India’s electric vehicle (EV) industry has clocked yet another milestone: cumulative sales have surpassed the 3-million units or 30 lakh mark at the end of October 2023. The past two years have witnessed accelerated growth for the sector – annual sales grew by 209% in CY2022 to charge past the 1-million-unit mark for the first time. CY2023 took off where CY2022 ended, and the million sales milestone was surpassed in September 2023.

EV sales in the first 10 months of 2023 have already gone beyond 1.23 million units and could reach 1.5 million for the entire year.

Cumulative 10-year retail data from the government’s Vahan portal reveals that India EV Inc has seen sales grow by 42,796% from a very low 2,389 units in CY20214 to 10,24,804 units in CY2022 (see data table above). And, a record 1.23 million EVs have already been sold in the first 10 months of CY2023 – with two months still to go for the year to come to a close, and in tandem with the existing rapid sales momentum, CY2023 should scale a new high of around 1.5 million EVs in the domestic market.

ELECTRIC 2- AND 3-WHEELERS OWN 95% OF INDIA EV MARKET

India EV Inc’s strong growth trajectory has its footprint across multiple states and Union territories in terms of EV ownership. With nearly all States and Union Territories wooing EV buyers with EV-ownership friendly policies and measures, finding out how they fare on the EV ownership / user chart is important. A deep dive into the EVreadyIndia dashboard, which consolidates sales data for all 34 Vahan states and Union Territories, and also Telangana, till end-September 2023, has some interesting takeaways.

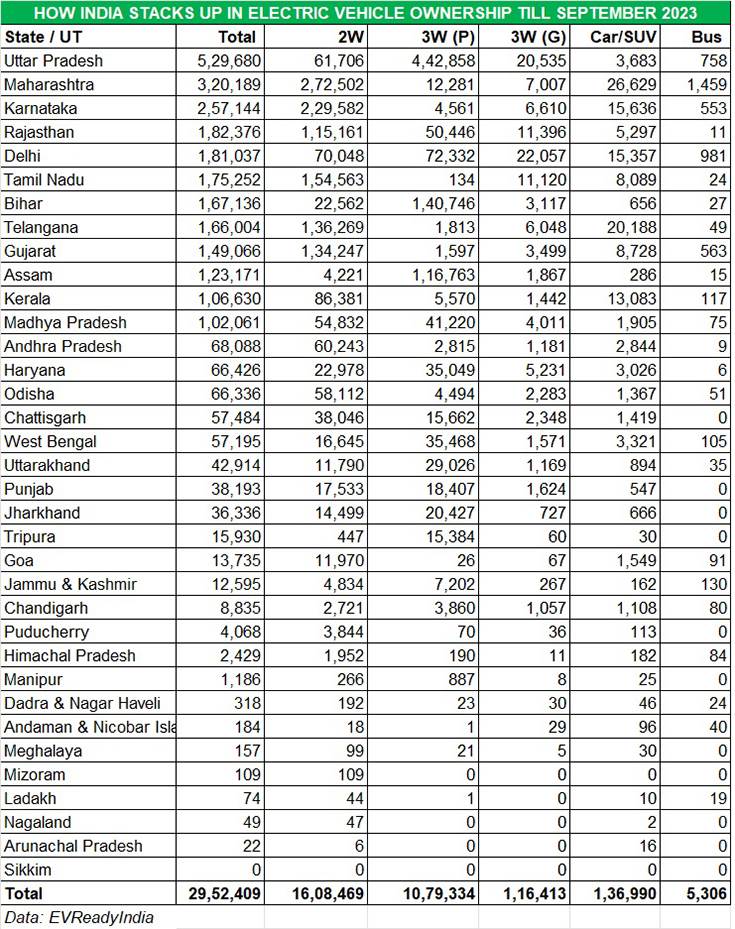

Given their level of affordability, the electric two- and three-wheeler sub-segments will always be the volume drivers. Of the total EV parc of 2.95 million units (29,50,563 units as of end-September 2023), 1.60 million or 54.48% comprise two-wheelers. Then there are 1.19 million three-wheeler owners, comprising both passenger-carrying and cargo carriers and accounting for 40.51% of the overall market. Club the two and what you get is 94.99% of the India EV market, leaving the balance to electric passenger vehicles (136,813 units / 4.63% share), electric buses (5,296 units / 0.17% share) and others (5,489 units, likely cargo vehicles).

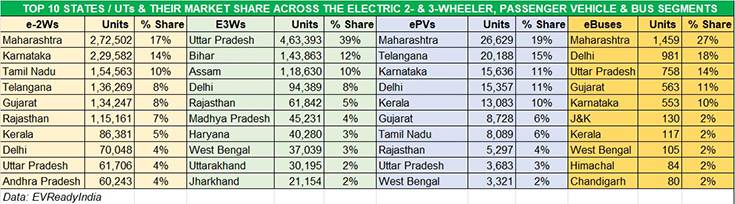

Uttar Pradesh has the the largest number of EVs – 529,680 units – mainly because it has the largest number of electric three-wheelers – 463,393 units. Maharashtra with 320,189 EVs, however, tops in e-two-wheelers, e-passenger vehicles as well as e-buses.

Uttar Pradesh has the the largest number of EVs – 529,680 units – mainly because it has the largest number of electric three-wheelers – 463,393 units. Maharashtra with 320,189 EVs, however, tops in e-two-wheelers, e-passenger vehicles as well as e-buses.

UTTAR PRADESH, MAHARASHTRA & KARNATAKA TOP 3 STATES IN EV OWNERSHIP

India EV Inc’s strong growth trajectory has its footprint across multiple states and Union territories in terms of EV ownership. With nearly all States and Union Territories wooing EV buyers with EV-ownership friendly policies and measures, finding out how they fare on the EV ownership / user chart is important.

As per the data, of the total 29,50,563 EVs sold in India till end-September 2023, 12 states including one UT, each with six-figure sales, cumulatively account for 24,59,746 EVs or 83 percent. Three states – Uttar Pradesh, Maharashtra and Karnataka – together account for 11,07,013 EVs or 37.51% of the India total.

Uttar Pradesh (UP) is the state with the largest number of EVs – 529,680 units and commands 18% of the total EV parc in India. This is thanks to UP being the state with the largest number of electric three-wheelers – 463,393 units and an overwhelming 43% of the 1.07 million three-wheeler sales in India.

In the other e-sub-segments, UP ranks down the line – in e-two-wheelers, the state is in ninth position with 61,706 units, and also ninth in e-passenger vehicles (3,683 units) and third in e-buses (758 units).

Maharashtra is ranked second overall on the all-India EV ownership scale with 320,189 units and an 11% share. However, it has the bragging rights because it is the leader in e-two-wheelers, electric cars and SUVs, and also e-buses. Of the 1.60 million e-two-wheelers sold in India, Maharashtra with 272,302 units has the largest share of 17%. Likewise, in e-PVs, the state leads with 26,629 units or 19.43% of 136,990 cars and SUVs sold till September 2023. And in e-buses, Maharashtra tops with 1,459 units and strong 27% market share.

Karnataka, with 257,144 units and 8.70% of India EV sales till end-September 2023, is the overall No. 3 as a result of its second rank in e-two-wheelers (229,582 units / 14% share), third rank in e-PVs (15,636 units / 11% share) and fifth rank in e-buses (553 units / 10% share). The state is low down the order in e-three-wheelers – 11,171 units.

Rajasthan, with 182,376 units, has pipped Delhi by 1,339 units to take fourth rank. The bulk of its sales comprise e-two-wheelers (115,161 units / 7% share). While the state’s e-three-wheeler parc is 61,842 units (5% share), its residents have also bought 5,297 e-PVs (4% share). As per the data, only 11 e-buses have been acquired in this state.

Delhi, with 181,037 units, is ranked fifth on the all-India chart. The largest EV parc is of 94,389 three-wheelers – 72,33 passenger and 22,057 cargo carriers – a segment where it is ranked fourth after UP, Bihar and Assam. The capital city is also home to 70,048 two-wheelers, 15,357 e-PVs and 981 buses plying its roads.

Tamil Nadu, which aims to become the EV hub of the country, has seen sales of 175,252 EVs which comprises 154,563 e-two-wheelers and a 10% all-India share, ranking third after Maharashtra and Karnataka. The state is seventh on the e-PV chart with 8,089 units and a 6% all-India share.

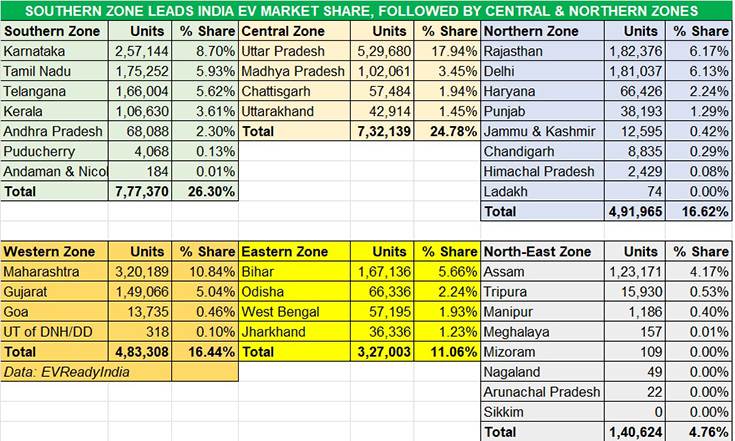

SOUTHERN ZONE JUST AHEAD OF CENTRAL ZONE

Southern India is increasingly where the EV action is what with Karnataka, Tamil Nadu, Telangana and Andhra Pradesh housing the manufacturing operations of the leading two-wheeler OEMs ranging from e-three-wheeler market leader Mahindra Last Mile Mobility’s plant in Bengaluru to Ather Energy’s state-of-the-art 420,000-units-per-annum facility at Hosur, Tamil Nadu or Hero MotoCorp’s Vida-producing factory at Chittoor in Andhra Pradesh.

Cumulatively, along with Kerala, the five states and two UTs account for 777,370 EVs or a leading 26.30% share of the Indian EV market.

Tamil Nadu has already made its intention clear to become the EV capital of the country and given the momentum and the sharpened focus of Southern India, expect this region to continue to provide the fireworks when it comes to increasing EV ownership.

The Central Zone, with combined sales of 732,139 EVs in Uttar Pradesh, Madhya Pradesh, Chattisgarh and Uttarakhand give it a 24.78% share of the all-India EV market, enabling it to close on the heels of the Southern Zone. This is thanks to it having the dominant presence of Uttar Pradesh (529,680 units). MP is the leader in three-wheelers with 442,858 units, which account for 83% of its total EV sales. Uttarakhand, with 30,195 units, is ranked ninth in three-wheeler sales. Expect this zone to continue to be dominated by the demand for electric three-wheelers for inter-city people transportation as well as growing ownership of last-mile mobility two- and three-wheelers.

Nudging cumulative sales of 500,000 EVs is the Northern Zone. At 491,965 units, this zone has a 16.62% share of India EV market, led by Rajasthan and followed by Delhi. Delhi, which was among the first in the country to come out with a comprehensive EV Policy in December 2019.

Nudging cumulative sales of 500,000 EVs is the Northern Zone. At 491,965 units, this zone has a 16.62% share of India EV market, led by Rajasthan and followed by Delhi. Delhi, which was among the first in the country to come out with a comprehensive EV Policy in December 2019.

The northern region, particularly Delhi, Rajasthan and Haryana, is home to the bulk of the nearly 450 three-wheeler manufacturers in the country as well houses the plants of a host of e-two-wheeler makers including Hero Electric and Okinawa Autotech. This region, as has been recorded for the past few years, continues to see poor levels of AQI (Air Quality Index), which could see a higher level of demand for zero-emission, eco-friendly EVs.

The Western Zone, comprising of two key markets in Maharashtra and Gujarat, along with Goa and the Union Territory of Dadra and Nagar Naveli, and Diu and Daman, have a total of 483,308 EVs. This gives the region a 16.44% share in the overall India market, fourth after the southern, central and northern zones.

Thanks to its leadership in two-wheelers, ePVs and e-buses, Maharashtra is the No. 2 state volume-wise for EV ownership in the country after UP. In the state-wise listing, Maharashtra with 320,189 units is followed by Gujarat (149,066 units), Goa (13,735 units) and the UT of Dadra & Nagar Haveli (318 units).

The Eastern Zone has over 300,000 EVs, most of them in Bihar (167,136 units), followed by Odisha (66,336 units), West Bengal (57,195 units) and Jharkhand (36,336 units).

Meanwhile, the North-Eastern Zone, which comprises all of eight states, has 140,624 EV users and accounts for a near-5% share of the India EV market. and leading them is Assam with 123,171 units, which is ranked 10th on the all-India list.

INDIA EV INDUSTRY FIRMLY PLUGGED INTO GROWTH MODE

What is helping accelerate EV ownership in India is a combination of factors. While demand for e-mobility was tepid in the initial years of the past decade, the government’s heightened focus towards the EV sector and the overall electric mobility eco-system in the form of the FAME Scheme and PLI (Production-Linked Incentive) Scheme for the automotive sector, along with EV OEMs across vehicle segments expanding their portfolio, and component suppliers either developing in-house or sourcing the latest e-powertrain and parts technologies have all contributed towards the sector’s growth.

Furthermore, growing consumer awareness of the need for eco-friendly mobility amidst the damaging effects of climate change which has also impacted India is helping the cause of EVs. Also, given the high prices of fossil fuels like petrol and diesel, and also CNG, the wallet-friendly nature of EV cost of ownership over the long run is a big catalyst for consumers planning to transition from IC engine motoring to EVs.

Another catalyst is the EV-friendly policies. Most of the states and UTs have notified EV policies which deliver plentiful benefits to EV uses and help accelerate the pace of EV adoption across the country.

Given the rapid pace of growth, the Indian EV industry can be expected to notch consistent progress. The EV-Ready India dashboard has forecast 45.5% CAGR in EVs between 2022 and 2030, rising to annual sales of 1.6 crore EVs in India by 2030. Some challenges remain like inadequate charging infrastructure and high initial EV prices, which is directly related to the battery cost. Nevertheless, with both the private and public sectors aggressively investing heavily in expanding the charging network across India, range anxiety for EV users should reduce over the coming years. In March 2023, the government sanctioned Rs 800 crores under the FAME India Scheme Phase II to PSU oil marketing companies to set up 7,432 public fast charging stations across the country comprising Indian Oil (3,438 stations), BPCL (2,344stations) and HPCL (1,660 stations).

There is also the sharpened focus from OEMs and component suppliers on localisation with a view to reduce costs and enhance affordability, and battery prices expected to reduce gradually, industry is optimistic about growth for this eco-friendly form of mobility, both in the near-term and long-term.

Clearly, India EV Inc is headed for another record year of sales and should achieve the 1.5 million mark if it makes the most of a festive November. This would translate into strong 46% YoY growth (CY2022: 10,24,804 EVs) on a high year-ago base. In CY2022, EVs accounted for 5% of total India Auto Inc’s sales of 2,07,52,305 units. Just how much will CY2023 raise the bar on the EV front? Guess, we’ll have to wait for early 2024 to find out.