Slower growth in 2023 was expected, and even welcomed as it came with a return to more normalized seasonal fleeting and de-fleeting patterns.

Graphic: Auto Rental News

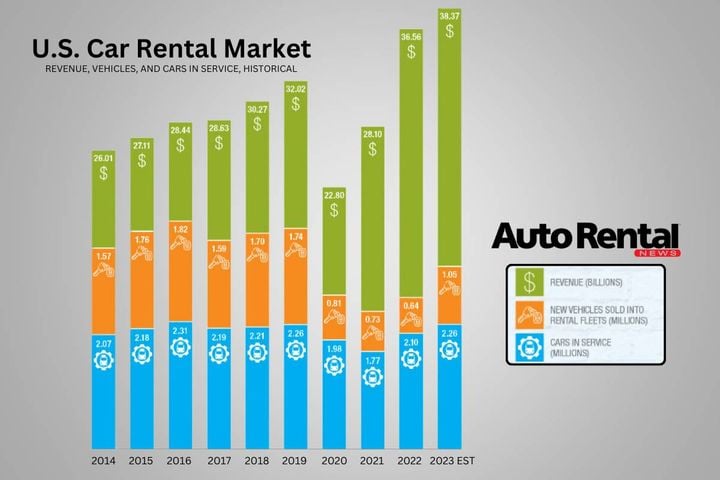

The U.S. car rental industry earned an estimated $38.3 billion in revenue in 2023, exceeding a “shattering record” from the previous year, according to data collected by Bobit for the 2024 Auto Rental News annual Fact Book.

The revenue total was up 5% over the 2022 record of $36.1 billion, figures show. The total is based on estimated data from the major car rental companies serving the U.S. as well as independent rental operations. Revised figures will be available in the first quarter of 2024 based on fourth quarter results.

“The U.S. car rental market hit another record, yet the 5% growth over 2022 was at a much slower rate than the astounding 23% and 30% year-over-year growth in 2021 and 2022,” said Chris Brown, associate publisher of Auto Rental News.

“This slower growth was expected, and even welcomed as it came with a return to more normalized seasonal fleeting and de-fleeting patterns. However, fleet and other expenses rose at least 15%, which ate into earnings.”

The all-time high in auto rental industry revenue before the COVID pandemic was $32 billion for 2019.

Other key industry indicators show the U.S. industry running 2,263,900 rental vehicles across about 16,000 rental outlets and locations nationwide.

Enterprise Mobility, which includes Alamo Rent A Car, Enterprise Rent-A-Car, and National Car Rental, runs the largest rental fleet in the U.S., with more than 50% of all rental vehicles.

The industry revenue per vehicle per month fell slightly to $1,412.50 per unit in 2023 from $1,424 in 2022 due to a higher ratio of vehicles in service compared to 2022, which had about 2.1 million vehicles in service.