Southeast Asian super app Grab Holdings Ltd, on Thursday, reported that its group adjusted EBITDA turned positive for the first time, at $29 million, in the third quarter of 2023 (Q3 2023), a notable improvement from negative $161 million in the same period last year.

The positive adjusted EBITDA was due to the Nasdaq-listed company’s growing GMV and revenue, improving profitability on a segment-adjusted EBITDA basis, and lowering regional corporate costs.

Grab booked revenues of $615 million in the quarter ended Sept. 30, up 61% YoY from $382 million in Q3 2022, thanks to growth across all business segments and incentive optimisations, as well as a business model change for certain delivery offerings “in one of the markets”, the Nasdaq-listed company said in a statement.

Its losses narrowed 71% year-on-year to $99 million in Q3 2023, from $342 million in the same period of 2022 due to lower group adjusted EBITDA losses and a reduction in fair value losses on investments, net interest expenses, and share-based compensation expenses.

“We achieved our first positive group adjusted EBITDA this quarter as we reached another all-time high in group monthly transacting users (MTUs) and saw increased earnings for our driver-partners,” said Anthony Tan, Grab’s co-founder and group CEO in a statement.

Tan added that this is just one of the many steps in its journey as Grab continues to drive growth sustainably and profitably. “Our progress forward remains anchored on improving our marketplace efficiency, building better and more affordable services for our users, and empowering the millions of everyday entrepreneurs on our platform to thrive,” Tan continued.

Grab’s GMV grew by a modest 5% YoY while its group MTUs grew 7% YoY.

Its corporate costs were also down to $192 million in Q3 2023, compared with $208 million a year ago as it implemented cost efficiencies across the organisation. Overhead expenses declined 9% YoY, primarily driven by lower staff costs.

In June, Grab announced 1,000 job cuts, which is equivalent to about 11% of its workforce as the firm wanted to manage costs and ensure more affordable services in the long term.

At the end of the third quarter of 2023, Grab had $5.9 billion of cash liquidity, compared to $5.6 billion at the end of the previous quarter.

Its net cash liquidity—cash on hand, time deposits, and marketable securities—stood at $5.2 billion in Q3 2023, compared with $4.9 billion at the end of Q1 2023.

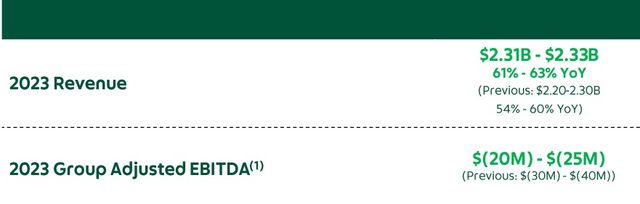

In its Q3 financial report, Grab adjusted its guidance for revenue for the financial year 2023 to $2.31 billion-2.33 billion, and its group adjusted EBITDA guidance ranged from a loss $30-40 million to a loss of $20-25 million for the full year 2023.

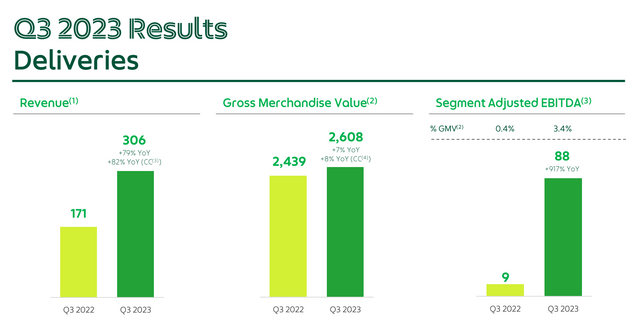

Deliveries division

Revenue for deliveries grew 79% YoY to $306 million in the third quarter this year from $171 million in the same period in 2022. The company attributed this growth to a reduction in incentives and GMV growth.

Its GMV grew by 7% YoY thanks to consistent demand in this segment.

Deliveries segment adjusted EBITDA as a percentage of GMV expanded to 3.4% in Q3 this year from 2.7% in the second quarter of 2023 and 0.4% in the third quarter of 2022.

Its GrabUnlimited program continued to see higher engagement as well and subscribers spent 4.2x more for food deliveries compared to non-subscribers. Subscribers also showed 2x higher retention rates than non-subscribers.

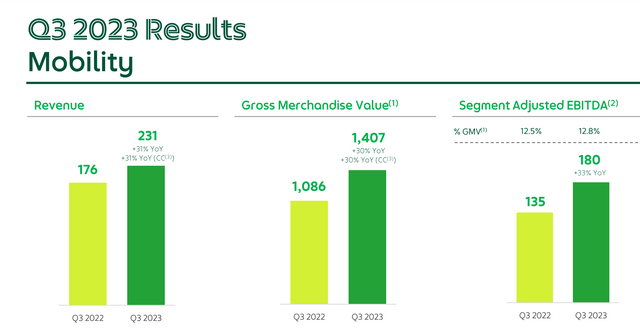

Mobility division

Revenue for the mobility business unit rose 31% YoY to $231 million in Q3 2023 from $176 million in Q3 2022. GMV of this segment increased 30% YoY from $1 billion in Q3 2022 to $1.4 billion in the July to September period this year.

The company increased monthly active driver supply by 9% YoY in the quarter while earnings per transit hour of driver-partners was up by 8% YoY.

Financial services

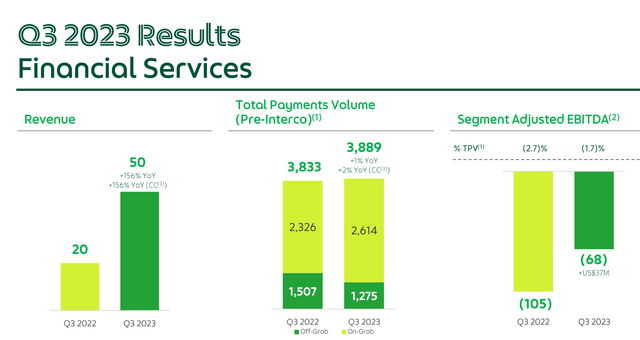

On the fintech front, revenue grew 156% YoY to $50 million in the third quarter of 2023 due to improved monetisation of the payment business and higher contributions from lending.

However, GMV declined 15% YoY in the third quarter of 2023 to $1.3 billion from $1.5 billion in the same period last year.

Segment-adjusted EBITDA for the quarter improved by 35% YoY to negative $68 million, as it improved cost efficiency in GrabFin’s cost structure.

Its loans disbursement grew by 52% YoY to $1 billion while total loans outstanding amounted to $275 million at the end of the third quarter.

In September, Grab’s Malaysia digital bank was the first of the five digital bank licence applicants to receive the approval to commence operations from Bank Negara Malaysia. Meanwhile, in October, South Korea’s KakaoBank, announced the investment of a 10% stake in Superbank, the Indonesian digital bank backed by Grab and Singtel, through the subscription of new shares.

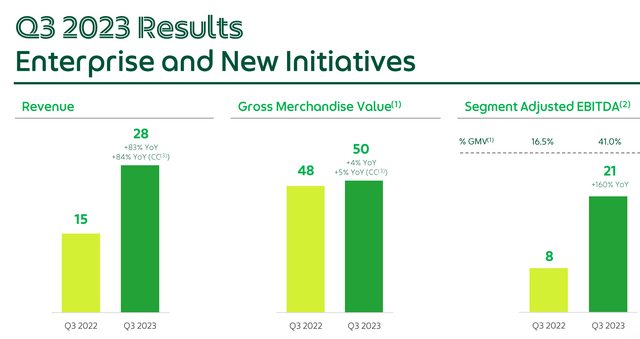

Enterprise and new initiatives

Grab booked $28 million in revenue from its enterprise and new initiatives segment, which represents an 83% increase YoY in the third quarter of 2023, thanks to growing revenues from advertising.

GMV for the period was up slightly by 4% YoY while segment-adjusted EBITDA grew 160% YoY in the third quarter of this year.

“Our third quarter results reflect our consistency and discipline in execution,” said Peter Oey, Chief Financial Officer of Grab. “As we look beyond 2023, we will continue to sharpen our focus on generating Adjusted EBITDA and free cash flows, while maintaining cost discipline to drive further operating leverage,” he continued.