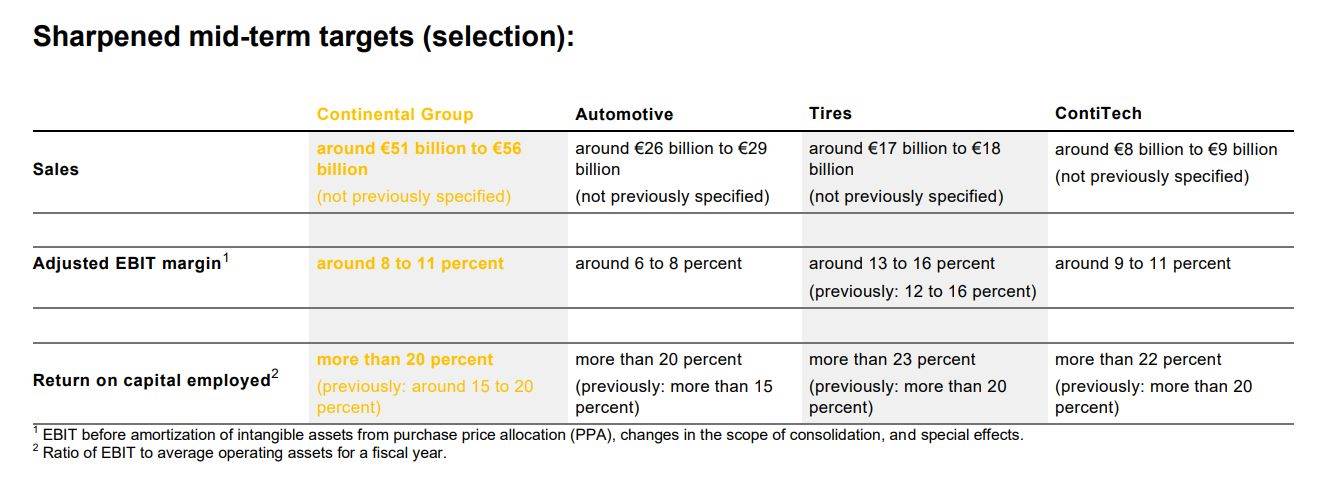

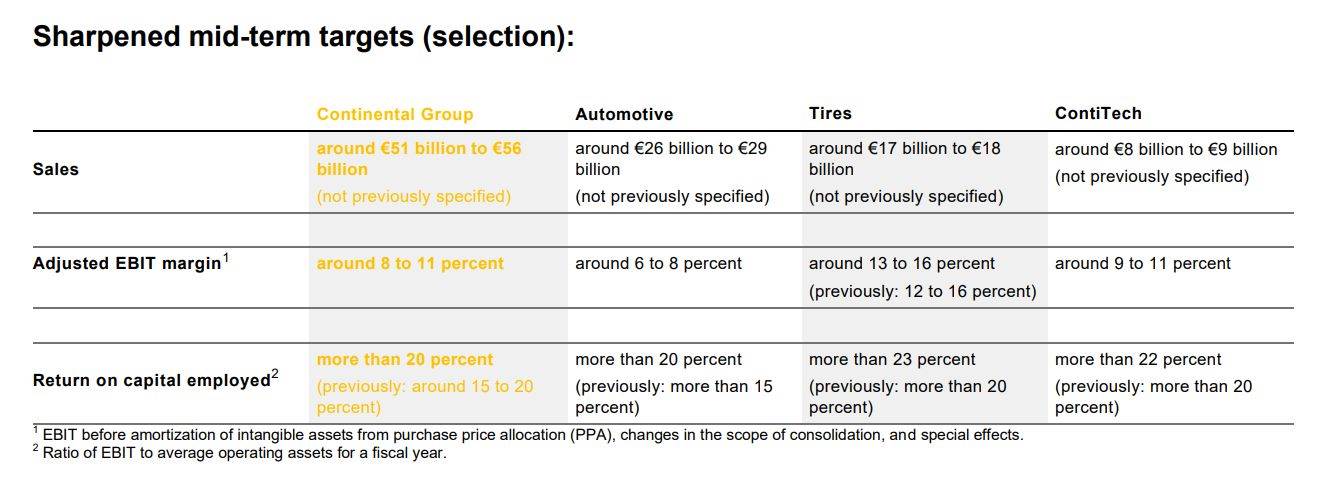

German Tier-1 automotive giant Continental has announced its mid-term strategy with a focus on value creation, and the company has targeted to achieve sales in the range of Euro 51 to 56 billion over the three- to- five-year horizon. In the short-term future, the company eyes sales in the range of Euro 44-48 billion in the two- to three-year timeframe.

While its revenue outlook for 2023 stands between Euro 41 and 43 billion, the company says it will adopt a package of cost-reduction measures to achieve a consolidated adjusted EBIT margin of around 8-11 percent in the next two- to three years, and then improve within this range. It will also carve out parts of the business and carry out further portfolio reviews.

In the Automotive group sector, Continental has outlined plans to step up its focus on value-creating business areas with high growth. In doing so, the group sector will prepare for the User Experience business area to become organisationally independent. As per the company, this step will open new strategic options for the displays and human-machine interface or HMI controls business. The technology company is also reviewing measures for further business activities within Automotive that are expected to contribute around Euro 1.4 billion to consolidated sales in this fiscal.

In the Tires group sector, Continental will continue to rely on stable earnings and operational excellence. Sustainability, electric mobility, and digital tire services will also create various opportunities for further profitable growth. In its ContiTech group sector, Continental will focus on reliable profitability owing to material solutions made from rubber and plastics. At the same time, the company will strengthen its strategic focus on the Group sector’s industrial business with the aim of increasing its share of ContiTech’s sales from currently around 55 percent to 80 percent.

According to Nikolai Setzer, CEO, Continental, “Our strategy aims to increase our value creation. This will allow us to continue to develop into the mobility and material technology group for safe, smart, and sustainable solutions. There are good reasons to invest in Continental.

“We have a clear strategy to achieve our mid-term targets. We will invest specifically in those areas with value creation upside and expand our technology position wherever this gives us an edge over the competition. Our three group sectors make up a balanced and resilient portfolio, which we and our highly effective and efficient team will manage flexibly, proactively and with foresight,” he added.

“After a long period of success, we have more recently had to face many challenges, and our results have not always met our expectations. At the same time, however, this extremely challenging time has also made us more robust. We are therefore entering this next phase of increased value creation in a strong position,” Setzer said.

Speaking at the company’s Capital Market Day, Katja Garcia Vila, CFO, Continental, said, “Achieving our mid-term targets is a priority. To do so, we have a clear plan that we will implement rigorously. With our planned measures, we will reach the corridor for our expected mid-term adjusted EBIT margin in the next two to three years and then continue to improve within this range.” Garcia Vila added: “Our vision is to create value for a better tomorrow. The foundation for this is a strong balance sheet and strong free cash flow. We are keeping both firmly in sight. And all of our stakeholders will benefit. We are underlining the importance of our shareholders with our updated dividend policy.”