Southeast Asian tech startups focused on climate adaptation and mitigation clocked more venture funding deals in the first 11 months of 2023 than in the whole of last year, finds a new DealStreetAsia – DATA VANTAGE report.

There were 92 equity funding deals in the climate tech space from January through November, up 12% from the same period last year, according to The State of Climate Tech in SE Asia 2023. Debt financing, too, trended up this year, although the increase was more modest.

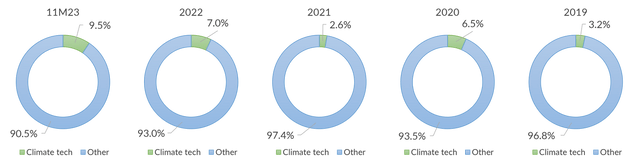

The climate tech landscape, however, was not immune to the overall liquidity crunch. Startups in the sector raised $685 million in equity funding in the first 11 months of this year, marking a 37% decline compared to the same period in 2022. On a positive note, the share of proceeds generated by climate tech startups relative to the region’s overall venture landscape continued its upward trajectory.

Share of climate tech funding in Southeast Asia

Focus on adaptation

Despite the downturn, seed and Series A funding rounds showed remarkable stability in 2023, indicating robust backing for emerging climate tech ventures. A notable highlight was Maka Motors, an Indonesian electric motorcycle producer, which raised a record $37.6 million in a seed round.

A decline in median values became apparent at the Series B stage, reflecting a dearth of larger funding rounds, particularly those above $50 million.

Singapore continued to be the frontrunner in venture capital activity in Southeast Asia’s climate tech sector, with startups in the city-state closing 59 transactions, accounting for 58% of all equity and debt funding deals this year. Surprisingly, Indonesia overtook Singapore in funding proceeds, with a 47% share of the total private capital flowing to climate tech.

As the impact of climate change has become increasingly immediate, the demand for adaptation technologies has seen a significant surge. Agriculture emerged as the most active category in climate tech over the last two years, with 30 deals struck by November-end, surpassing the low-carbon mobility and renewable energy sectors.

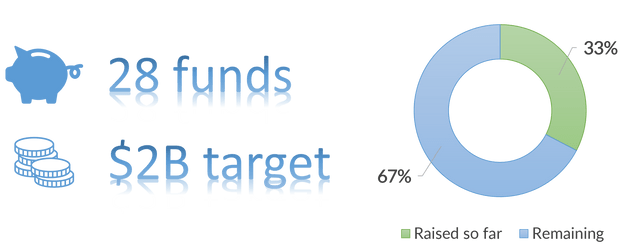

Despite the prevailing global liquidity crunch affecting Southeast Asia’s venture capital investment, the region has welcomed an influx of new sustainability funds this year, including those from traditionally agnostic players such as East Ventures.

Open sustainability funds with major allocations for Southeast Asia

A tipping point

The overall funding climate in Southeast Asia will remain challenging in the next 12 months, according to fund managers who were interviewed for the report. However, they point to signs of ongoing opportunities in the climate tech space.

“We expect the ‘funding winter’ to continue through 2024. Elections in countries like the US, India and Indonesia will also create a more cautious environment. We anticipate climate-focused funds, like other categories of VC, to also be cautious and focus on revenue-generating businesses with strong unit economics,” said Marie Cheong, founding partner of Wavemaker Impact.

While funding challenges remain, Nakul Zaveri, co-head of climate investment strategy at LeapFrog Investments, said many technologies are reaching a tipping point where they have become more affordable than high-carbon incumbent alternatives. This cost competitiveness can enable mass market adoption and provide climate-friendly options even for emerging consumers, he added.

As Southeast Asia grapples with escalating climate impact, adaptation technologies are expected to gain prominence, said Alina Truhina, CEO and managing partner of The Radical Fund.

“There are various interesting technologies that we are seeing, including deep tech AI software for forestry management, energy storage development to decarbonise agriculture, and disruption of industrial processes to better utilise energy and water in a more sustainable manner,” she said.

Lauren Blasco, the head of ESG at Indonesian VC major AC Ventures, is bullish on regenerative and precision farming, smart grid technologies, green building materials and electric vehicle ecosystem.

“We foresee a surge in the production of electric vehicles, both two-wheelers and four-wheelers. Complementing this, we plan to develop a robust EV ecosystem, encompassing charging and swapping stations, green mobility SaaS solutions, and sophisticated battery management systems,” said Blasco.

DealStreetAsia’s The State of Climate Tech in SE Asia 2023 report has extensive data on:

- Fundraising by Southeast Asian climate tech startups

- Fundraising by sustainability funds

- Sub-sector review, including renewable energy, agritech, low-carbon mobility and more

- Data-led analysis on future trends

- Perspectives from fund managers investing in climate tech