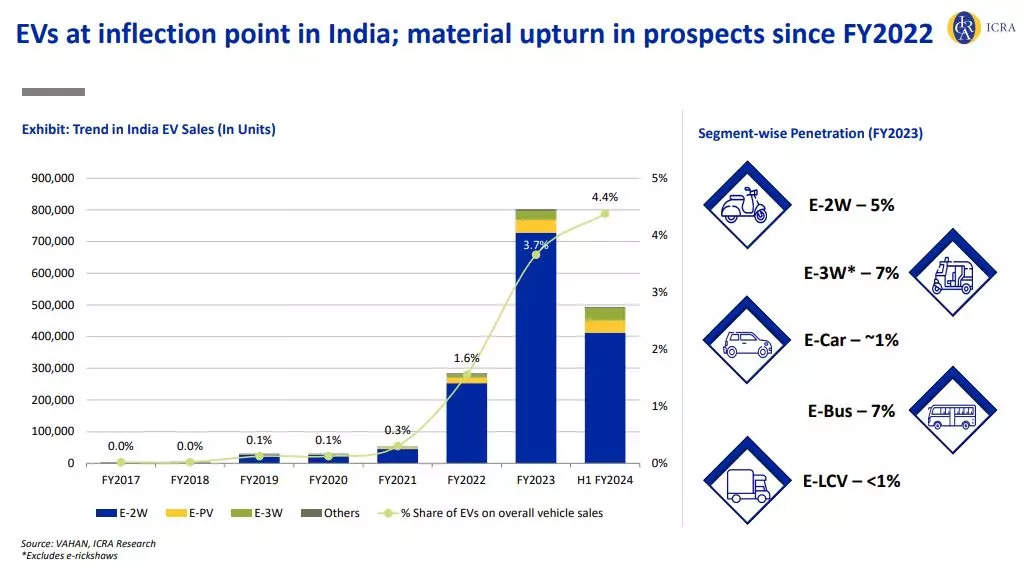

New Delhi: Spurred by Government subsidies (under the FAME-II policy), enhanced awareness, and increasing product launches, the electric vehicle (EV) segment has seen a material upturn in prospects over the past two years.

According to the VAHAN website, cumulative EV industry sales (including two-wheelers. Three- wheelers, passenger vehicles and commercial vehicle sub-segments), for the first 10 months of 2023 stood at 12,34,325 units, marking year-on-year growth of 55% as against 798,196 units recorded during Jan-Oct 2022 period.

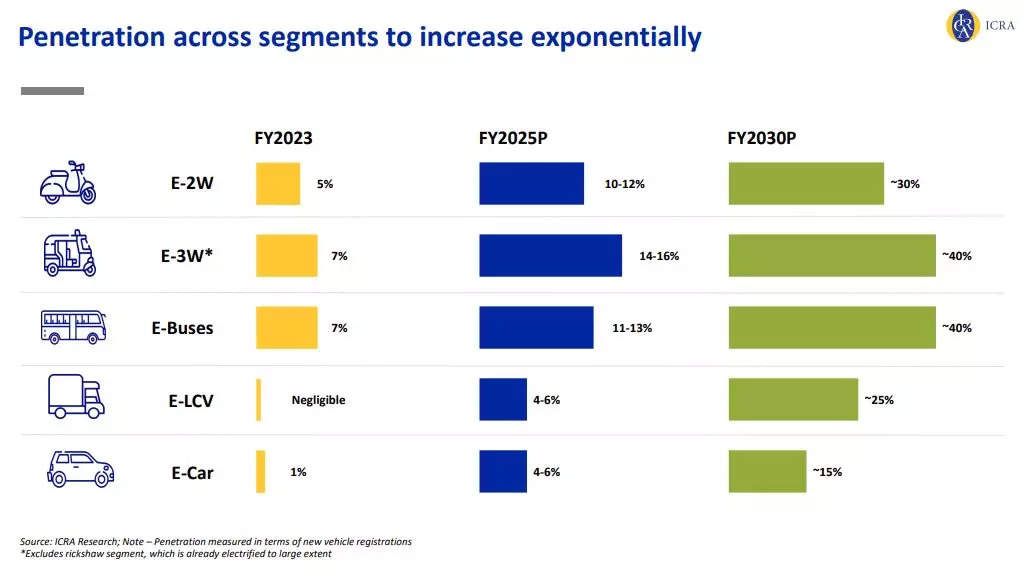

Sales of EVs is on a growth path, led by the two-wheeler segment. Penetration of electric two-wheelers in the overall two-wheeler sales increased to about 5% in FY23, though the pace of adoption has slowed over the past few months owing to the reduction in subsidy, according to the ratings agency ICRA.

The government reduced the subsidy amount to INR 10,000/kWh with a cap of up to 20% of the ex-showroom price, effective June 1 this year. This had an immediate impact on electric two wheeler sales.

To boost the sales of EVs with a budget of INR 75 crore, the central government rolled out the FAME subsidy scheme in August 2015. The scheme called for cash subsidy being credited to EV dealers to bring down the acquisition cost for vehicle buyers. The budgetary allocation was subsequently increased on an annual basis along with the extension of the scheme, till FY19 when the budget stood at INR 145 crore.

April 2020 onwards, this was replaced by the FAME-II scheme, which entailed a massive increase in budget to INR 10,000 crore and was initially applicable for three years till March 31, 2022. This was extended in June 2021 for another two years till March 31, 2024.

In June 2021, the government hiked the subsidy on EVs to INR 15,000/kwh from INR 10,000/kwh with the maximum cap increased to 40% from 20% of the ex-showroom price of the vehicle. Apart from the subsidies available under the FAME scheme, various state governments also introduced their own incentives such as a subsidy amount per kwh of battery capacity, and discounts or complete exemption on payment of road tax.

Experts suggest that OEMs are aware that high levels of subsidies will not be provided again and thus they remain focused on value engineering initiatives to develop more affordable products. It is likely to aid adoption over a medium term.

To offset the vehicle cost hike owing to reduction in subsidy, electric two wheeler OEMs including Ather Energy, Ola Electric, Tork Motor recently introduced de-spec versions of their existing electric scooters in the market. As advanced features involve more costs, this is aimed at ensuring vehicle sales while also keeping the cost at check.

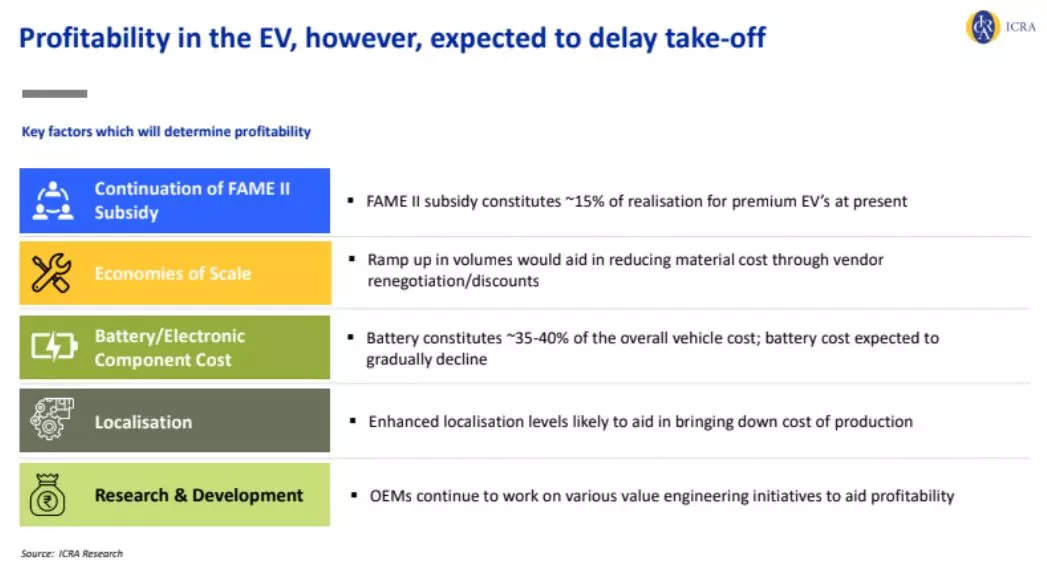

“It is important that the volumes pick up and the economy of scale happens because that is when the vendor negotiation or the vendor discounts will actually come in, which will eventually help in reaching economies of scale and thus profitability,” Rohan Kanwar Gupta, Vice President & Sector Head – Corporate Ratings, ICRA, said.

The ratings agency suggests that amid the ongoing trend of transition to electrification, OEMs are expected to incur significant investments in the development of ground-up EV platforms and enhance manufacturing capacities. The increased investment towards product development is expected to moderate the return indicators to an extent for the industry over the near to medium term. Profitability in the EV sector is still some time away.

Key factors which will determine profitability include continuation of FAME-II subsidy, reaching economies of scale, battery cost, localisation and R&D initiatives.

Global scenario

After the EV maker Tesla missed Wall Street expectations on third-quarter gross margin, profit and revenue, CEO Elon Musk said he was cautious about going “full tilt” on the Mexico factory.

According to a Reuters report, Musk has recently expressed concern about the impact of high interest rates on car buyers. Subdued demand has prompted the company to cut prices.

High interest rates are derailing the shift to EVs across the globe, which was also underscored by the scrapping of a GM-Honda partnership and a warning from battery maker LG Energy Solution.

Germany’s Volkswagen also cut its profit margin outlook for the year, blaming negative effects for raw material hedges at the end of the third quarter. Some of those materials are used in EV batteries. It warned that demand for EVs is not developing as expected, with the German group’s own order intake for EVs down to 150,000 in Europe from 300,000 last year.

Like many other industrial firms, carmakers hedge against commodity price swings, and with EV demand slowing, raw material prices have softened, including those used heavily in batteries.

Lithium prices have dropped 67% so far this year based on spot lithium carbonate prices assessed by Fastmarkets. Prices of cobalt metal on the CME have declined 20% this year and more than halved since May last year.

US automaker Ford earlier this month said it would temporarily cut one of three shifts at the plant that builds its electric F-150 Lightning pickup truck, and in July slowed its EV ramp-up, shifting investment to commercial vehicles and hybrids.

China’s CATL, the world’s largest battery maker for EVs, has also reported that third-quarter profit rose 10.7%, its weakest quarter since the start of last year due to slowing demand and stiff competition.

EV sales are still growing strongly, but that demand is not keeping up with the expectations of carmakers and other companies that have invested billions of dollars in this emerging mobility space. Expectations of higher interest rates havs led companies to alter plans as they eye 2024 warily.