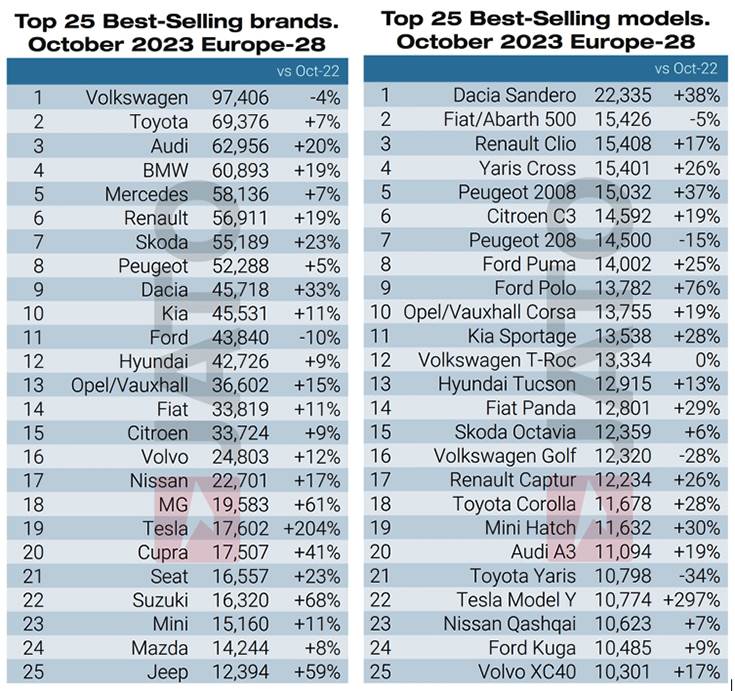

October 2023 saw a total of 1,040,278 passenger vehicles being sold in Europe, which constitutes a 14% increase on the 909,724 units registered in October 2022.

According to JATO Dynamics data for 28 European markets, the increase in volumes in October marked the 15th consecutive month of growth in the European new car market, with year-to-date registrations reaching 10,677,402 – a 17% year-on-year rise. Felipe Munoz, Global Analyst at JATO Dynamics, commented: “Overall, October’s new vehicle registration data suggests that the European car market is more resilient and better prepared for the prospect of an economic downturn in the coming months.”

BEVs continue to gain traction

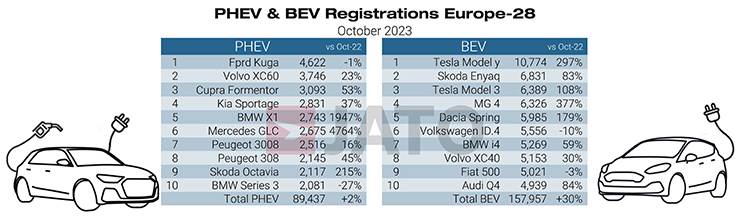

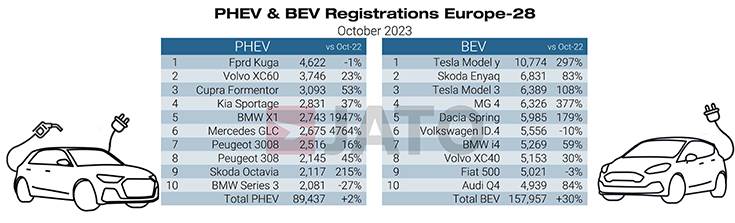

The growth recorded in October can largely be attributed to the rising demand for battery electric vehicles (BEVs), a trend that has been driven by the range of incentives available to European consumers. Sales of pure electric models across Europe rose by 30% to 157,957 units with BEVs accounting for 15% of total new registrations in October. Since January 2023, more than 1.6 million electric vehicles have been registered across Europe. Munoz added: “The increasing demand for electric cars is more a response to the range of deals on offer and the increase in supply, rather than competitiveness in price and the variety of models available.”

The uptick in BEV registrations in October was largely driven by three major players: Tesla, BMW Group and Chinese group SAIC Motor. Tesla registrations across all models tripled from October 2022 thanks to strong sales of the Model Y and the Model 3. However, due to a more limited line-up, the US manufacturer failed to keep pace with the bigger automotive groups, such as Volkswagen, BMW Group and Stellantis, in total registrations. In October, Volkswagen was the best-selling group in the BEV segment, followed by BMW Group, which recorded a 53% increase in BEV registrations with 18,297 units, thanks to strong results with the i4 and iX1.

China’s SAIC Motor, the owner of MG and Maxus, recorded a 66% increase in registrations with 8,841 units. The MG 4 recorded impressive growth, ranking as the most popular electric hatchback in October and the fourth best-selling BEV in Europe, with sales 1.6 times higher than its rival, the Volkswagen ID.3. Munoz highlighted: “The MG 4 is a prime example of how China’s OEMs are becoming more competitive – not only in terms of price, but also in terms of specifications.”

Although Norway continued to be the leading market for BEV penetration, the most significant growth is taking place elsewhere in Europe. Last month, Finland saw the largest increase in BEV market share, almost doubling from 20% of the total market in October 2022 to 36% in October 2023. Finland was followed by Luxembourg, where the market share of BEVs rose to 30%, and Denmark, where the figure increased from 22% to 36%. By contrast, BEV market share in Croatia dropped from an already low base of 3.1% in October 2022 to 1.8% last month, while BEVs also lost traction in Ireland and Germany.

Tesla Model Y reigns supreme in Europe

Although it did not top the table for monthly registrations in Europe in October, the Tesla Model Y remains the most popular new passenger vehicle in 2023 so far. Munoz said: “The Tesla Model Y is the gold standard for those looking to buy an electric vehicle. It is an SUV, it has competitive features, and its price continues to fall.”

Tesla Model Y is on course to become Europe’s best-selling new vehicle by the end of this year.

Tesla Model Y is on course to become Europe’s best-selling new vehicle by the end of this year.

With more than 209,000 units registered between January and October 2023, an increase from 85,823 units in the same period in 2022, the Model Y is on course to become Europe’s most registered new vehicle by the end of this year. This would be the first time a non-European model tops the annual ranking. Registrations of the Model Y since January totalled 209,503 units, accounting for 13% of all BEV registrations, and exceeding the 165,594 BEVs registered by Volkswagen brand, and the 206,100 units registered by Seat across all powertrains.

The Dacia Sandero led the way for monthly registrations in October, although it stands in second place for total registrations so far in 2023, behind the Model Y by more than 13,000 units. In total, 10,744 units of the Model Y were registered in October, and while it was only the 22nd most registered vehicle during the month, total volumes increased by 297 percent.

All data charts: JATO Dynamics