Demand for CNG-powered cars and SUVs in the Indian passenger vehicle (PV) market has bounced back in the second half of this year. In the first half (January-June 2023), retail sales had dropped by 5.47% to a little over 150,000 units but with new models being introduced amidst an expansion of the CNG filling network across the country, it was expected that sales of CNG passenger vehicles would pick up, and they have.

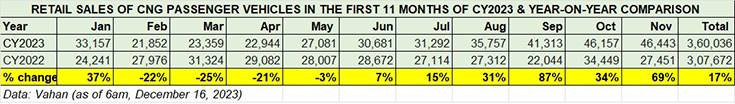

As per the latest retail data available on the Vahan website (LMV and petrol-CNG), a total of 360,036 CNG PVs have been sold in the January-November 2023 period, up 17% (January-November 2022: 307,672 units). This is also the best-yet sales of CNG PVs in a calendar year, with December 2023 numbers yet to be factored in. CY2022’s 331,111 units have been the previous best.

The 360,036 CNG PVs sold in January-November 2023 means India PV Inc has already clocked its best-ever sales in this category in a calendar year.

India’s market for CNG-powered cars and SUVs expanded in August 2023 with the launch of the Tata Punch CNG compact SUV (Rs 710,000-Rs 968,000 ex-showroom), which was Tata Motors’ response to the introduction of the Hyundai Exter CNG compact SUV (Rs 824,000-Rs 897,000, ex-showroom). This takes the total number of CNG cars and SUVs sold in India to 23, with market leader Maruti Suzuki India having the biggest portfolio of 13 models, followed by Tata Motors (4 models) and Hyundai and Toyota Kirloskar Motor (three models each).

MARUTI SUZUKI LEADS WITH 70% MARKET SHARE, TATA MOTORS SELLS OVER 55,000 UNITS TO DRIVE AHEAD OF HYUNDAI

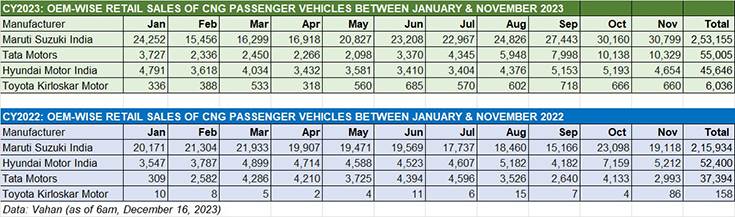

There are only four CNG carmakers in India. Maruti Suzuki India, with all of 13 models (Alto K10, Baleno, Brezza, Celerio, Dzire, Eeco, Ertiga, Grand Vitara, S-Presso, Swift, Wagon R, XL6, and the Fronx), understandably, has a vice-like grip on the market.

While Tata Motors has four models (Altroz, Tigor, Tiago, Punch), Hyundai Motor India’s CNG range has expanded to three models now (Aura, Grand i10 Nios, Exter) and Toyota Kirloskar Motor has three CNG-powered passenger vehicles (Glanza, Hyryder, Rumion).

Hyundai was ahead of Tata Motors till August this year, but Tata Motors has gone ahead with strong numbers in the September-November 2023 period.

A quick look at the OEM-wise retails in the January-November 2023 period reveals that market leader Maruti Suzuki India has sold 253,155 CNG variants of its cars, SUVs and MPV, up 17% YoY (January-November 2022: 215,934 units), accounting for 18.71% of its total PV retails of 13,52,489 units. By the end of this decade, Maruti Suzuki expects to see CNG vehicles account for a third of its total PV retail sales. The company currently has an overwhelming 70.31% share of the total CNG PV market in India.

Tata Motors has sold 55,005 CNG cars and SUVs in the first 11 months of CY2023 to Hyundai’s 45,646 units, with strong numbers from September.

In a surprise move, possibly as a result of the introduction of its Punch CNG model in August, Tata Motors has gone ahead of Hyundai to take the No. 2 position in the market. The company has sold a total of 55,005 CNG cars and SUVs in the first 11 months of CY2023, up 5% (January-November 2022: 52,400 units) to Hyundai Motor India‘s 45,646 units (up 22% / January-November 2022: 37,394 units). Tata Motors currently has a CNG PV market share of 15.27% to Hyundai’s 12.67 percent.

A close look at the Vahan month-wise retail sales split below reveals that Hyundai (30,646 units) was ahead of Tata (26,540 units) till August, but Tata has gone ahead with strong numbers in the September-November period.

Toyota Kirloskar Motor, which has recently entered the CNG market with the Glanza hatchback, Urban Cruiser Hyryder SUV and the Rumion MPV, has sold a total of 6,036 units in the first 11 months of this year and has a 1.67% share of the CNG PV market. In fact, an overwhelming market response to its Rumion E-CNG variant had the company stop taking bookings for the eco-friendly MPV in end-September.

The sustained growth of the CNG PV sector is also why vehicle manufacturers are gradually expanding their product portfolios to include CNG variants. The past few years have seen the share of the CNG car market in the overall PV market increase – from 6.30% in FY2021, the CNG share increased to 8.60% in FY2022 and was 8.19% in FY2023. In the first half of CY2023, at 156,938 units, the CNG share of total PVs retailed was 8.53% of the total 18,39,514 PVs retailed. In the January-November 2023 period, that share has now grown to 10.54% of the total 34,14,155 PVs retailed.

WALLET & ECO-FRIENDLY FUEL

From a consumer point of view, other than the environment-friendliness of CNG, a CNG-powered vehicle provides considerable savings compared to its petrol or diesel-engined siblings. What’s also driving the consumer shift to CNG models is the long-time unchanged high price of petrol (Rs 106.29 a litre in Mumbai) and diesel (Rs 94.27 a litre in Mumbai on December 16, 2023).

The slashing of CNG prices in early April was a welcome respite to motorists using CNG-powered vehicles and at present, at Rs 76 per kg in Mumbai, CNG is Rs 30.29 cheaper than petrol and Rs 18.27 cheaper than diesel.

CNG POWER VS CONSUMER SHIFT TOWARDS EVs

While CNG vehicle running costs are significantly lower compared to petrol or diesel as a CNG vehicle inherently delivers better fuel economy, a few challenges to speedier adoption of CNG vehicles remain.

Refuelling takes longer due to a fewer number of CNG stations and highway driving requires additional planning in terms of trying to take a route with a CNG station. That’s set to gradually change though. Plans are to substantially increase the existing parc of 4,500 CNG stations to 8,000 over the next two years. Also, servicing costs of CNG-powered cars are higher compared to petrol siblings with the CNG filter requiring scheduled replacement in factory-fitted CNG kits.

CNG vehicle manufacturers also face some level of competition from electric vehicles, which are seeing demand accelerate with new models rolling out, a fast-expanding EV charging network across India and greater consumer awareness. While the initial cost of an EV is higher than a CNG or petrol/diesel model, the much lower cost of EV ownership in the long run remains a very attractive buying proposition. Nevertheless, with both modes of power, the focus is on eco-friendly transportation.

ALSO READ: CNG becoming a strong alternative to diesel