Mumbai: Infrastructure investors Actis and Edelweiss and Malaysian state oil company Petronas are in talks to acquire a portfolio of 185 megawatts (MW) of solar assets in India owned by Finnish utility Fortum and co-investors for an enterprise value of at least USD 150 million, two people aware of the development told ET.

ET first reported on April 25 that Kotak Mahindra Capital had been appointed to find buyers for the solar portfolio.

“The prospective buyers are currently conducting due diligence on the solar assets and final bids are expected soon. These are good quality assets and have generated strong investor interest,” said one of the persons cited above.

“The transaction is likely to value the portfolio at an enterprise valuation of over USD 150 million. This will be a complete sale and the two co-investors along with Fortum will exit the portfolio completely,” the person added.

The operational assets are jointly owned by Fortum, Macquarie Group-backed UK Climate Investments and Finnish asset management firm Elite Alfred Berg. Fortum is the largest shareholder with a 46% stake, UK Climate Investments owns 40% and Elite Alfred Berg has a 14% stake. UK Climate Investments and Elite Alfred Berg acquired their stakes from Fortum in 2018.

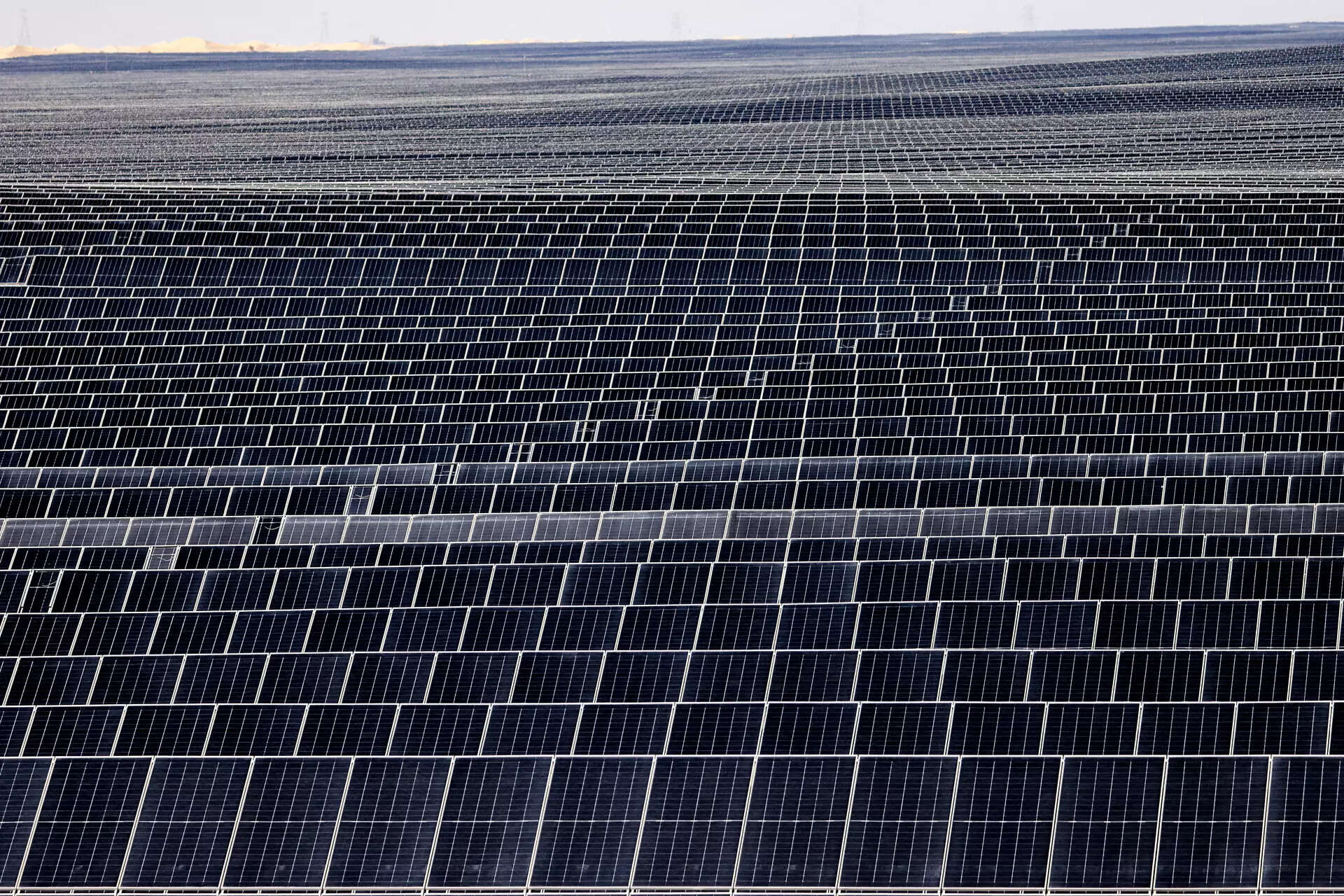

The portfolio comprises a 100 MW solar project at the Pavagada Solar Park in Karnataka, two projects of 70 MW and 5 MW each in Rajasthan and another 10 MW facility in Madhya Pradesh.

Fortum has 25-year power purchase agreements with both state-owned NTPC Ltd and Solar Energy Corporation of India Ltd (SECI) for the solar projects.

Fortum started its solar power business in India in 2013 with the acquisition of a 5 MW power plant. It set up the 10 MW greenfield facility in 2015. The other capacities of 70 MW and 100 MW were commissioned in 2017.

In June 2021, it sold its other assets – a 250 MW solar power plant in Karnataka and another 250 MW in Rajasthan, to Actis for 280 million euros.

Fortum is currently building two solar projects with a total capacity of 600 MW in Karnataka and a 200 MW solar project in Gujarat.

Fortum, Actis, Edelweiss and UK Climate declined to comment. An email query sent to Petronas did not elicit a response till press time.

Actis, Edelweiss and Petronas are among the most active investors in the Indian green energy space.

In an interaction with ET, Actis chairman Torbjorn Caesar said that the firm plans to invest up to USD 2.5 billion in the Indian energy and infrastructure space over the next four years, with renewables comprising the bulk of its investment plans. Actis has built and sold two large renewable companies in India – Ostro Energy and Sprng Energy.

ET reported on 17 October that Petronas and two other bidders had evinced interest in acquiring a majority stake in TPG-backed Fourth Partner Energy, a company which supplies green energy to commercial and industrial establishments. In 2019, Petronas acquired Amplus Energy for ₹2,700 crore, a rooftop solar power producer.

In 2021, Edelweiss acquired a 74% stake in an 813 MW renewable portfolio owned by French energy major Engie.