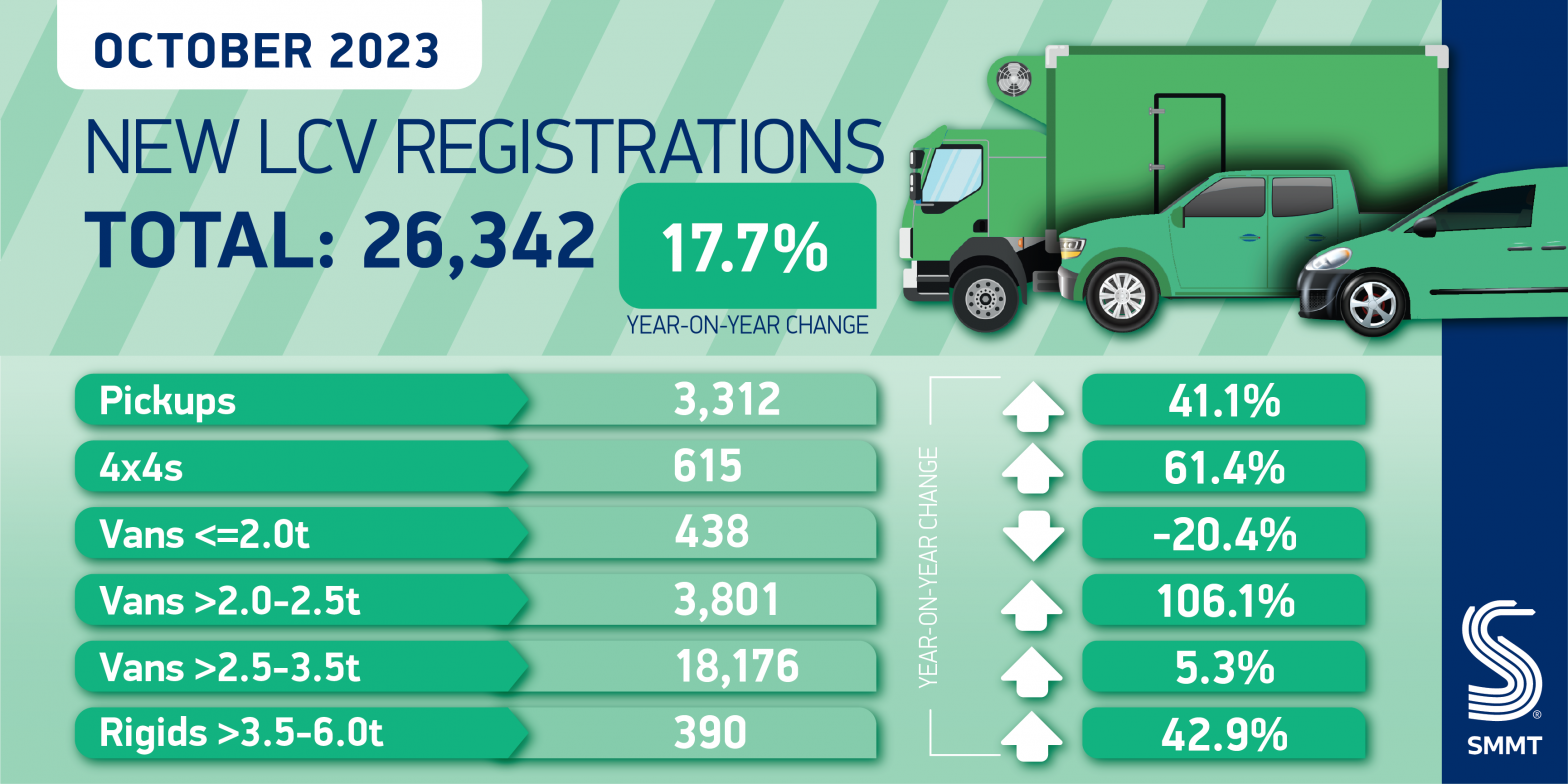

- UK new light commercial vehicle market rises for 10th month in a row, up 17.7% to 26,342 units in October.

- Growth driven by doubling of demand for medium-sized vans, rising by 106.1%, while largest van models still most popular.

- Battery electric van registrations fall -20.2%, with van-suitable chargepoint rollout and driving licence derogation needed in time to support green growth.

SEE LCV REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

Britain’s new light commercial vehicle (LCV) registrations increased by 17.7% in October with 26,342 of the very latest vans, pickups and 4x4s joining Britain’s fleets, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). The growth is some 3.8% above pre-pandemic 2019 levels1 and rounds off 10 consecutive months of rising demand this year, totalling 284,321 units. This is the highest volume for two years as the easing of supply chain disruptions means that more operators can more readily renew their fleets.2

New van buyers continue to opt for payload and fuel efficiencies, with large vans – weighing greater than 2.5 tonnes to 3.5 tonnes – up 5.3% to 18,176 units last month, representing 69.0% of the market. Demand for medium-sized vans drove growth, however, with deliveries more than doubling, up 106.1% to 3,801 units. There was also a jump in demand for 4x4s and pickups, up 61.4% and 41.1% respectively, while registrations of the smallest vans continue to fall, -20.4% below last year at 438 units.

Following a glut of new battery electric van (BEV) registrations in September, uptake was slower in October, down by a fifth (-20.2%) to 1,362 units – skewed in comparison with a particularly large fleet order in the month last year. In 2023 to date, BEV demand has risen by 19.8%, with 15,658 units registered since January. These greenest vehicles represent one in 20 (5.5%) new LCVs so far this year as manufacturers continue to make net zero investments, having already delivered 27 different all-electric van models to market. Uptake rates will need to accelerate, however, and as the Zero Emission Vehicle Mandate comes into effect in less than two months, government must pull every lever to stimulate demand.

The Autumn Statement due later this month is a key opportunity to send a message that now is a good time to make the switch, by committing to retain existing incentives and beneficial tax frameworks for BEV buyers. Looking further ahead, it must also address major barriers to mass uptake, particularly by ramping up the rollout of public chargepoints which meet the specific needs of vans of all types and sizes. Furthermore, by providing prompt legislative approval for driving licence derogations for LCVs weighing more than 4.25 tonnes, it will be easier for fleets to invest in the largest BEV vans, accelerating decarbonisation and improving air quality in every region of the UK.

Mike Hawes, SMMT Chief Executive, said,

As the crucial pre-Christmas delivery period commences, there is a clear appetite for fleets to be fitted out with the latest vans – and it is of critical importance that those vans are the latest, cleanest zero emission models. With van makers committed to decarbonisation, the upcoming Autumn Statement is the moment for government to send the right signal to operators ahead of the introduction of the Zero Emission Vehicle Mandate. Measures that address van-specific infrastructure challenges and enable more operators across the UK to make the switch are essential as we move towards a pivotal stage of the transition.

With the van market enjoying 10 consecutive months of growth, the outlook for the year has been revised upwards to 332,000 units, a 1.4% rise on July’s outlook. However, anticipated BEV registrations have been cut by -9.0% on the previous outlook to 21,000 units – still 26.8% above 2023 – to a 6.3% market share. Looking further ahead, 2024 is expected to see 334,000 new van registrations, with 34,000 BEVs exceeding 10% of the overall market.

Notes to Editors

1 October 2019: 25,373 units.

2 January-October 2022: 235,962 units.