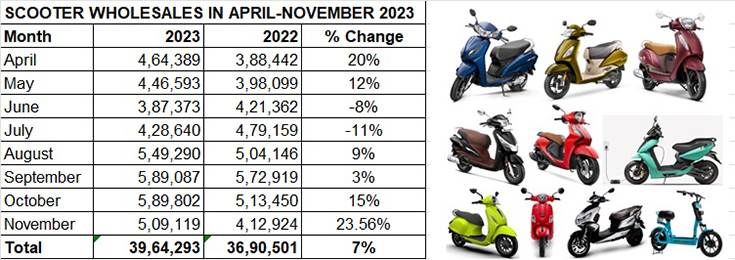

The action is back in India’s scooter market. As per SIAM’s wholesales numbers, November 2023 with 509,119 units is the fourth consecutive month that scooter sales have surpassed the half-a-million mark (see data table below). And cumulative sales for the April-November 2023 period at 39,64,293 units are up 7% year on year (April-November 2022: 36,90,501 units).

Last month, scooter sales accounted for a 31.36% share of the overall two-wheeler market (16,123,399 units) and logged solid 23% YoY growth. Motorcycles (10,70,798 units), where demand for commuter bikes is returning from rural India, had a 66% share while mopeds (43,482 units) had a 2.67% share.

In November 2023, of the 10 SIAM member OEMs which make scooters, only two saw YoY declines. The other eight saw strong double-digit growth. While Honda with 220,034 units recorded 14% growth and a 43% market share, TVS Motor with 127,879 units and 59% YoY growth had a scooter market share of 25%. Suzuki Motorcycle India (70,921 units / up 14% / 14% share), Hero MotoCorp (46,216 units / up 24% / 9% share), India Yamaha Motor (23,569 units / up 14%, 4.6% share) and Bajaj Auto (8,472 units / up 153% / 1.66% share) were the other strong performers.

Scooter wholesales have crossed the 500,000-unit mark for the fourth consecutive month.

Scooter wholesales have crossed the 500,000-unit mark for the fourth consecutive month.

In November 2023, of the 10 SIAM member OEMs which make scooters, only two saw YoY declines. The other eight saw strong double-digit growth.

TOP 3 OEMS ACCOUNT FOR 84% OF TOTAL SALES

A look at the cumulative wholesales reveals that the 39,64,293 units in the first 8 months of FY2024 are already 76% of FY2023’s 51,90,018 units and 96% of FY2021’s 41,12,672 units, ample proof that growth has returned to this segment.

The top five OEMs among the SIAM 10 scooter members account for 37,89,463 units or an overwhelming 96% of total scooter sales in April-November 2023. Of them, the top three players – Honda Motorcycle & Scooter India, TVS Motor Co and Suzuki – cumulatively have 33,23,773 units or 84% of the industry numbers. In terms of volume increase amongst these 10 OEMs, five OEMs –TVS, Suzuki, Yamaha, Ather and Bajaj Auto – stand out.

Honda Motorcycle & Scooter India (HMSI), which sells the best-selling brand of Activa scooters, has 1.75 million units to its credit, 20,232 units fewer than a year ago and down 1% YoY. This sees HMSI’s scooter market share reduce to 44.28% from the 48.11% it had a year ago.

TVS Motor Co with 987,840 units posted 14% growth, which helps increase its market share to 25% from 23% a year ago. While the Jupiter continues to be its best-seller, followed by the NTorq 125, the iQube electric scooter has contributed 132,894 units to its overall scooter sales, which works out to be a 13.45% EV share.

Suzuki Motorcycle India is the third OEM to have sold over half-a-million scooters – 580,457 units – up 20% YoY and an increase of 98,072 units. This sees Suzuki’s market share rise to 14.64% from 13% a year ago.

Hero MotoCorp with 271,150 units, up 10% and a market share of 6.82% takes fourth position among the 10 OEMs. India Yamaha Motor with 190,540 units, saw demand up 41% YoY, a strong performance that enables its scooter share rise to nearly 5%, up from 3.74% a year ago.

Two electric vehicle OEMs – Ather Energy and Bajaj Auto – have both witnessed strong sales in April-November 2023. While Ather has sold 68,220 e-scooters in the form of the 450S and 450X for a market share of 1.72%, a hard-charging Bajaj Auto has dispatched 62,991 Chetaks, 39,831 units more than in April-November 2022 for a market share of 1.58%, up on the 0.62% a year ago.

The electric two-wheeler market leader though is Ola Electric, which is not a SIAM member company and thus not present in the data table. At 29,764 units, its November sales were up 25% on October’s 23,821 units. Ola’s market share has grown to 32% in November. What’s more, it has clocked cumulative sales of 236,441 units in the first 11 months of 2023 and will easily cross the 250,000-unit mark for the year, making it the first OEM in India to do so.

WILL SCOOTER SALES GO PAST THE 5.75 MILLION MARK IN FY2024?

Average monthly scooter sales for the April-November 2023 period are 495,536 units. With four months still to go for FY2024 to end, at given that sales maintain the same pace, the scooter industry could add another 1.98 million units to the entire fiscal total. That would take the FY2024 total to around 5.94 million units, which would be better than FY2023 and also ahead of pre-Covid FY2020.

In FY2023, 5.19 million scooters were sold, up 26% on FY2022’s 41,12,672 units. However, this was well below the pre-Covid FY2020 total of 5.5 million units (55,66,036 units) and way below the record 6.71 million units (67,19,811 units) of FY2018 and 6.70 million units of FY2019.

While there is no doubt that the domestic market scenario is much improved since a year ago, the scooter market in tandem with motorcycles is yet to see fulsome demand come its way. The cost of two-wheeler ownership has increased over the past year and the demand in the critical entry-level segment continues to be impacted. However, the green shoots of recovery in rural India are welcome news for India Auto Inc.

EV sales in India jump 50% to 1.38 million units in January-November 2023