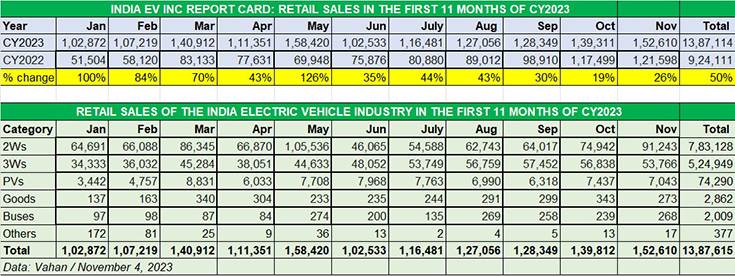

India’s electric vehicle (EV) growth story continues to make the big numbers and just got better with November coming to a close. Total all-India EV sales in November 2023 (as per Vahan on December 3, at 8am) were 152,610 units, up 26% year on year (November 2022: 121,598 units) and just 5,810 units fewer than the best-ever monthly sales of 158,420 in May 2023, which were driven by buyers rushing to buy EVs ahead of the FAME subsidy cut from June 1.

November 2023 becomes the 14th month in a row that India EV Inc has exceeded the 100,000-unit sales mark. Having first notched the milestone in October 2022 (117,200 units), the sales momentum continued in November 2022 (121,602 units) and December (105,003 units) last year and through each of the first 11 months of CY2023, hitting a high in May 2023.

Cumulative EV industry sales, comprising the two- and three-wheeler, passenger vehicle and commercial vehicle sub-segments, for the first 11 months of 2023 are a record 13,87,114 units, which constitutes strong 50% year-on-year growth (January-November 2022: 924,111 units).

The volume drivers for the EV industry are the two ‘low-hanging fruits’ – two- and three-wheelers, which are the more affordable segments compared to electric cars and SUVs, goods carriers or buses. While electric two-wheelers (7,83,128 units) account for 56 % of total EV sales in the January-November 2023 period, three-wheelers (524,949 units) have a 38% share of the India EV pie. An estimated 74,290 electric cars, SUVs, MPVs and also vans were also sold, which gives them a 5.35% share, with commercial vehicles comprising goods carriers and buses (4,871 units) getting a 0.35% share (see EV segment-wise retail sales split data above).

Let’s now take a deep dive into each of the four sub-segments of the EV industry: two- and three-wheelers, passenger vehicles and commercial vehicles comprising goods and passenger transports. The data, sourced from Vahan, factors the total cumulative sales of each company from January through to end-November 2023 and their resultant ranking.

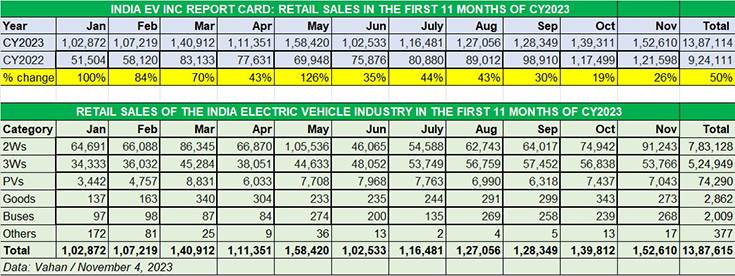

ELECTRIC 2-WHEELERS: OLA COMMANDS 30% SHARE, TVS SELLS OVER 150,000 iQUBES, ATHER AND BAJAJ IN PITCHED BATTLE

November 2023: 91,243 units, up 19% YoY, up 22% MoM (October 2023: 74,942 units)

Jan-Nov 2023: 783,128 units, up 38% YoY (Jan-Nov 2022: 566,801 units)

November 2023, with 91,243 units, was the best month for e-two-wheeler OEMs after the FAME subsidy was slashed by 25% in June. See the data table above for this sub-segment and it’s amply clear that demand is going through the roof. Compared to the monthly average of 77,906 units in the pre-slashed FAME subsidy first five months of CY2023, the June-November 2023 period sees average monthly retails of 65,599 units, reflecting the growing maturity of EV buyers.

Cumulative January-November 2023 sales at 783,128 units are up 38% YoY and already a 24% improvement over entire CY2022’s sales of 631,461 units, with December still to add to the CY2023 tally. Expect the industry to surpass the 850,000 units mark for this year and set a new benchmark.

While this EV category has nearly 175 players, the bulk of the sales are cornered by the Top 10 OEMs (see sales table below), each with over 10,000 units. Of the Top 25 OEMs, these Top 10 account for 698,623 units in January-November 2023 or 90% of total sales. Only two players – Ola Electric (236,485 units) and TVS Motor Co (153,964 units) – have sales in excess of 100,000 units. Ather Energy (97,900 units) is just 2,100 units shy of the 100,000 mark and will surpass that in the first week of December.

Market leader Ola Electric has benefited hugely from its refreshed S1 series of e-scooters and continues to scale new monthly highs. The company has sold a record 236,485 units in the first 11 months of 2023, averaging 21,498 units a month. November retails at 29,808 units were its best monthly sales yet – interestingly, Ola is the only OEM to have surpassed its May 2023 (28,728 units) total, a month in which most EV players hit monthly highs due to buyers rush to avoid paying more from June to the slashed-by-25% FAME subsidy. Ola currently has a commanding 30% share of the market.

TVS Motor Co, with 153,964 units, has a 19.66% share of the EV pie and that too with a single product – the iQube. In November, TVS sold 18,935 iQubes, its second-best monthly sales.

In third place, in terms of cumulative sales, is Bengaluru-based smart e-scooter maker Ather Energy with 97,900 units, which gives it a 12.50% share. However, with an aggressive Bajaj Auto hard on its heels, Ather is getting ready to protect its turf with the launch of the new Apex 450 which is set to be the quickest and most powerful Ather yet.

Bajaj Auto, another legacy player with a single product, the Chetak, is making news with its rising sales. The company outsold Ather in October (Bajaj: 9,052 units / Ather: 8,415 units) as well as in November (Bajaj: 11,681 units / Ather: 9,171 units). Cumulative January-November sales of 61,311 units give Bajaj a market share of 7.82% albeit for November per se its share rose to 13%, quite a jump from the 4% it had in January 2023. The company, which has launched the new Chetan Urbane with 113km range on December 1, is looking to ramp up production as well as expand its network of exclusive Chetak showrooms. Expect Bajaj Auto to be among the EV newsmakers in the months to come.

At No. 5 position is the Greaves Cotton-promoted Ampere Vehicles with 45,528 units. The company seems to be seeing good traction for its Ampere Primus e-scooter launched in February. Powered by a mid-mounted motor that develops peak output of 4kW, Ampere claims the Primus can do 0-40kph in 4.2 seconds and has a top speed of 77kph. The Ampere Primus is equipped with three riding modes – Power, City and Eco – as well as a Reverse mode. Ampere Vehicles’ sales, when combined with Greaves Cotton company Greaves Electric’s 21,049 units, gives the combined entity total sales of 63,577 units (which also helps it go above Bajaj Auto).

Next up is Okinawa Autotech with 30,644 units. Considering the company had opened CY2023 with 4,408 units in January, it is clearly feeling the heat of slowed-down sales. It’s a similar story with Hero Electric. With 29,396 units, Hero Electric is ranked seventh and has a 3.75% share of the market. A look at the data table reveals that after a strong start to the year, sales have fallen to three figures since July.

While ninth-ranked Okaya EV has done well to sell 15,111 e-scooters in the first eight months of this year, Bgauss Auto clocked sales of 10,235 units. Hero MotoCorp, the third legacy player, notched its best-ever monthly sales of 3,031 units in November and clocked cumulative sales of 9,523 units.

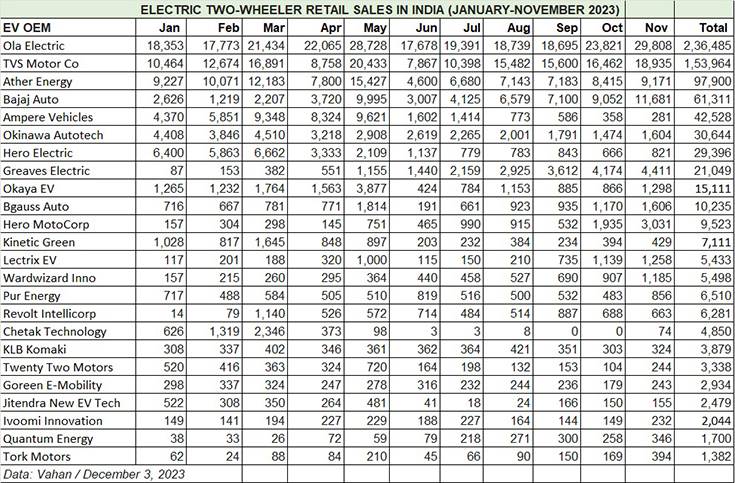

ELECTRIC 3-WHEELERS: MAHINDRA LAST MILE MOBILITY LEADS WITH 9% SHARE, YC ELECTRIC, SAERA AUTO, PIAGGIO PACK A PUNCH, BAJAJ CHECKS IN

November 2023: 53,766 units, up 33% YoY, down 5.40% MoM (October 2023: 56,838 units)

Jan-Nov 2023: 524,949 units, up 67% YoY (Jan-Nov 2022: 314,677 units)

While the electric scooter and motorcycle segment leads in terms of sheer volumes, the rate of transition to zero-emission mobility is fastest in the three-wheeler market, where now every second product sold is an electric model. November 2023 numbers as well as cumulative January-November 2023 retail sales are ample proof of that.

This e-three-wheeler sub-segment, which sells passenger-transporting e-rickshaws and cargo-carrying three-wheelers, continues to witness strong double-digit growth thanks to sustained demand for passenger transportation and from last-mile operators for e-commerce applications, food deliveries and other applications.

In November, 53,766 units were sold, up 33% YoY but down 5.40% on October 2023’s 56,838 units. Cumulative 11-month sales at 524,949 units are up by 67% over the year-ago 314,677 units. The transition to e-mobility is happening fastest in this segment. From January 2023, when the penetration level was 48%, the EV share of the entire two-wheeler market in November 2023 was 54%, which speaks for the rapid shift underway.

Of the nearly 475 players in the market, we have shortlisted the Top 40 OEMs in terms of sales in November. Mahindra Last Mile Mobility (MLMM), the market leader in FY2023 with over 35,000 units and a 9% share, maintains its leader position status with 49,524 January-November retails and a market share of 9.43 percent The company, which expanded manufacturing capacity in April with a new line for its Treo e-three-wheelers at the Haridwar plant, currently has six EVs on sale – the Treo Plus, Treo Yaari and e-Alfa Super for passenger transport and the Zor Grand, Treo Zor and the e-Alfa cargo for goods transport.

YC Electric Vehicles, the firm No. 2 player, has sold 36,836 from the start of this year and has a 7% share of the market with its five products – the Yatri Super, Yatri Deluxe and Yatri for passenger duties and the E-Loader and Yatri Cart for cargo operations. Low initial cost, from Rs 125,000 to 170,000 for passenger EVs, and Rs 130,000 to Rs 165,000, is what is driving demand for this OEM.

Saera Electric Auto, the No. 3 OEM, saw 26,675 of its e-three-wheelers being bought and currently has a 5% share.

Piaggio Vehicles, which is also recording strong market gains, clocked its best monthly retails in the year to date in November: 2,217 units. The company’s January-November 2023 sales of 18,721 units give it a 3.56% market share. The Italian major is benefiting from its new models and aggressive network expansion. These include the Apé E-City FX Max passenger model (with 145km range) and Apé E-Xtra FX Max cargo carrier (115km range), both fully assembled by an all-women team at its Baramati factory in Maharashtra.

There are four other companies which have cumulative clocked over 10,000 sales each: Mini Metro (14,429), Champion Polyplast (13,575), Unique International (12,354), Hotage Corporation (11,508) and JS Auto (10,080).

The Top 10 OEMs, each with five-figure sales, cumulatively sold 216,480 units in January-November 2023, effectively having a 41% share of the total e-three-wheeler market, leaving the remaining 59% of the market to the other 465 manufacturers to battle it out. The data table below reveals that the battle down the line is intense, with many OEMs separated by just a few units.

Interestingly, Bajaj Auto, which has entered this market six months ago, has sold a total of 3,314 units till end-November, its sales growing smartly month on month from 124 units in June through to 1,232 last month. The company is currently ranked 33rd in the 475-player market but given its ambition and potential, expect it to climb up the ranking table rather speedily in the coming year.

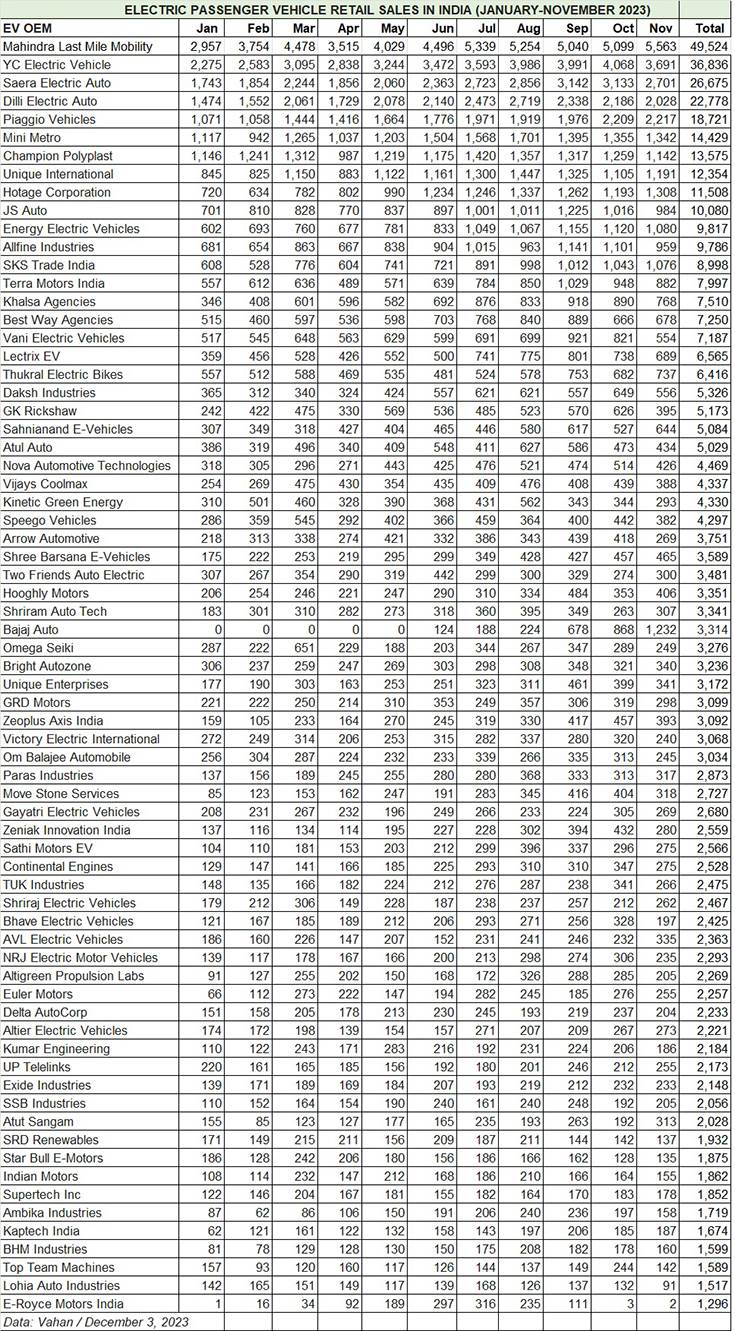

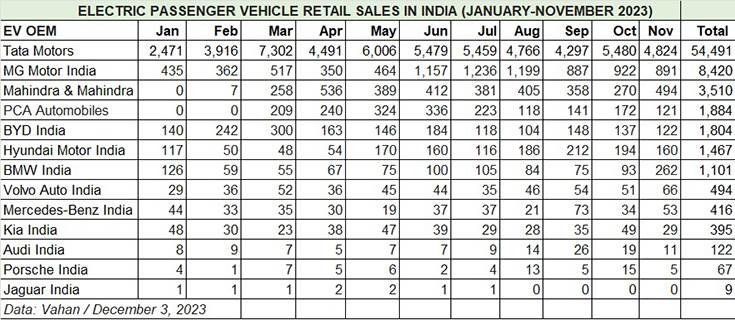

ELECTRIC CARS & SUVs: TATA MOTORS’ E-PV MARKET SHARE AT 76%, MG INDIA ACCOUNTS FOR 10% SHARE, CITROEN INDIA DRIVES AHEAD OF BYD INDIA

November 2023: 7,043 units, up 98% YoY, down 5.29% MoM (October 2023: 7,437 units)

Jan-Nov 2023: 74,290 units, up 145% YoY (Jan-Nov 2022: 30,336 units)

An indication of the growing shift to e-mobility on four wheels is seen on our roads in the form of green-plated SUVs, sedans and, more recently, hatchbacks as an increasing number of passenger vehicle buyers are preferring to put their money on a wallet-friendly EV, despite the higher initial price compared to their petrol or diesel brethren.

This movement is reflected in the retail sales. As per Vahan, a total of 74,290 electric PVs were sold in the first 11 months of CY2023, up 145% YoY (January-November 2022: 30,336 units). That’s 36,075 units more than all ePVs sold in entire CY2022 – 38,215 units.

The data table above is indicative of the sustained demand this year. While FY2023-ending March 2023 (8,831 units) was the best month, May (7,708), June (7,968), July (7,763), October (7,437) and November (7,043) have each seen sales above 7,000 units. With December adding to the tally, annual sales in CY2023 could be near the 85,000-unit mark for the full year.

Electric PV market leader Tata Motors, which has the largest portfolio comprising the Nexon EV, Tigor EV, Tiago EV and the Xpres-T (for fleet buyers), has sold an estimated 54,491 units, which gives it a 73% market share. Tata’s market share used to be in excess of 80% but has now reduced due to the expanding and dynamic EV market which now has wider product choice from a growing number of rivals.

MG Motor India, with 8,420 units comprising the ZS EV and Comet EV, is the firm second-ranked ePV OEM. MG’s performance in the first 11 months of 2023 gives it a notable market share of 11 percent.

Mahindra & Mahindra, with 3,510 units, is in third position. The company, which has two products in the all-electric XUV400 – the first real rival to the high-selling Tata Nexon EV – and also retails the eVerito sedan, currently has a 4.72% EV market share.

Interestingly, PCA Automobiles India (Citroen India), which recently entered the EV market, has driven ahead of BYD India. Total sales of the Citroen eC3, the electric version of the C3 hatchback, are 1,884 units in nine months since launch in end-February at Rs 11.50 lakh. This gives PCA India an EV market share of 2.53%, slightly ahead with BYD India’s 2.42% – very creditable for a recent entrant and a pointer that e-hatchbacks will see demand going forward. BYD India, which sells the Atto 3 SUV and e6 MPV, is now in fifth position with total sales of 1,804 units and a market share of 2.42 percent.

Korean carmakers Hyundai Motor India and Kia India have together sold 1,862 units. While Hyundai, which retails the Kona and the Ioniq 5, posted sales of 1,467 units, the Kia EV6 went home to 395 buyers.

As per the Vahan data, luxury carmakers in India accounted for 2,209 units or 3% of total ePV sales in January-November 2023. Of this lot, BMW India has a strong lead with 1,101 units, followed by Volvo Auto India (494), Mercedes-Benz (416), Audi (122), Porsche (67) and Jaguar (9).

ELECTRIC CVs: TATA MOTORS CONTINUES DOMINANCE, MAHINDRA IN SECOND PLACE, PMI ELECTRO MOBILITY RANKED THIRD

November 2023: 541 units, up 166% YoY, down 7% MoM (October 2023: 582 units)

Jan-Nov 2023: 4,871 units, 105% YoY (Jan-November 2022: 2,378 units)

The commercial vehicle industry, where electric mobility makes eminent and wallet-friendly TCO sense given the much larger number of kilometres driven, compared to personal EVs, has registered cumulative sales of 4,871 units, up 105% YoY. The CV sector essentially comprises goods carriers and passenger-transporting buses. As per Vahan, electric goods carriers accounted for 2,862 units and electric buses for 2,009 units, corresponding into 59% and 41% respectively of the total e-CV pie (see sub-segment splits below).

In the combined sales tally of goods carriers and buses, Tata Motors leads with 2,434 units, which makes for a strong 50% market share. Mahindra Last Mile Mobility, with 304 units, is in second place and a 6.24% market share. It is followed by PMI Electro Mobility with 281 units and an 5.76% share. Olectra Greentech (270 units) and BYD India (263 units) are close behind. Mytrah Mobility (165 units), Switch Mobility (154 units), JBM Auto (119 units) and Piaggio Vehicles (106 units) are the four other OEMs whose e-CV sales run into three figures in the first 11 months of CY2023. What will give a major boost to sales of electric buses in the coming months and year will be the government’s recent move to allocate a big-ticket spend of Rs 57,613 crore for 10,000 electric buses.

INDIA EV INC NEEDS TO SELL 112,886 UNITS IN DECEMBER TO CHARGE PAST 1.5 MILLION SALES IN CY2023

Given the sustained and rapid pace of growth, India’s EV industry can be expected to notch consistent progress. While some challenges remain in the form of inadequate charging infrastructure (which is being addressed) and high initial EV prices (which are directly related to battery cost), India EV continues to see robust double-digit growth.

Furthermore, with OEMs’ sharpened focus on localisation with a view to reduce costs and enhance affordability, and battery prices expected to reduce gradually, demand in this eco-friendly vehicle segment can only get better.

At the current high double-digit rate of growth, India EV Inc could be headed towards the 1.5 million units mark in the current calendar year. Compared to the 10,24,801 EVs sold in CY2022, sales in the first 11 months of the year have surpassed that record number with cumulative retail sales of 13,87,615 units. That translates into handsome 35% YoY growth.

As per Vahan data, India Auto Inc, across all vehicle segments and multiple fuels like petrol, diesel, CNG, LPG and electric, a total of 2,19,16,410 or 21.9 million vehicles have been sold between January and November 2023. Of this, EVs with 13,87,114 units or 1.38 million units accounts for a 6.32% share of the entire automobile sales.

The EV industry needs to sell another 112,886 units in December to get past the 1.5 million-units mark, which it should achieve. Stay plugged in as we bring you up-to-date on the India EV sales growth story.

ALSO READ:

Electric two-wheeler sales surpass 91,000 units in November, record 11-month retails at 780,000 EVs