Indonesia’s financial services regulator OJK has further tightened norms governing the peer-to-peer (P2P) lending industry by putting a cap on the interest rates on loans.

Furthermore, the regulator said the caps will apply based on the nature and use of the loans, which have been split as consumptive or productive loans.

The pricing tiers and caps were earlier proposed by the Indonesia P2P Lending Association (AFPI). The new rules come under SEOJK No.19/2023, which is the continuous regulation of POJK No.10/2022.

For consumptive loans, the pricing will gradually decline from 0.4% interest a day, as the association set earlier, to 0.3% a day in 2024, 0.2% a day in 2025, and eventually 0.1% a day in 2026.

For productive purposes, the pricing will be 0.1% interest charged per day in 2024 and 2025, and reduce to 0.067% a day in 2026.

OJK executive director of multifinance, venture capital, microfinance, and other financial institutions Agusman told reporters recently “The pricing [interest rates] is set to decline gradually as the industry is not mature yet and it can be also evaluated periodically.”

The new regulation is aimed at protecting customers as high interest rates leads to a low governance situation, which eventually harms the customers, Agusman noted.

The low pricing will also increase lending disbursement, especially in the productive loan category. Agusman mentioned that the productive loan has contributed around 30% of total lending and is expected to contribute 50% in 2025 and 60% in 2027.

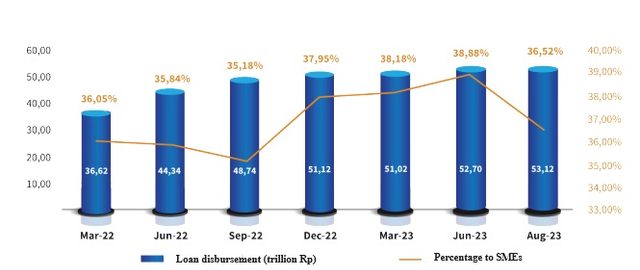

OJK noted that loan disbursement from the P2P lending sector reached 53.13 trillion rupiah in August 2023, up 12.46% from August 2022 at 47.23 trillion rupiah. The industry’s non-performing loan (NPL) level is almost flat at 2.88% for the said period, compared to 2.89% in August 2022.

Indonesia’s P2P lending loan disbursement

Source: OJK

At present, the majority of the loan disbursement from P2P lending is for consumptive purposes at 60.95%, while productive loans account for only 36.52%.

Source: OJK

Besides regulating the pricing rate, the new regulation also clarifies the assessment of lending quality and code of conduct in debt collection.

Indonesia’s peer-to-peer lending association executive director Kuseryansyah said that theoretically, the P2P lending industry will be impacted by this new regulation, but the companies can adjust themselves by looking for suitable business models with low pricing rates and finding other alternatives for income sources.

Before the latest regulation, OJK had previously set minimum capital requirements for P2P lending players at 25 billion rupiah for new operators and 2.5 billion rupiah for existing players. In addition, the maximum loan limit for a single customer was set at 2 billion rupiah or 25% of the lender’s total disbursements.

Increased regulation and consolidation in fintech lending have slowly led to a drop in the number of P2P lending players. At the end of 2019, the number of players was 164, while there are only 101 now.

Some lenders have been unable to meet the minimum capital requirement and have non-performing loans (NPLs) above the regulatory threshold. According to the OJK, NPLs of fintech lenders stood at 3.47% as of July 2023, up from 3.29% in the previous month even though it declined to 2.88% in September 2023. Nearly 26 companies are yet to meet the capital requirement of 2.5 billion rupiah and must do so before Oct 2023.