[1/2]A Tesla electric vehicle is plugged to a charger in a parking lot in Teia, north of Barcelona, Spain, October 31, 2023. REUTERS/Albert Gea/File Photo Acquire Licensing Rights

BERLIN/LONDON, Nov 13 (Reuters) – After years of accelerating growth, Europe’s electric car sales appear to be entering a go-slow zone as drivers wait for better, cheaper models that are two to three years down the road.

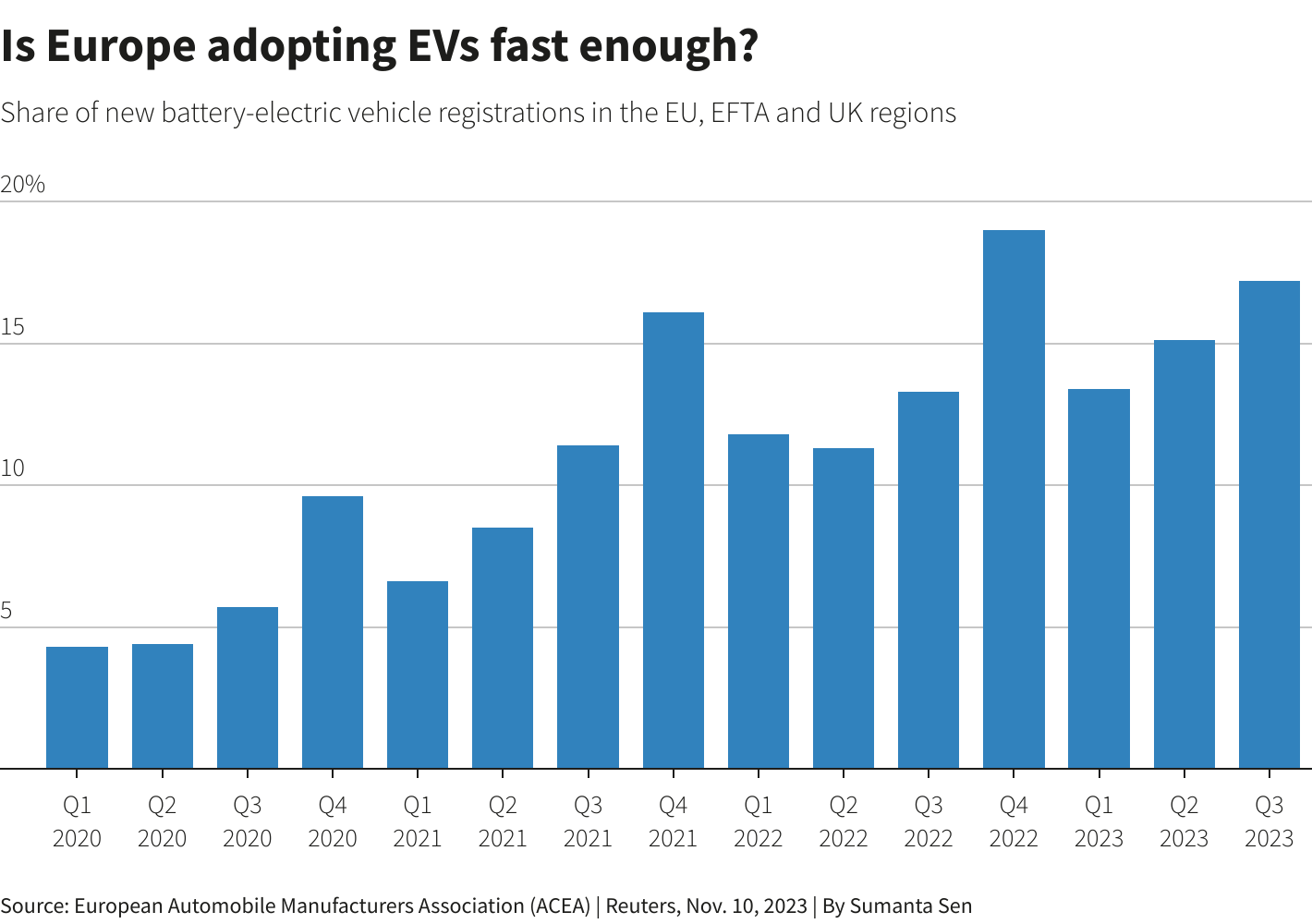

Fully-electric sales in Europe were up 47% in the first nine months of 2023, but instead of celebrating, automakers including Tesla (TSLA.O), Volkswagen (VOWG_p.DE) and Mercedes-Benz (MBGn.DE) sounded a sombre note.

High interest rates and a subdued market are putting customers off, they warned, with Volkswagen’s EV order intake half what it was last year.

Dealers in Germany and Italy as well as research by four global data analysis firms say there is more behind the slower uptake than economic uncertainty, with the consumers unconvinced that EVs meet their safety, range and price needs.

“The main problem is uncertainty,” said Thomas Niedermayer, head of a 45-year-old family-owned Bavarian car dealership.

“Many assume that the technology will improve and would rather wait three years for the next model than buy a vehicle now that will quickly lose value.”

Take Flavia Garcia and Tom Carvell in Edinburgh, Scotland.

Their 15-year-old hand-me-down Toyota Auris, nicknamed Martina, needs replacing. With a petrol and diesel car ban nearing, the couple would consider an EV, but are put off by a lack of charging infrastructure, battery life fears and price.

AutoTrader says new EVs in Britain are still on average 33% more expensive than fossil-fuel models.

And most new models in the pipeline targeting entry-level consumers will not hit the market before 2025 at the earliest – by which time they will be contending with an expanded Chinese line-up from BYD (002594.SZ) to Nio (9866.HK) in Europe.

“You want to do the right thing for the environment, but it feels like you’re setting yourself up for a very expensive investment that will make your life that bit more complicated,” Garcia, a 29-year-old corporate media director, said.

“We’ll probably get a hybrid first”.

FALLING BEHIND

Critics have long warned that a lack of affordable EVs would eventually stall the steep sales growth boosted by early adopters and corporate fleets.

A weaker performance in September, consumer sentiment surveys and bleak commentary from carmakers and dealers indicates that low growth era may have arrived.

U.S. automakers, though further behind on the transition to EVs, are also feeling the pinch. Ford and GM warned recently they were delaying the launch of cheaper EV models and pulling back on spending due to weaker demand and higher costs in the wake of new United Auto Worker contracts.

But the problem is cyclical.

Demand will remain slow for as long as there are no cheaper EVs available, Felipe Munoz of JATO Dynamics said of the slowdown in sales in Europe in September.

“From a regulatory standpoint, they don’t have to push product out right now – they can afford to focus on profitability,” said Alistair Bedwell, head of powertrain forecasting at GlobalData (DATA.L).

“But they need to have an eye on Tesla and the Chinese brands, because they don’t want to get too far behind.”

Intention to buy an EV has stayed constant in Germany over the past year, a poll by consumer research firm The Langston Co showed – meaning that although the number of EVs being sold is rising, the number of people wanting to buy an EV is not.

Growing sales may simply be a sign that carmakers who were struggling to produce EVs because of supply chain bottlenecks can finally meet backed up orders, rather than a sign of rising demand, said The Langston Co’s insights manager Ben DuCharme.

Philip Nothard, insight director at dealer services firm Cox Automotive, said low residual values also put buyers off as companies and many consumers choose new cars based on what they can sell them for a few years down the line.

“We call it the valley of death, which we will be going through in 2024 to 2027: low residual values, high supply, and low demand,” Nothard added.

Reporting by Victoria Waldersee, Nick Carey; Additional reporting by Giulio Piovaccari in Rome, Paul Lienert in Detroit; Graphics by Sumanta Sen; Editing by Alexander Smith

Our Standards: The Thomson Reuters Trust Principles.