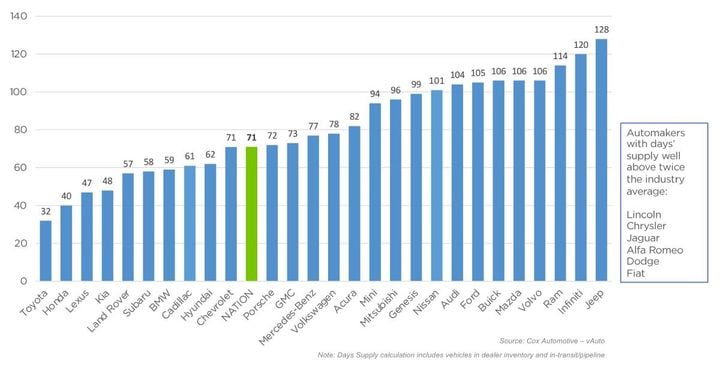

As usual, Toyota, Honda, Kia and Subaru had the lowest supply among non-luxury brands at the start of December. Of luxury brands, Lexus, Land Rover, BMW, and Cadillac had the lowest.

Graphic: Cox Automotive

December opened with new-vehicle inventory at the highest level since early spring of 2021, according to Cox Automotive’s analysis of vAuto Available Inventory data released Dec. 14. Supply surpassed 2.5 million units and 71 days’ supply for the first time in two years.

Mounting inventory and slowing sales have prompted some automakers to cut production and/or boost incentives. In November, thanks in part to higher discounts and incentives, new-vehicle transaction prices were lower by 1.5% year over year, according to Kelley Blue Book.

The total U.S. supply of available unsold new vehicles climbed to 2.56 million units. That is up 57%, or 925,000 units, from the same time a year ago. Inventory numbers include vehicles available on dealer lots and some in transit.

Days of supply climbed to 71 at the start of December, up from 69 at the start of November. Production ramped up after the UAW ended its strike against the Detroit Three automakers. Inventory was in the 70 days’ supply range for the entire month of November and into December. Inventory, measured as days’ supply, was more than 17 days higher than the same time a year ago.

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period ended Dec. 4, when sales totaled nearly 1.01 million units. Sales for the full month of November were up 7% from a year ago and up almost 2% from October. The November seasonally adjusted annual rate (SAAR) was 15.3 million, up from 14.3 million a year ago but down from October’s 15.4 million.

Inventory Builds, Some Automakers React

Last week, Stellantis announced it was cutting one of three shifts at a Jeep plant in Detroit and cutting jobs and output at a Jeep plant in Toledo, Ohio. The automaker blamed strict emissions standards adopted by California and a dozen other states that limit its sales of gas-powered vehicles without penalty as California and the others move towards banning sales of gas-powered vehicles in 2035.

Indeed, Stellantis has been slower in introducing EVs and hybrids to accommodate the California market. However, Jeep sales have been lower for nine consecutive quarters, while inventory has been mounting. At the start of December, Jeep inventory was 128 days, among the most plentiful in the industry. Dodge and Chrysler also had inventory levels well above the industry average.

Likewise, General Motors is taking some actions to keep inventory levels in check. The company is scheduling downtime at several North American assembly plants for maintenance and product changeovers in the coming weeks. Cadillac has the tightest supply among GM’s four major brands and is below the industry average. Buick, Chevrolet and GMC are all at or above the industry average.

As usual, Toyota, Honda, Kia and Subaru had the lowest supply among non-luxury brands at the start of December. Of luxury brands, Lexus, Land Rover, BMW, and Cadillac had the lowest.

EV Inventory Remains Elevated

While EV sales volumes continue to increase, inventory levels are increasing faster. New electric-vehicle supply at the end of November was at 114 days. EV inventory levels have been climbing throughout Q4 and by volume and days’ supply are at a high point for the year. EV inventory estimates from Cox Automotive do not include Tesla, Rivian or other companies that do not have a dealer body holding inventory.

Chevy Bolt inventory levels remain relatively tight, with the larger Bolt EUV model at 59 days’ supply and below the industry average. The new Subaru Solterra and Toyota bZ4X also both had inventory levels well below the industry average at the start of December, at 42 and 68 days’ supply, respectively.

EVs with higher-than-average supply at the end of November include, among others, the Nissan Leaf and Ariya, the Kia EV6, and the Mustang Mach-E.

Days’ supply for the Ford F-150 Lightning was at 111 in this timeframe, slightly below average for an EV, but Ford is already taking action. The Blue Oval recently announced plans to cut 2024 production targets for its all-electric pickup truck with a new target to build 1,600 trucks a week in 2024, down from the previously planned 3,200 units per week.

In the announcement, Ford said it will match production to customer demand. Ford CEO Jim Farley suggested that the anticipated strong demand has not materialized, blaming high prices and spotty charging infrastructure. By the end of November, Ford had sold just over 20,000 Lightning pickups in the U.S.

Originally posted on Vehicle Remarketing