Norway is seeing a historic decline in new car sales, while zero-emission cars dominate the market

November 2023 marks a historic moment in Norway’s car industry, with a dramatic decline in sales of new passenger cars. Compared to November 2022, 10,348 new passenger cars were registered, which amounts to a decrease of 47 percent. This phenomenon is not isolated to just one month; so far this year, 114,770 new passenger cars have been registered, which is 20,051 fewer than in the same period in 2022, a decrease of 14.9 per cent.

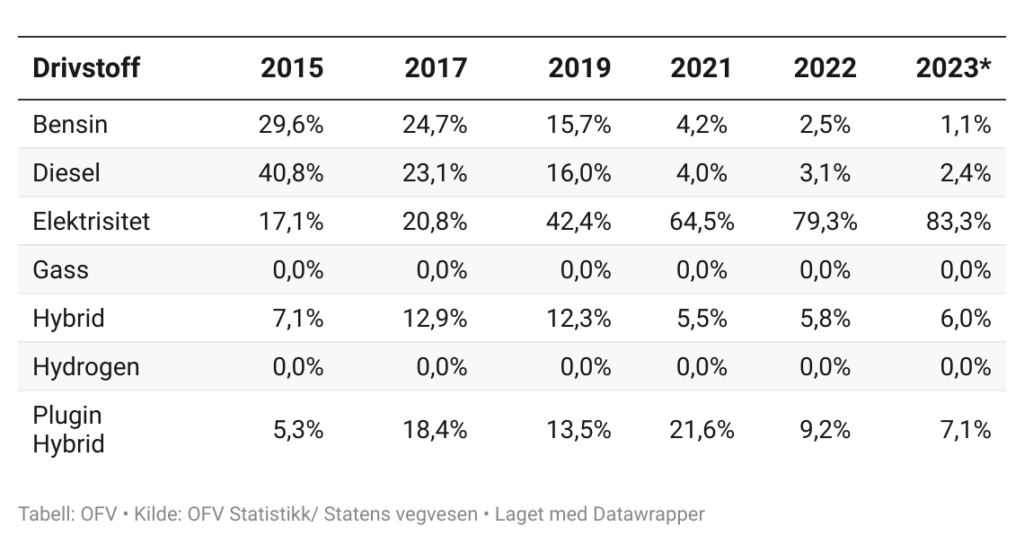

This significant drop in new car sales has not been seen since the liberalization of passenger car sales in 1960. Interestingly, even with this drop in total sales, zero-emission cars have made a marked inroad with a market share of an impressive 81.6 percent in November. This indicates a clear trend towards more environmentally friendly transport alternatives, with average CO2 emissions for all newly registered passenger cars in November at just 14.0 g/km.

This trend also reflects a significant change in consumer choice. For the first time since 1960, exceptionally few new petrol cars were registered during the year, and the same is observed for diesel cars. These figures suggest not only a change in consumer preferences, but also a growing awareness of the environmental impact of vehicles.

Øyvind Solberg Thorsen, director of the Road Traffic Information Council (OFV), believes that these figures indicate two important trends. Firstly, clean petrol and diesel cars are in the process of being phased out in Norway. Secondly, the decline in new car sales in 2023 reflects that people’s finances are under pressure, which can be partly attributed to the sharp increase in prices and high interest rates in the country.

Passenger car fleet in rapid change So far this year, only 1,310 new passenger cars with pure petrol engines have been registered. These are figures that have not been seen since 1960, when the sale of passenger cars was released after being regulated. In November, there were only 59 first-time registrations of new passenger cars with pure petrol engines. So far this year, new petrol cars make up only 1.1 per cent of all passenger car registrations. And over the past 23 years, there have been one million fewer petrol cars in the passenger car fleet in Norway.

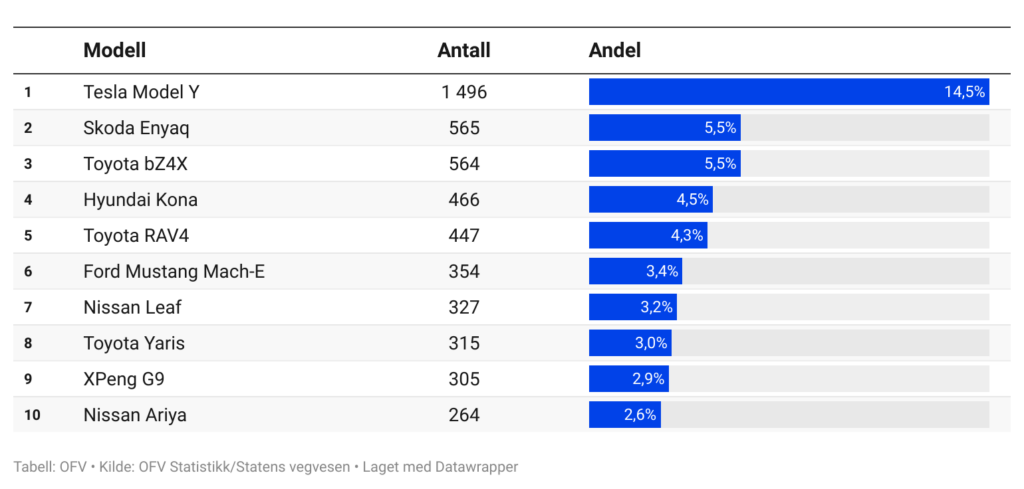

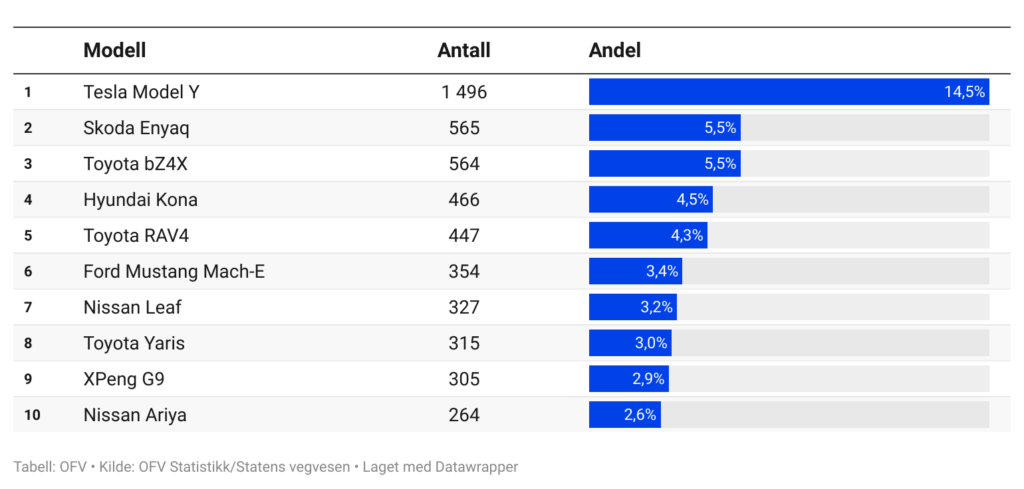

The 10 best-selling car models in November – number

Steady speed in the used market Although many people want a brand new car, there are many who cancel or postpone the purchase of a new car. Many people keep the car they have for longer, or choose a used car.

There is a steady pace in used car sales. So far this year, around half a million passenger cars have changed hands, and that is exactly on par with last year, says Solberg Thorsen. Electric cars are attractive in the second-hand market, and more and more electric cars in the vehicle fleet have resulted in an increase of approx. 10 percent in the number of changes of ownership of electric cars so far this year.

Different in Sweden and DenmarkWhile the number of first-time registered new passenger cars in Norway has fallen markedly this year, compared to the last two years, the brothers in Denmark and Sweden have the opposite situation: In Denmark, new car registrations have increased by 15 percent, and in Sweden the increase is almost three percent, even though “sweet brother” also experienced a decline in car sales in November.

These days, most Norwegians clearly notice the sharp price and interest rate increases. The effect of the interest rate increases is greater here than in Denmark and Sweden, because we have fixed interest rates to a lesser extent. It has a rapid effect on people’s finances and again on car sales, says Solberg Thorsen.

He also reminds that even though there is a sharp decline in new car registrations now – compared to the record-high years 2021 and 2022 – the current situation is more similar to “normal” years before this.

In December last year, we had the highest number of registrations ever, with almost 40,000 new cars. Much of it was the delivery of cars that had been ordered a long time in advance. In addition, there was a rush to the car shops because VAT was to be introduced on electric cars and new increases in car taxes from the turn of the year, he says. If we go back to 2019, this year’s November figures are completely in line.

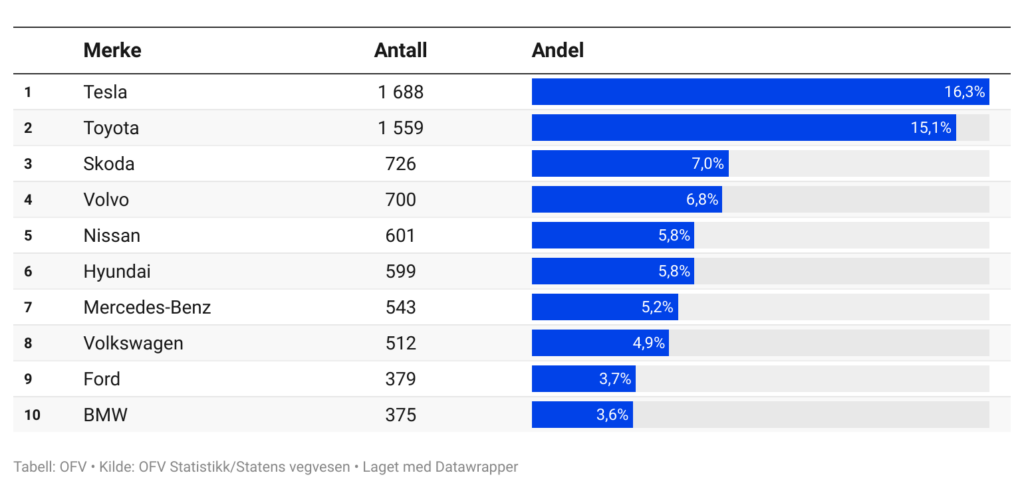

The 10 best-selling car brands in November – number

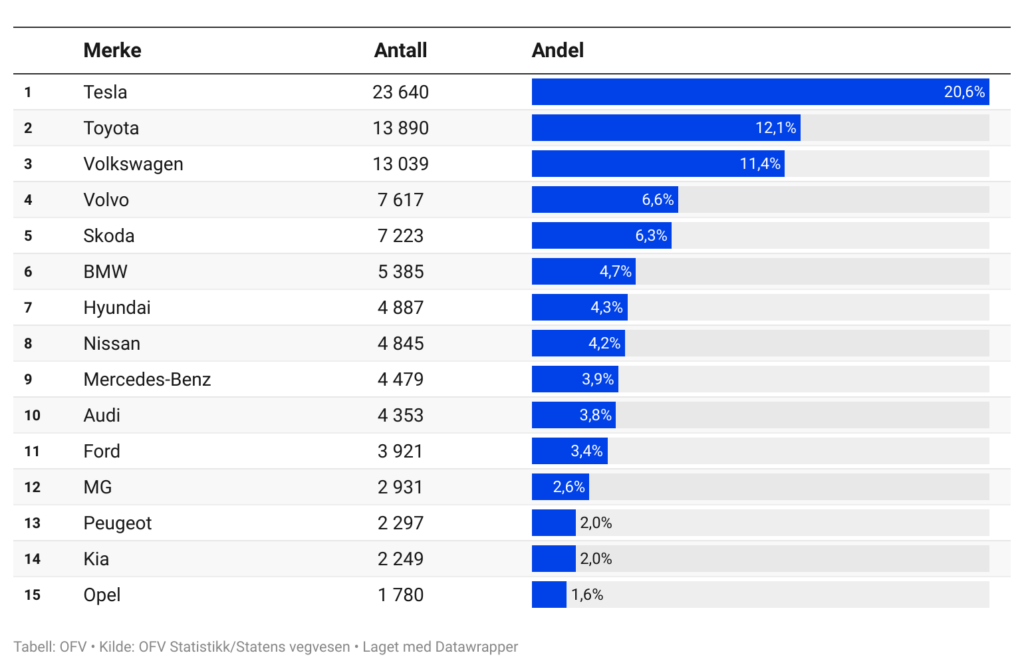

The 15 best-selling car brands in the period January-November

Manual transmission is disappearing The strong growth of electric cars, which only have automatic transmission, has also soon made manual transmission “history”. Of all just under 115,000 new registered passenger cars, approximately 400 have a manual transmission. This corresponds to 0.3 per cent, while the share with manual transmission in 2000 was a whopping 82.3 per cent. Out of a total selection of 61 different car brands offered in Norway, spread over almost 1,600 model variants, only 62 are offered with manual transmission.

The growth in electric cars explains much of the change. At the same time, almost all modern car brands and models have automatic transmissions, regardless of drivetrain. The transition to automatic transmission has followed the development of cars. Automatic transmission also has an important road safety aspect in that you have less to think about when the car shifts itself, says Solberg Thorsen.

Diesel-heavy van sales, but electric vans on the rise The number of new vans registered for the first time is still dominated by diesel vehicles. Of the 24,790 new vans so far this year, over 16,000 are diesel vehicles. This corresponds to a decrease in the number of 11.9 per cent compared to the same period last year. At the same time, the number of new electric vans has increased, and 7,906 new electric vans have been registered this year. With a share increase of just over nine percentage points, the electric van share amounts to 32 per cent.

The range of electric vans is increasingly meeting the needs of the user groups and the share is now almost a third of sales, but the registration rate is far too low to reach the 2025 target for light vans. Both more incentives and the reintroduction of Enova support must be put in place quickly if we are to come close to reaching the target, says Øyvind Solberg Thorsen.

First-time registered new passenger cars per fuel share*2023 figures as of 30 November. 2015-2022 is the proportion for the whole year