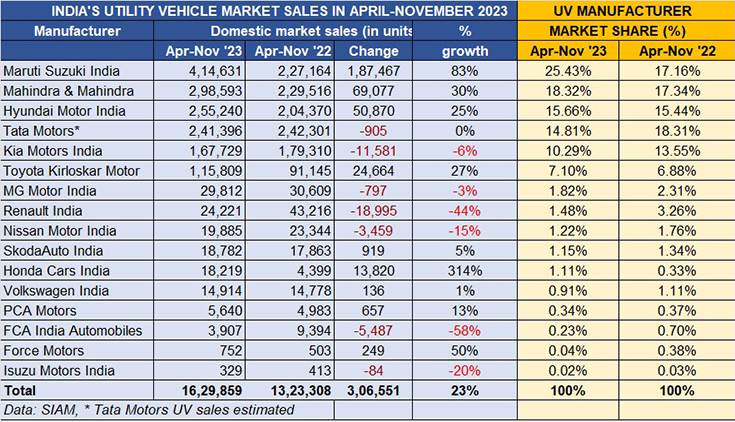

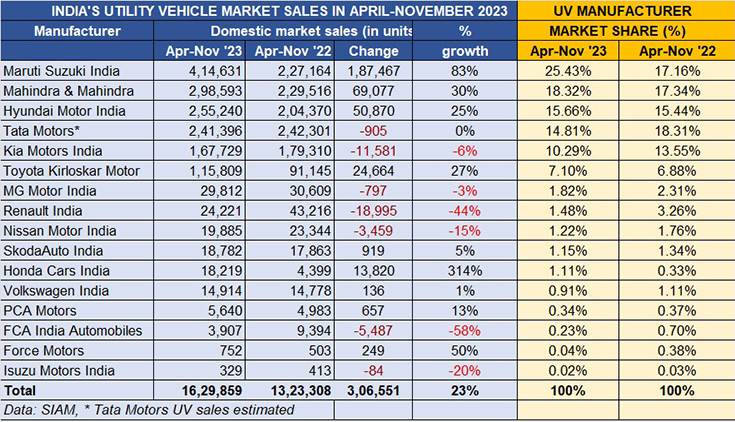

The utility vehicle (UV) category continues to stamp its power on the overall passenger vehicle (cars, sedans, UVs and vans) segment in India and the latest cumulative April-November 2023 wholesale numbers are ample proof. At an estimated 16,29,859 units, an increase of 23% YoY, UVs now account for 58% of the total PV sales of 27,89,569 units. This is a big increase from the 51% UVs contributed to PV sales in April-November 2022.

No carmaker in India can now afford to be without an SUV, which is why each of the 16 OEMs feature in the UV sales table (see data table below). As per the wholesales data released by apex industry body SIAM, while nine companies have recorded YoY increases, seven – Tata Motors, Kia India, Renault India, MG Motor India, Nissan Motor India, FCA India and Isuzu Motors India – have registered a YoY decline. And all of this is reflected in their market shares.

The intense competition means that despite the UV market growing by 23%, only 5 OEMs out of 16 manufacturers have increased their market share.

The top six OEMs (each with sales in six figures), together account for nearly 1.5 million units – 14,93,398 units – and an overwhelming 91% of total UV sales in the first eight months of FY2024.

PV market leader Maruti Suzuki India is the strong UV leader too – with 414,631 UVs sold in April-November 2023, the company has recorded handsome 83% YoY growth (April-November 2022: 227,164). This robust performance is thanks to a number of new SUVs it has launched over the past 8-12 months, which has not only helped it expand its market share but also eat into those of rivals.

As a result, Maruti’s UV market share has jumped to 25.43% from 17.16% a year ago, when it was just below Mahindra & Mahindra’s 17.34% share, and just 2,352 UVs behind M&M.

Important for Maruti Suzuki’s perspective, its sterling UV segment performance has helped buffer the decline in its passenger car and van sales. While Alto and S-Presso budget cars’ sales were down 45%, sales of compact hatchbacks and sedans (Baleno, Celerio, Dzire, Ignis, Swift, Tour S, and Wagon R), registered a 3% YoY decline, and sales of the premium Ciaz sedan are down 19% in April-November 2023. Mahindra & Mahindra, which has eight SUVs (Bolero, Bolero Neo, Scorpio, Scorpio N, Scorpio Classic, Thar, XUV300, XUV400 and XUV700), is also making the most of the surging wave of demand for UVs. With cumulative sales of 298,593 units in the April-November 2023 period, up 30% YoY, the company is well set to record its best-ever sales in a fiscal. With four months left to go for FY2024, M&M’s sales in the fiscal to date are already 83% of its record sales of 359,253 units in FY2023. Its current UV market share stands at 18.32%, up from the 17.34% a year ago.

Third-ranked Hyundai Motor India, with 255,240 units is up 23% and a marginal UV share increase to 15.66% from 15.44% a year ago. The Creta, India’s best-selling midsize SUV, continues to be Hyundai’s best-seller with 1,08,584 units, up 8%. The compact SUV duo of the Venue and Exter has sold 1,27,635 units, up 56% (April-November 2022: 81,609), as a result of the demand for the recently launched Exter compact SUV.

Tata Motors, which has four models – Nexon, Nexon EV, Punch, Harrier and Safari, has witnessed flat UV sales – 241,396 units versus 242,301 units a year ago. This sees its market share reduce to 14.81% from 18.31% a year ago. One can put this down to lower sales of both the Nexon and the Nexon EV in the July-August-September period as the company was transitioning to the model change and dispatches to dealers were possibly fewer. The facelifted Nexon and Nexon.ev were launched on September 14.

Kia India has also seen its UV sales decline in the first eight months of this fiscal. Cumulative sales of 167,729 units are down 6% YoY. This sees an impact on market share which is now 10.29% compared to 13.55% a year ago. Seltos sales (69,898 units) are up 1.15% YoY, Sonet numbers (51,992 units) down 14% as a result of the model change (the new Sonet was launched on December 14). While the Carens MPVs has sold 45,187 units, down 3.58% YoY, the all-electric EV6 has sold 652 units, up 120 percent.

Toyota Kirloskar Motor, which has recently announced plans for a third plant, has registered 27% YoY growth with 115,809 units. While demand for the popular Innova Crysta and Hycross MPVs remains strong, the butch Fortuner SUV has its fair share of buyers. What has also helped Toyota in India is its global partnership with Suzuki. Rebadged Maruti Suzuki models like the Urban Cruiser Hyryder and more recently the Rumion MPV are helping accelerate growth for TKM, whose UV market share has risen to 7.10% from 6.88% a year ago.

Honda Cars India, which was missing out bigtime on the action in the UV market, is back in the numbers game with its Elevate midsize SUV. Launched on September 4, the Honda Elevate has sold a total of 18,219 units till end-November which makes for average monthly sales of 6,073 units and gives the Japanese major a 1.11% UV market share.

UV SALES ALREADY 81% OF RECORD FY2023 2 MILLION SALES

With four months left in FY2024, cumulative eight-month UV sales are already 81% of FY2023’s record sales of 20,03,718 units, which was the first time that India UV Inc drove past the 2 million mark and accounted for 51% of the record 3.89 million PVs sold. The UV segment’s share of the PV market has increased by seven percent to 58%, which is a telling statement of just how strong customer demand remains for SUVs and MPVs in India.

With average monthly sales of 203,732 UVs in the fiscal to date, India UV Inc is well set to cross the record FY2023 total in the next couple of months and drive towards the 2.35 million or 2.40 million mark for FY2024.

ALSO READ:

CNG car and SUV sales bounce back, Tata Motors goes ahead of Hyundai

Motorcycle sales exceed million units for third straight month as rural demand kicks in

Scooter sales near the 4-million mark in first 8 months of FY2024

EV sales in India jump 50% to 1.38 million units in January-November 2023