With India in the peak period of the 90-day festive period which began over two months ago, October 2023, as expected, has delivered the goods for vehicle manufacturers in terms of wholesale dispatches to dealers.

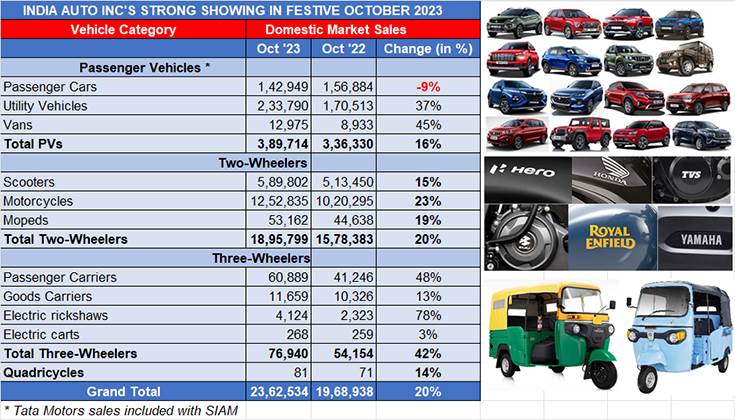

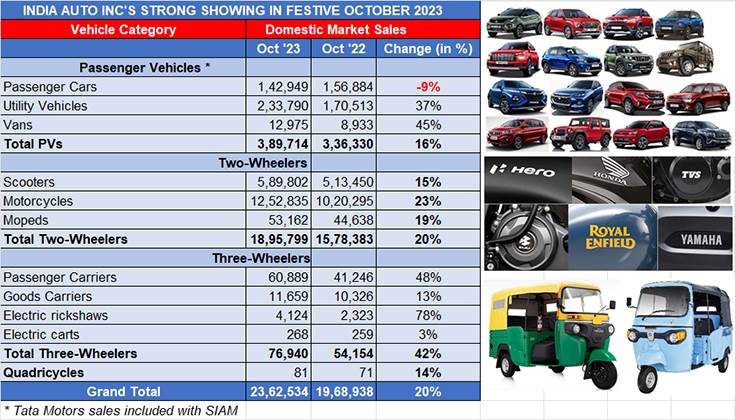

As per the monthly numbers released by apex industry body SIAM, for three vehicle categories (passenger vehicles, two- and three-wheelers), cumulative sales at 2.36 million units are a strong 20% year-on-year growth (October 2022: 19,68,938 units). Importantly, all three segments have registered strong double-digit growth. Let’s take a look at how each vehicle segment fared in October.

PASSENGER VEHICLES: 389,714 units – up 16% YoY, up 7.58% MoM

The passenger vehicle category scaled a new monthly peak in October with all of 389,714 units. This figure is arrived at by combining SIAM’s official data of 341,377 units (which does not include Tata Motors’ wholesales) and Tata Motors’ 48,337 units as per the company’s official press release.

As a result of the continued and surging demand for SUVs and MPVs, the PV segment, has surpassed the 350,000-unit sales mark for the 10th month in a row. The 389,714 units dispatches in October are a 16% YoY increase (October 2022: 336,330 units), which is propelled by the sustained and surging demand for utility vehicles (UVs) in the form of SUVs and MPVs, which continue to act as a buffer to slowed-down sales of passenger cars and sedans.

Wholesales of cars and sedans at 142,949 units are down 9% on October 2022’s 156,884 units. What offers hope for this sub-segment is that demand from rural India, a key buyer of entry-level budget hatchbacks, has begun to pick up after a long span of time. It is understood that market leader Maruti Suzuki, with its strong rural market network and reach, has witnessed an improvement in its rural India sales.

Nevertheless, the UV segment, which comprises SUVs and MPVs, continues to be the strong buffer to the decline in car and sedan sales. At 233,790 units, UVs accounted for 60% of PV sales last month, taking their share to a record high. In October 2022, the UV share was 51%, which is ample proof of just how strong demand remains for this vehicle category. No surprise then that OEMs with a UV-heavy portfolio have seen strong growth.

The top six OEMs – Maruti Suzuki, Hyundai Motor India, Tata Motors, Mahindra & Mahindra, Kia India and Toyota Kirloskar Motor – have each recorded strong growth, four of them in double digits. What’s more, other than Toyota, the other five OEMs have also seen month-on-month growth over their September sales (see data table above). And, it’s not surprising that all these six OEMs product portfolios are armed with a strong armoury of SUVs and MPVs.

TWO-WHEELERS: 18,95,799 units – up 20% YoY, up 8.34% MoM

The two-wheeler segment, which comprises scooters, motorcycles and also mopeds, registered total wholesales of 1.89 million units, up 20% YoY (October 2022: 15,78,383 units) and 8.34% on September 2023’s 17,49,794 units.

Motorcycles, with 1.25 million units, recorded 23% YoY growth and 12% MoM growth, and accounted for 66% of total segment sales. Market leader Hero MotoCorp dispatched over half-a-million units – the 516,840 units, up 27% YoY, mean the company continues to have a strong grip with a 41% share.

5,89,802

Bajaj Auto, the No. 2 motorcycle OEM, maintains its strong position too. The Pune-based manufacturer registered wholesales of 262,774 units, up 16% YoY (October 2022: 202,375) and a current market share of 21 percent.

With 51,268 units fewer than Bajaj Auto, Honda Motorcycle & Scooter India, with 211,506 units and 13% YoY growth, is in third position. The only other OEM to clock six-figure wholesales last month is TVS Motor Co which dispatched 137,964 bikes, which makes for a strong 31% YoY increase (October 2022: 105,400 units).

In tandem with the motorcycle market, demand has also come the way of the scooter segment, which has a 47% share of the overall two-wheeler market. At 589,802 units, October 2023 numbers were 15% up on the year-ago 513,450 units.

Scooter market leader Honda, with its Activa brand, continues to maintain its unassailable position with 251,241 units, up 4.85% YoY (October 2022: 2,39,598) and a market share of 42.64%. However, this also indicates that HMSI’s share has declined from 46.66% in October 2022.

TVS Motor Co, which continues to witness sustained demand for its Jupiter and NTorq 125 scooters, dispatched 153,831 units last month – this constitutes 22% growth over October 2022’s 125,896 units gives the company a scooter market share of 26%, up from the 24% it had a year ago. What is helping TVS is the growing contribution of its e-scooter, the iQube. At 20,121 units, the iQube accounted for 13% of TVS’ sales last month, up from the 6% it had a year ago (October 2022: 8,103 iQubes / 125,896 scooters).

Interestingly, Bajaj Auto dispatched all of 12,137 Chetaks, its best monthly performance yet since the company began selling the electric scooter in January 2020, the same month when the TVS iQube rolled out.

THREE-WHEELERS: 76,940 units – up 42% YoY, up 3.38% MoM

Like the PV sector, the three-wheeler segment is also firing on all cylinders and at 76,940 units dispatched in October 2023, the YoY increase is a robust 42 percent (October 2022: 54,154 units). The month-on-month growth is a more considerate 3.38% (September 2023: 74,418 units), given the larger base.

Importantly for the three-wheeler sector, demand has returned to the goods transporting sub-segment. While passenger carriers, at 60,889 units recorded 48% growth and 79% of the overall market, demand for goods carrier has grown by 13% to 11,659 units.

The shift to electric mobility is strongest in the three-wheeler segment which has recorded 70% YoY with 4,392 units versus 2,582 units a year ago (for SIAM member companies). This e-three-wheeler sub-segment, which sells passenger-transporting e-rickshaws and cargo-carrying three-wheelers, continues to witness strong double-digit growth thanks to sustained demand for passenger transportation and from last-mile operators for e-commerce applications, food deliveries and other applications.

Bajaj Auto, with 51,051 units and 39% YoY growth, has maintained its market share at 66%, similar to what it was in October 2022. Piaggio Vehicles, with 11,344 units, has clocked 37% YoY growth and has a 15% a year ago. Mahindra & Mahindra is ranked third with 9,402 units, recording sterling 85% YoY growth and expanding its market share to 12.21% from 9% a year ago.