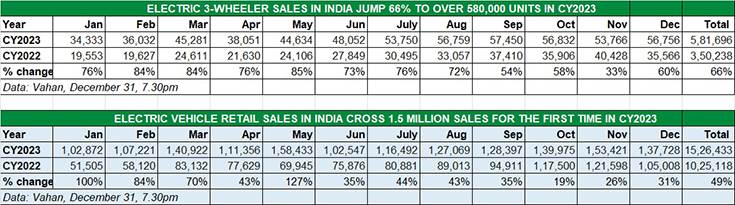

In tandem with record sales of the electric two-wheeler industry of over 850,000 units, the Indian electric three-wheeler industry surpassed the half-a-million sales milestone for the first time in CY2023. At 581,696 units sold (as per Vahan data at 7.30pm on December 31, 2023), this sub-segment of India EV Inc recorded handsome 66% year-on-year growth (CY2022: 350,238 units).

In India’s fast-growing electric vehicle industry, the two- and three-wheeler segments, which are the most affordable compared to their four- and more-wheeled brethren, are setting the pace. While the electric scooter and motorcycle segment leads in terms of sheer volumes, the rate of transition to zero-emission mobility is fastest in the three-wheeler market, where now every second product sold is an electric model.

Every second three-wheeler sold in India is now electric. The 581,696 e-three-wheelers sold comprise 53.94% of total three-wheeler sales in CY2023.

CY2023 saw a total of 10,78,279 three-wheelers (fuelled by petrol, CNG, LNG and electric) sold in India. This means the 581,696 e-three-wheelers sold comprise 53.94% of total three-wheeler sales – the EV penetration increasing marginally from the 51% in CY2022 (350,238 EVs out of 677,476 three-wheelers sold) albeit the overall three-wheeler market has expanded by 59% year on year.

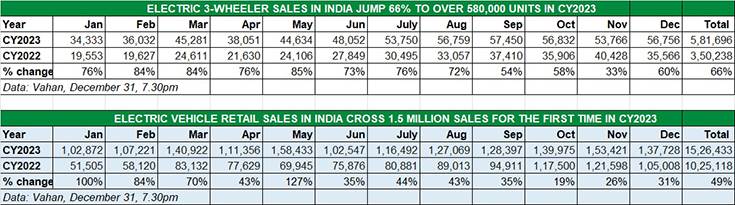

After two-wheelers, which accounted for 56% share of total EV sales of 15,26,433 units (up 49% YoY), three-wheelers had the next biggest share – 38.10% – which means the two EV sub-segments together constitute 94% of India EV Inc’s total sales in CY2023.

This e-three-wheeler sub-segment, which sells passenger-transporting e-rickshaws and cargo-carrying three-wheelers, continues to witness strong double-digit growth thanks to sustained demand for passenger transportation and from last-mile operators for e-commerce applications, food deliveries and other applications.

Compared to fossil fuel or CNG-powered models, the long-term wallet-friendly proposition of electric three-wheelers is drawing both single-user buyers (autorickshaw drivers) as well as fleet operators. This segment has maintained a consistent growth trajectory, having opened CY2023 with 34,333 units and crossing the 50,000-unit monthly sales mark for the first time in July with 53,750 units and then clocking over 55,000 units every month right till December.

Mahindra Last Mile Mobility’s sales of 54,592 units translate into 85% YoY growth and an increased market share of 9.38% in 2023. Bajaj Auto, which sold 4,573 units in seven months is the dark horse for CY2024.

MAHINDRA RETAINS CROWN WITH 8% SHARE, BAJAJ AUTO CHECKS IN

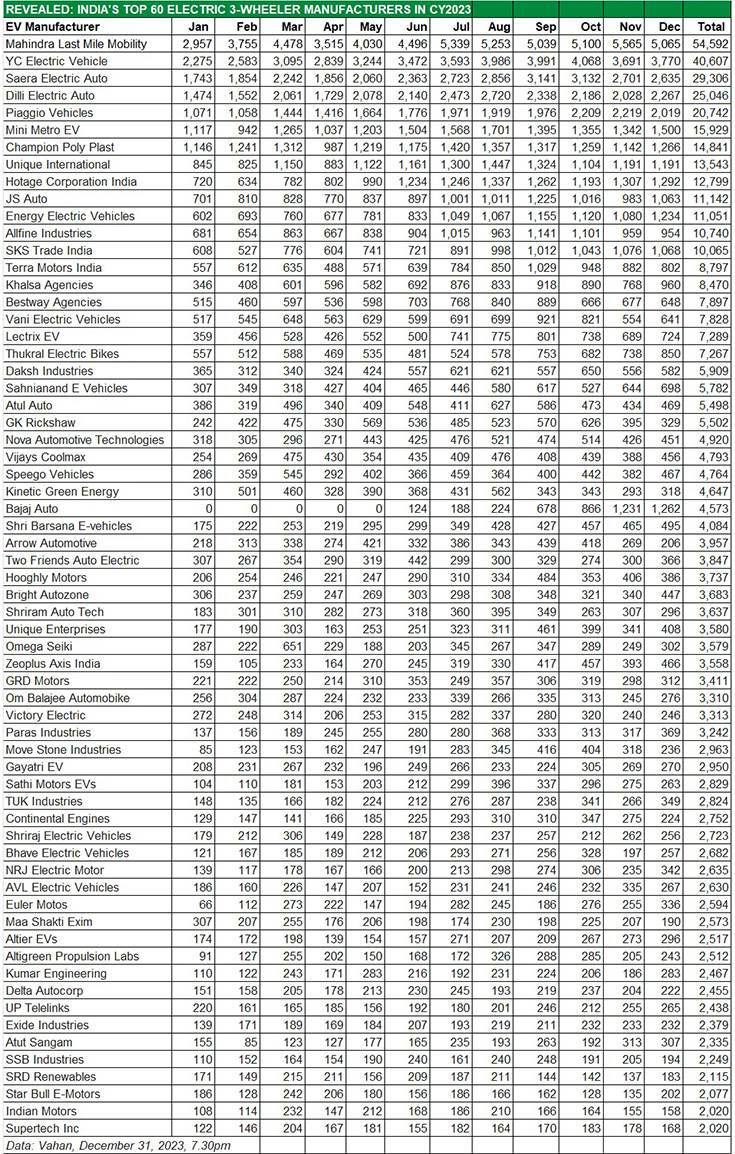

The e-three-wheeler segment has the maximum players of any vehicle category in India – 496 companies! Of them, only 13 have exceeded annual sales of 10,000 units each (see Top 60 OEMs of CY2023 data table below).

These Top 13 OEMs, each with five-figure sales, cumulatively sold 270,403 units in 2023, effectively having a 46% share of the total e-three-wheeler market, leaving the remaining 54% of the market to the other 483 manufacturers to battle it out in the arena. The data table below reveals that the battle down the line is intense, with many OEMs separated by just a few units.

Mahindra Last Mile Mobility (MLMM), the market leader in FY2023 with 29,497 units and an 8.42% share, has retained its crown. The company’s cumulative sales of 54,592 units translates into 85% YoY growth and an increased market share of 9.38 percent. The company, which expanded manufacturing capacity in April 2023 with a new line for its Treo e-three-wheelers at the Haridwar plant, currently has six EVs on sale – the Treo Plus, Treo Yaari and e-Alfa Super for passenger transport and the Zor Grand, Treo Zor and the e-Alfa cargo for goods transport.

YC Electric Vehicles, the firm No. 2 player, has recorded its best-ever annual sales of 40,067 units – up 36% YoY (CY2022: 29,792 units). YC EV has five products – the Yatri Super, Yatri Deluxe and Yatri for passenger duties and the E-Loader and Yatri Cart for cargo operations. Low initial cost, from Rs 125,000 to 170,000 for passenger EVs, and Rs 130,000 to Rs 165,000, is what is driving demand for this OEM.

Third-ranked Saera Electric Auto sold 29,306 units in CY2023, up 52% YoY (CY2022: 29,306 units). Dilli Electric Auto is in fourth place, with 25,046 units, up 79% (CY2022: 13,987 units).

Piaggio Vehicles, which is also recording strong market gains, sold a total of 20,742 units, which constitutes handsome YoY growth of 181% (CY2022: 7,378 units), the company benefiting from its new models and aggressive network expansion. A year ago Piaggio had launched two new models – the Apé E-City FX Max passenger model (with 145km range) and Apé E-Xtra FX Max cargo carrier (115km range), both fully assembled by an all-women team at its Baramati factory in Maharashtra.

There are eight other OEMs which have sold over 10,000 units each in CY2023. They comprise Mini Metro EV (15,929 units), Champion Poly Plast (14,841 units), Unique International (13,543 units), Hotage Corporation (12,799 units), JS Auto (11,142 units), Energy EVs (11,051 units), Allfine Industries (10,740 units) and SKS Trade India (10,065 units).

Interestingly, the ICE-engine three-wheeler market leader Bajaj Auto, which entered the fast-growing electric three-wheeler market in June 2023 with two products – the Bajaj RE E-Tec 9.0 passenger EV and Maxima XL Cargo E-Tec 12.0 – has sold a total of 4,573 units, with sales growing month on month. In CY2023, it took 28th rank with seven-month sales – expect it to up the ante in CY2024 with ramped up production and growing demand for its zero-emission products.

ALSO READ:

EV share of auto sales in India grows to over 6% percent in CY2023

Record-breaking year for electric two-wheeler sales, Ola-TVS-Ather command 62% market share

Electric car, SUV and MPV sales jump 114% to over 81,000 units in CY2023